It’s advice relevant not just to the men of Ancient Greece, but to the insurance industry of today. Because Amazon, not content with world-retail domination, is moving into the home insurance space.

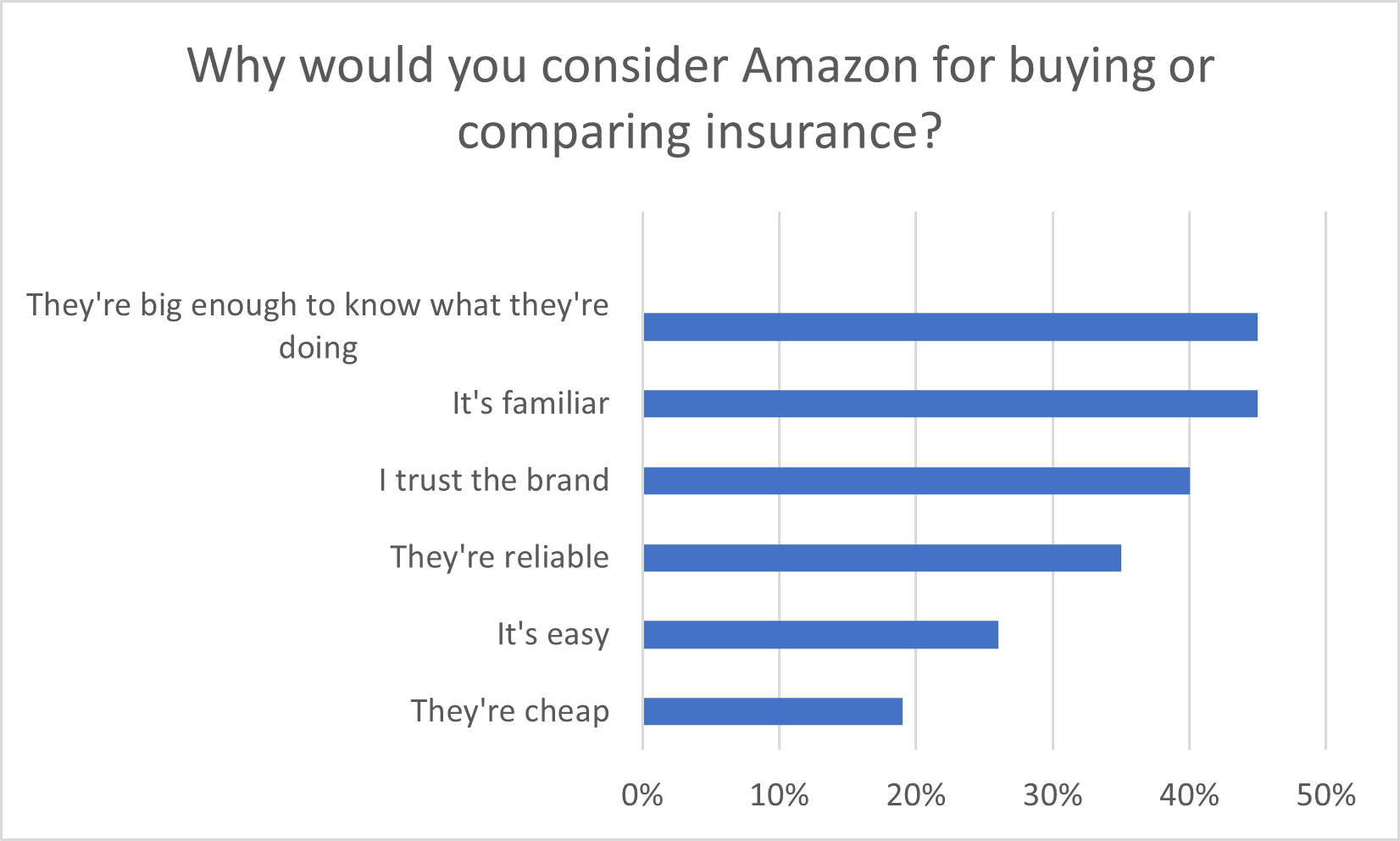

But trying to predict consumer behaviour is a complicated business – and no business should underestimate the Great British Public’s instinct for ease, habit, or a bit of a bargain.

Viewsbank poll conducted 25-27 November 2022. 846 adults in the UK who buy home insurance.

