In the final month of 2021, changes in pricing strategies were already becoming apparent. Before the final curtain fell for dual pricing, some brands were pushing for market share gain with price cuts, others were already starting to raise new business prices to bring them in line with those offered to renewal customers.

In this edition of Exciting Insight Plus – sent exclusively to Consumer Intelligence clients – we show what was happening to prices at the end of the year, an early snapshot of how they have been moving in 2022, and how product tiering has developed in response to fair value rules.

New business prices rises… for some

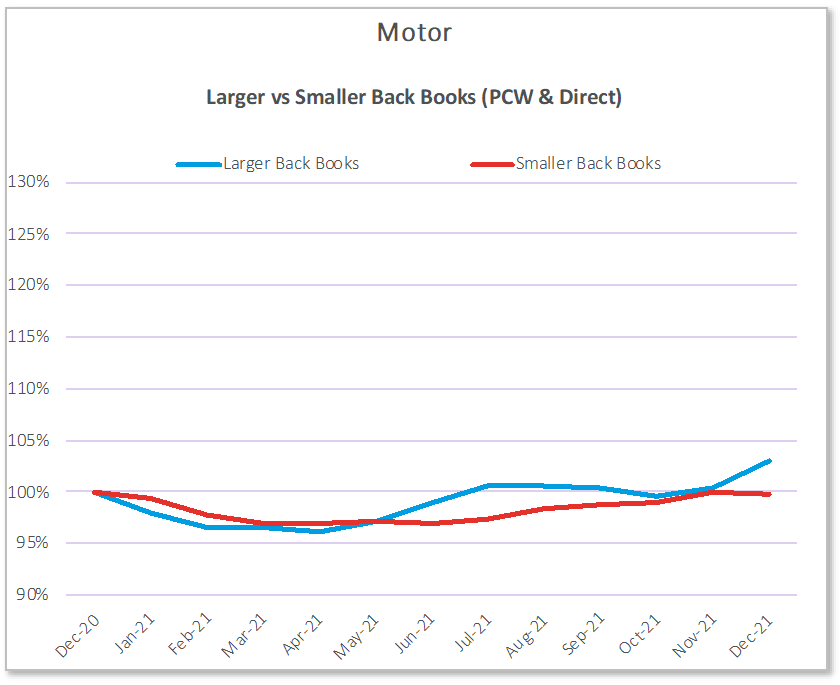

In motor, December showed the beginning of a divergence in pricing between providers with smaller and larger back books. Brands with a longer-standing customer base increased premiums for new customers whilst those with a heavier slant towards new business very slightly reduced them.

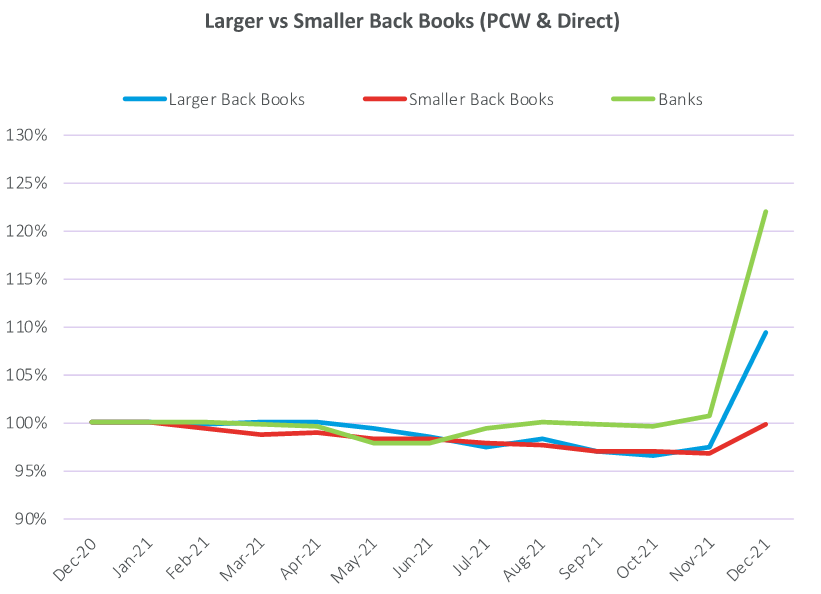

That trend was far greater for home insurance. In a single month, home premiums from providers with a larger back book went from deflationary with November premiums down 3.1% on the previous December, to an inflation-beating 9.4% annual increase. Banking brands jumped up even more, with new business premiums up 22% year-on-year.