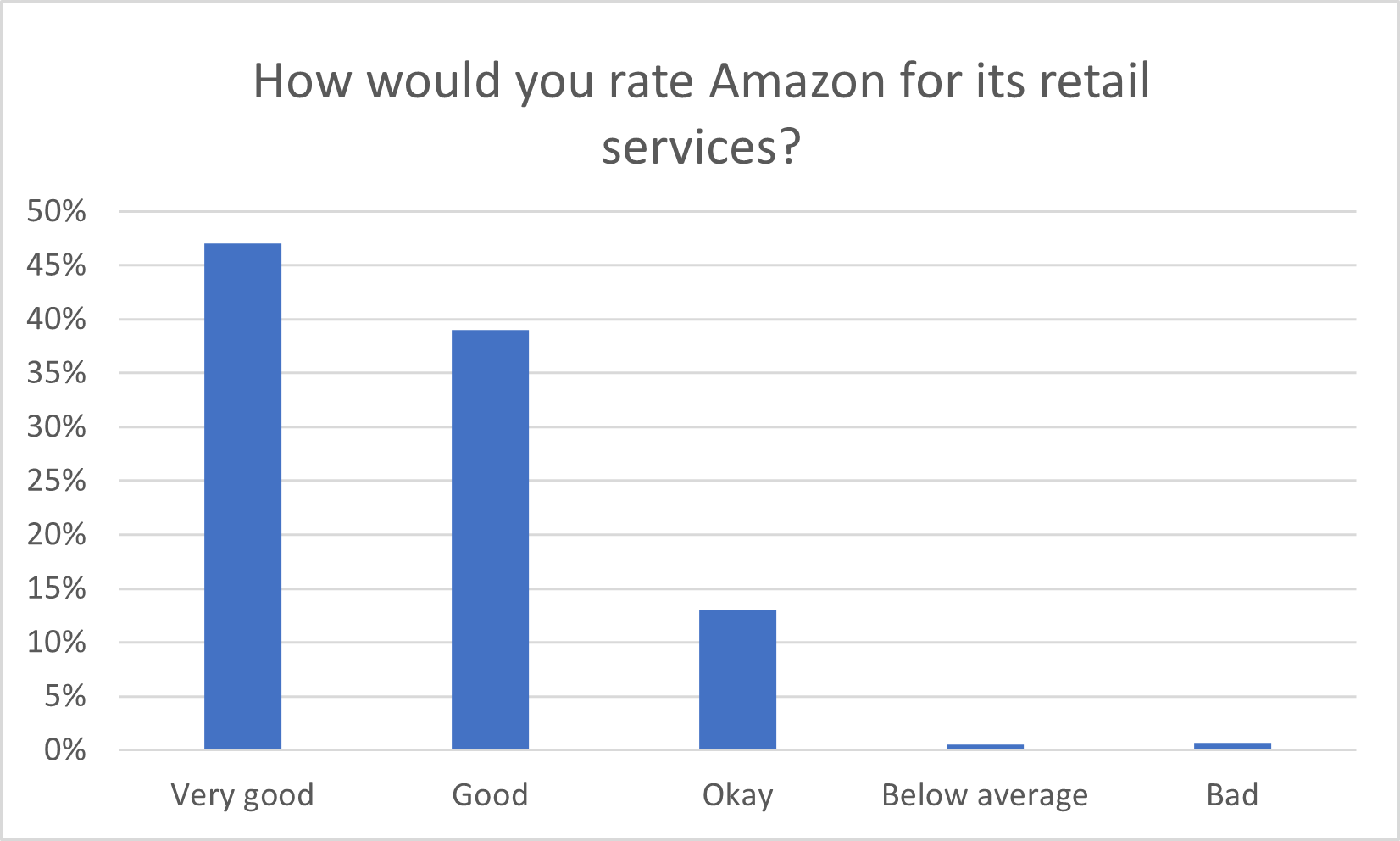

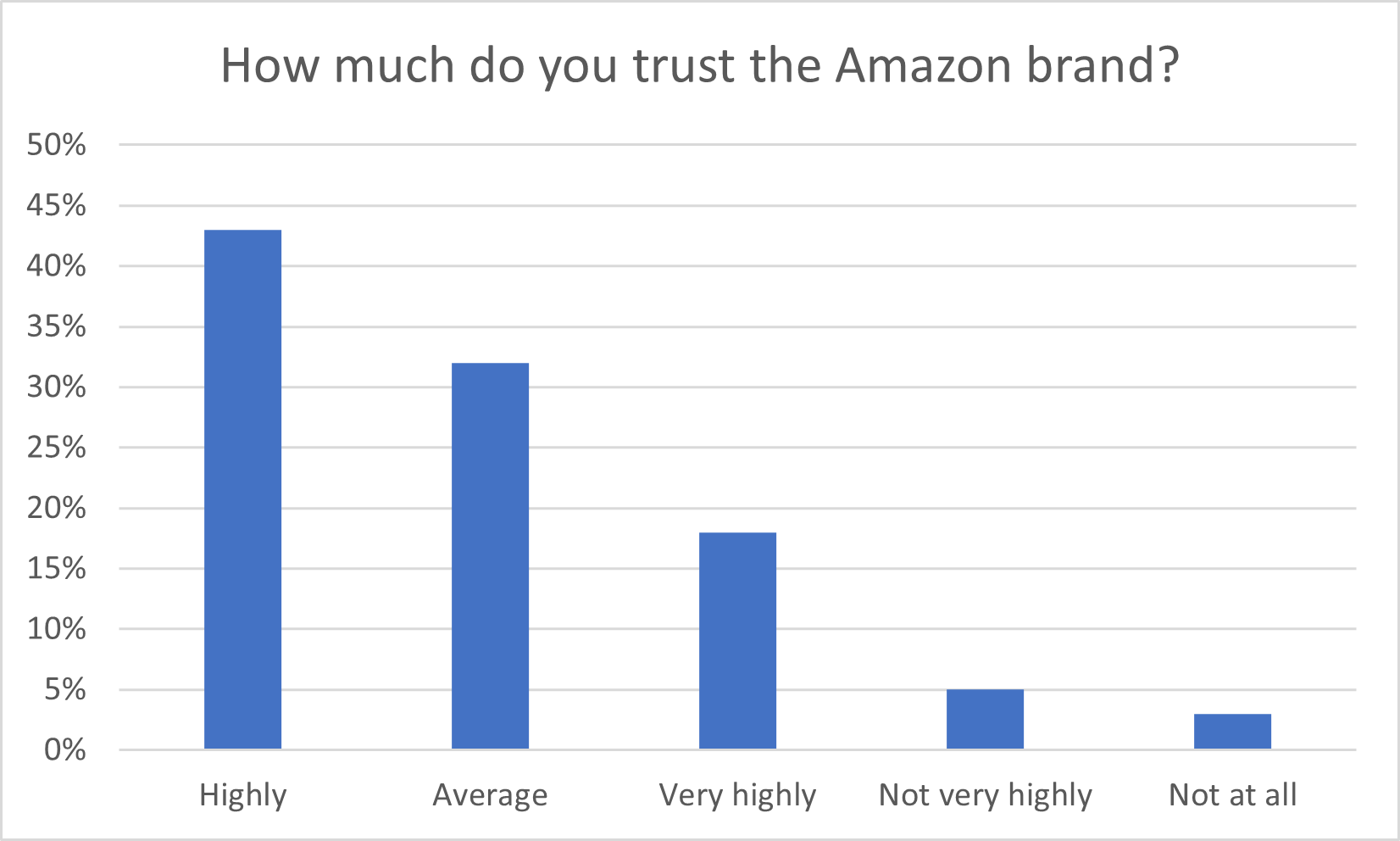

Viewsbank poll conducted 25-27 November 2022. 846 adults in the UK who buy home insurance.People rated Amazon highly for its retail services, and had levels of trust in the brand that the insurance industry can only dream of:

Viewsbank poll conducted 25-27 November 2022. 846 adults in the UK who buy home insurance

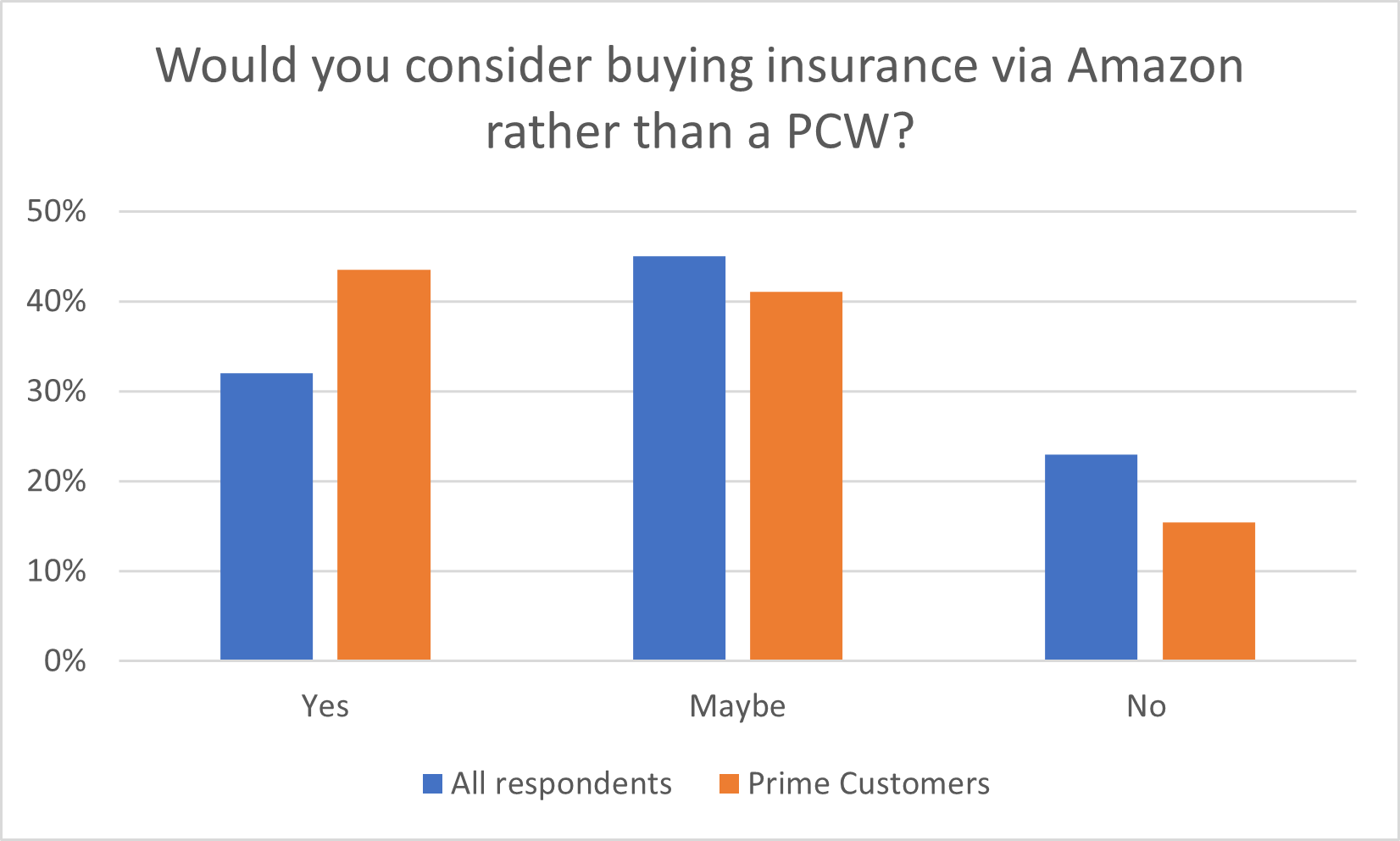

Of the 23% of dissenters who wouldn’t use Amazon for insurance, 62% would rather go to an established brand, and 53% felt they weren’t insurance experts.