Within that, some brands increased new home insurance business prices by over 50% in December.

The data also indicates a different pricing strategy by distribution channel for many. One brand, for instance, put up prices on the PCWs by over 30% on 14 December, whilst increasing them by over 60% for customers that purchase through its own direct website. These products, in turn, are changing. Halifax, for instance, has tiered products on its direct channel but a single product at PCWs.

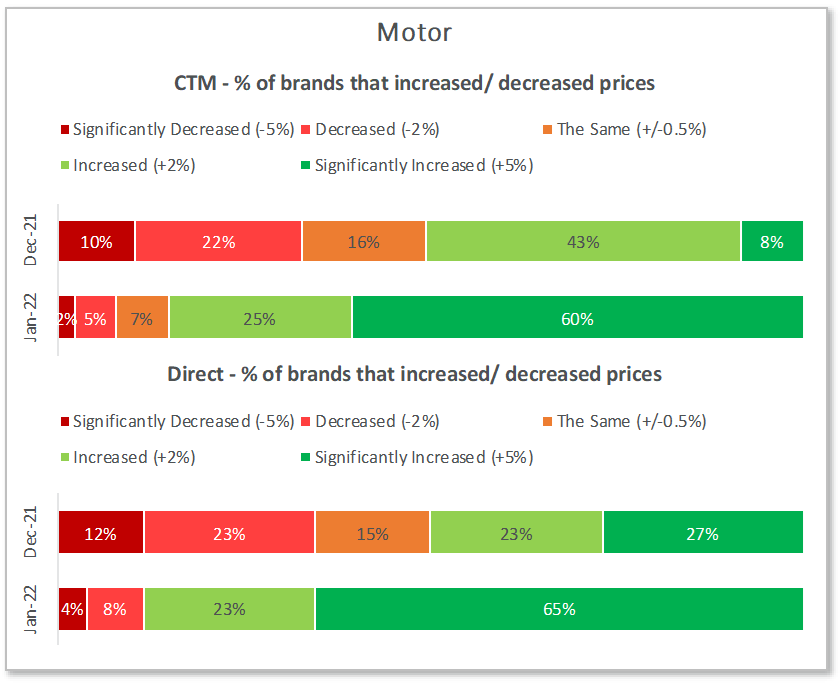

In motor, increases were more subdued while three groups implemented deeper December price cuts. Not that all cuts will translate market share gains, of course. If three highly competitive brands all reduce their premiums, the customer picks up a policy for less but no single brand necessarily ends up with more customers.

Putting the brakes on

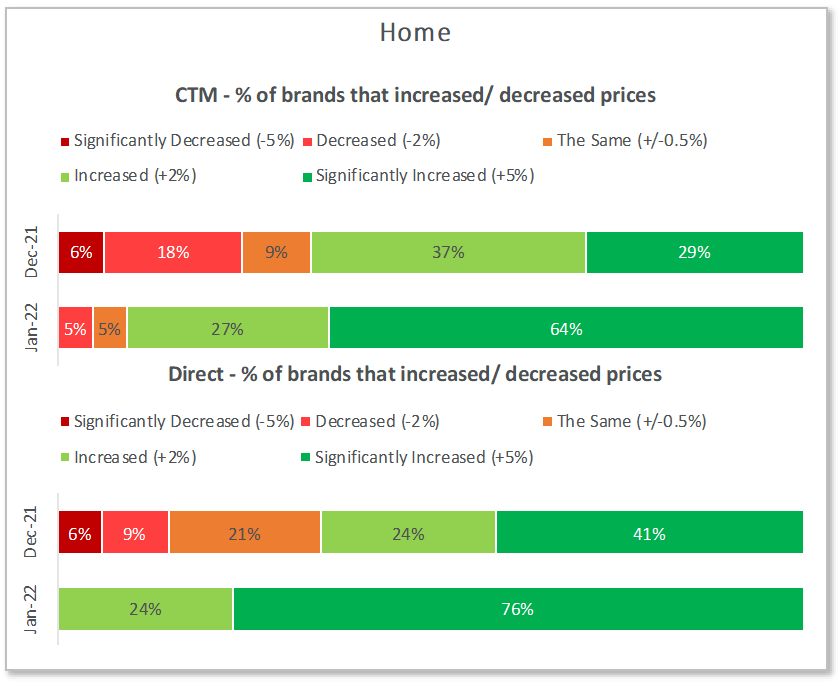

An early and high level view of price movements indicate that most last-gasp plays for market share have been initially tempered by price rises in January. Some 35% of motor brands decreased premiums on direct channels in December; only 12% did so in January. And in home every single brand has so far increased prices on direct channels, 76% of those by over 5%.

Time will tell who sticks and who moves, and how much market share the small minority of brands slashing prices on the PCWs stand to gain.

Segments and tiers

At its heart, GIPP was intended to ensure a better relationship between price and quality, one which firms could measure and demonstrate. With enhanced rules on product governance and fair value coming into force on 1 October, providers responded by rolling out good-better-best product tiers and rejigging their brand line ups and footprints.

Aviva Online was joined by Aviva Premium in November while More Th>n launched Essentials (higher excess and no personal possessions cover) and Extra (legal, breakdown and driving abroad included) across the major PCWs the same month. Admiral continued its rollout of Gold and Platinum and also launched Admiral Essential, extending its competitive footprint into a cheaper area of the market.