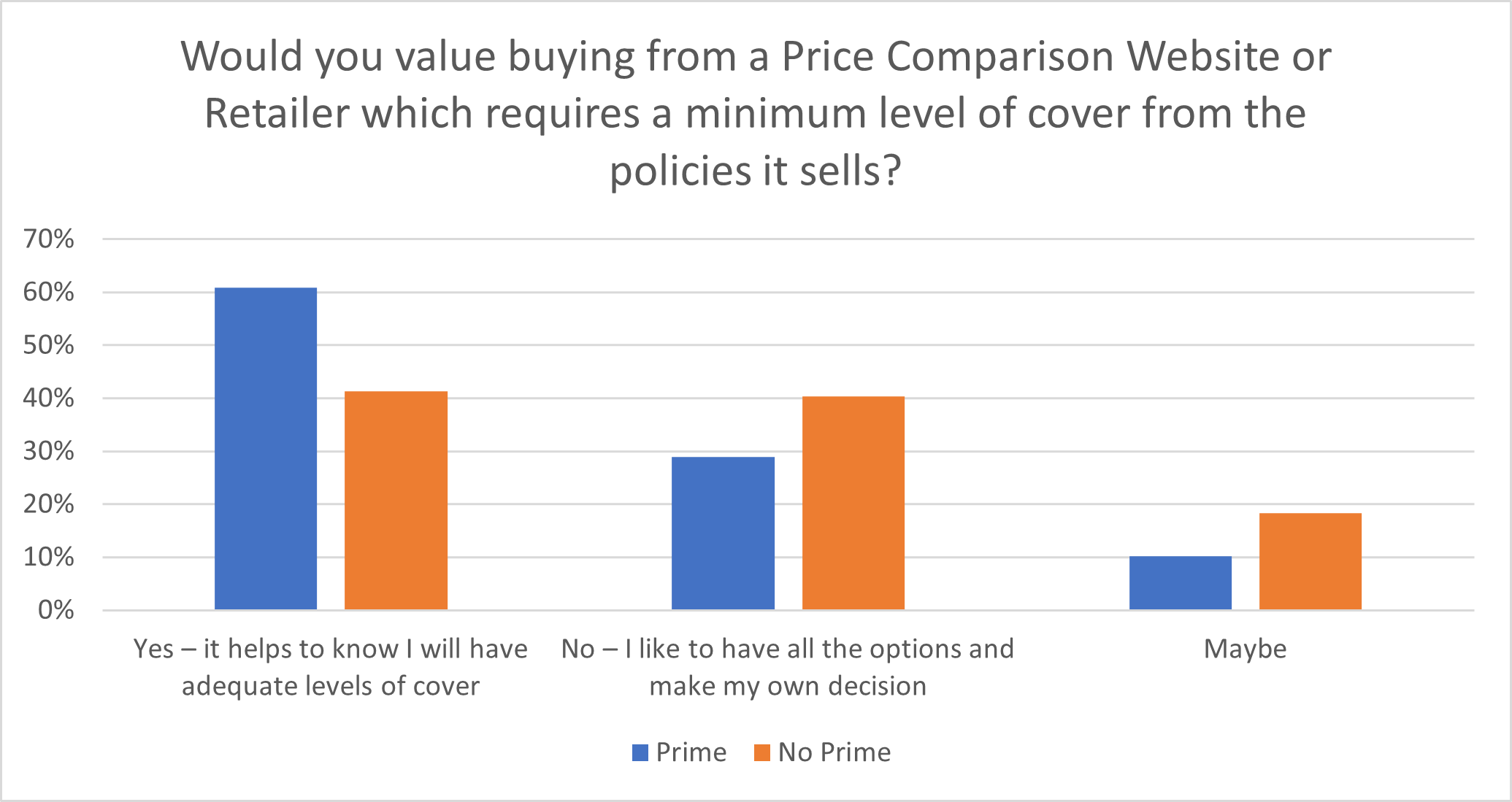

But when asked if they’d buy an established brand via Amazon, 82% felt they would now say yes or maybe to buying from the platform. 53% of people also really liked the idea of a minimum cover level as something that would help them know they’d got adequate cover, whereas only 33% wanted the freedom and all the options to make their own home insurance decisions.

The idea of a minimum cover level appealed more to Amazon Prime customers.

Viewsbank poll conducted 25-27 November 2022. 846 adults in the UK who buy home insurance

Viewsbank poll conducted 25-27 November 2022. 846 adults in the UK who buy home insurance

All that harnessed brand power means Amazon might actually be mounting a real and credible challenge which providers – and PCWs – should sit up and take notice of. Not least because with Amazon the sky really is the limit…