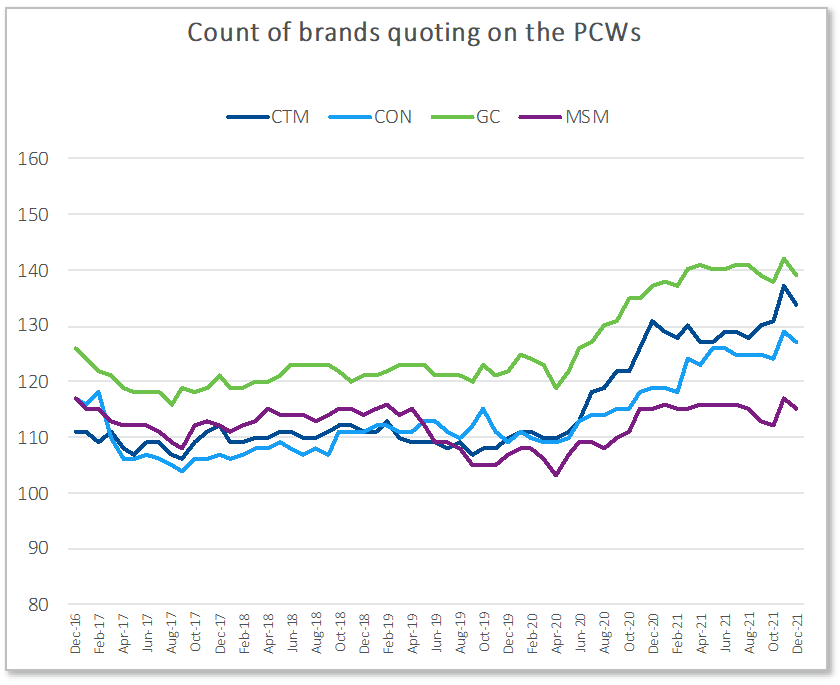

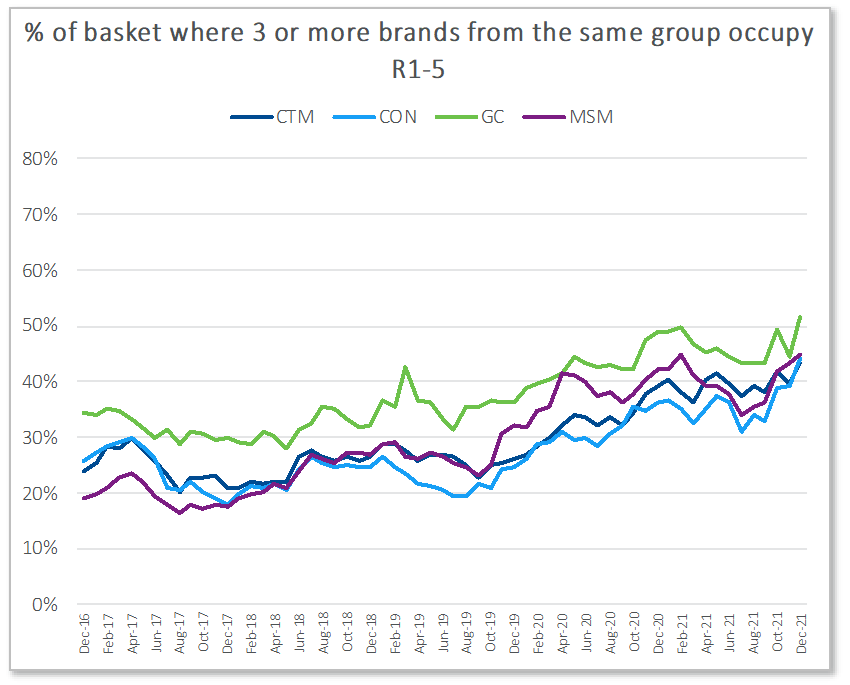

The proliferation of product tiers has a greater capacity to change the competitive landscape in motor, where there is greater price density, than in home. Indeed since Q1 2020, there has been a solid correlation between increased numbers of products quoting on the PCWs and repetition of brands from the same underlying provider in the top 5 positions.

From the providers’ perspective they are offering greater diversity of choice, and showcasing product features, but consumers may be faced with less diversity of providers at the top end of PCW results pages.

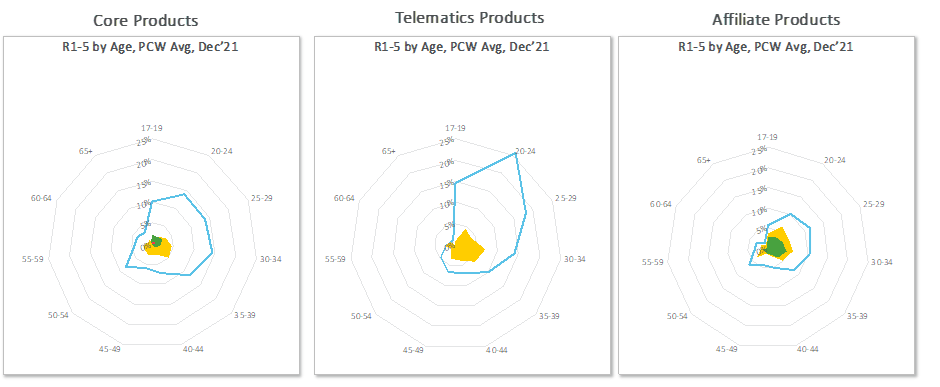

Product tiers and a multi-brand strategy allows groups to refine or expand their footprint, such as by age group, geography or house size. The below chart shows the range of products and tiers from a single group across a total of nine propositions, demonstrating how layered and effective some strategies are becoming.

These are early days, but the change within just a few weeks is a clear indicator of the movement caused by huge regulatory intervention. The marketplace is undergoing more innovation and deployment in both pricing strategies and products than we have seen in a long time. Understanding your own in the context of change, evaluating change and refining will be key.

Track the market in response to the general insurance pricing practices policy implementation

In response to the FCA's general insurance pricing practices (GIPP) directive, we've launched a unique service that has been specifically designed for insurance brands to track changes across the market, and help you inform your product proposition and pricing strategies.

Comment . . .

Submit a comment