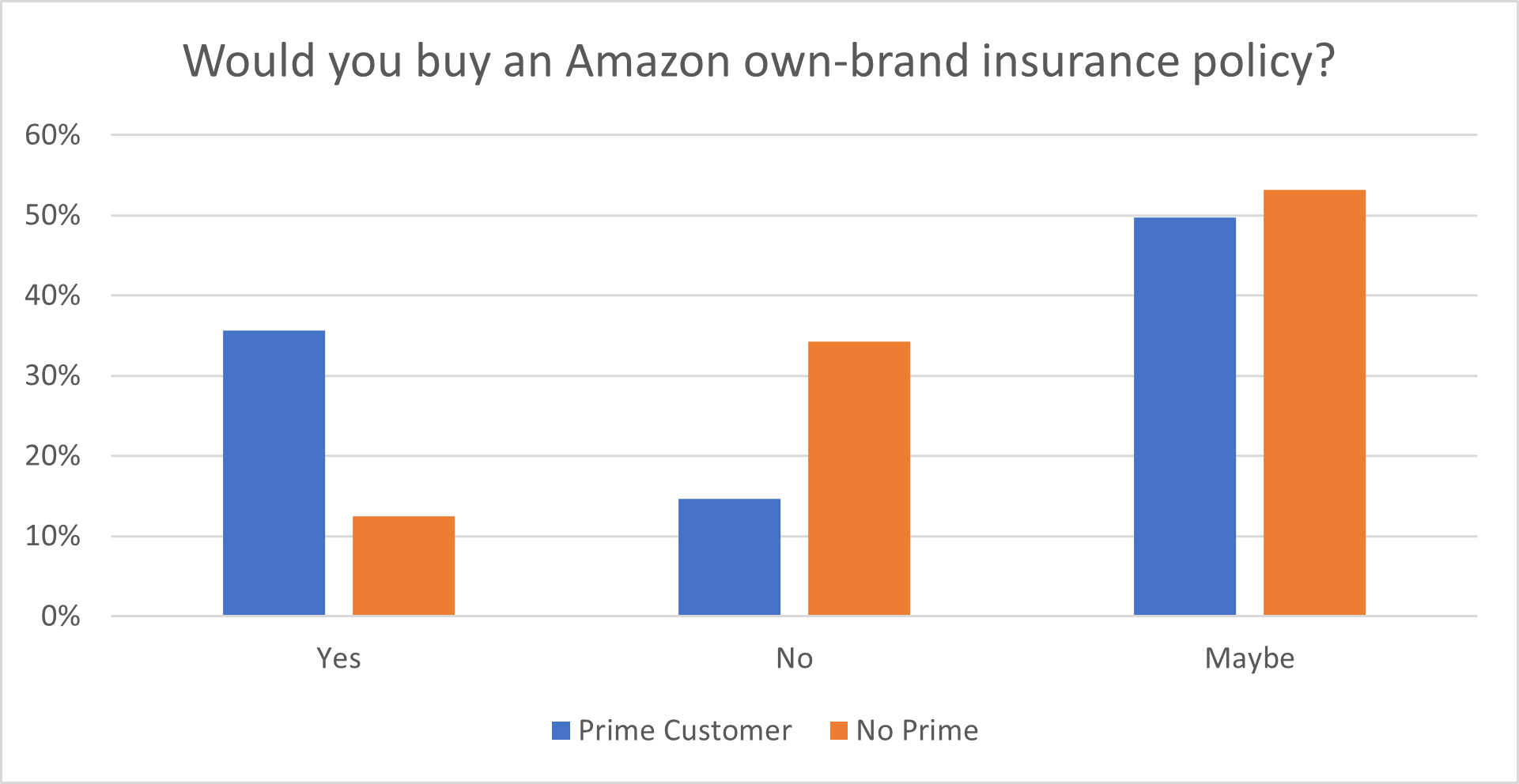

While there’s currently no suggestion of it, our survey found that three quarters of people would definitely or maybe consider buying an Amazon ‘own brand’ insurance product, with Prime customers once again more open to the idea. And more than half (54%) would be happy for Amazon to use their personal information and shopping habits to adjust insurance premiums or deliver promotions, rising to 65% of Prime customers.

Viewsbank poll conducted 25-27 November 2022. 846 adults in the UK who buy home insurance

Viewsbank poll conducted 25-27 November 2022. 846 adults in the UK who buy home insurance

Imagine being able to automatically serve pet insurance options to people buying puppy supplies, or home emergency to people buying bathroom fittings, or figuring out people watching violent movies are higher-risk of dangerous driving/accidents – or that those buying family films are more likely to lock their windows at night. The possibilities are endless, and rest assured, Jeff Bezos and the brains behind Amazon have already thought of them…

Whether the retail giant does go on to change the whole insurance world may all hinge on the first few months of real customer service – and as an industry we should all be watching, waiting, and planning our own next moves.

Viewsbank is our in-house consumer research panel. It’s a large, responsive and community driven panel that conducts both quantitative and qualitative research.

Our Viewsbank panel helps our customers with a wide variety of projects ranging from detailed mystery shopping to demographically targeted research surveys. The research helps our clients make informed decisions based on true understanding of the consumer’s voice.

Comment on blog post . . .

Submit a comment