All eyes were on dual pricing when the FCA published its radical proposals for general insurance pricing in September.

What the industry didn’t expect was a step-change in product governance through the expansion of fair value requirements.

Previously firms had to consider the fair value of new products launched after October 2018. The FCA now intends to extend fair value requirements to ALL general insurance products, no matter how long they have been around, and include add-ons and premium finance.

Many firms are still working out what that means for them. When we asked 190 insurance professionals if they really understood what it meant for their business, 27% said no, and 55% said they weren’t sure.

The good news, though, was that only 15% of thought it would actually be BAD for their business…

Consumer Intelligence CEO Ian Hughes said: “It seems fair value is increasingly being seen as ‘fair enough’. Certainly it’s now fair game as a new front for insurance brands as the FCA steers the industry away from price walking and into a new era of customer service and support.”

So what IS Fair Value?

Sue Mallender from boutique financial services consultancy Sicsic Advisory told attendees of our recent webinar: “Fair value is described by the FCA as the relationship between the total price paid by the end customer and the quality of the products and service provided.”

From a distribution perspective, Sue explained it’s also about fees, charges and commission, and also HOW a product is sold.

Each part of the business “has to represent value in its own right.”

Not stand alone

Fair value isn’t a standalone consideration but something that needed to be embedded in culture and business models as an ongoing process.

James Yerkess, Manager Director of HAL Consulting, has been a global head in a major international bank - a part of the financial services sector further along the line in the adoption of a fair value ‘exchange’ with customers. He emphasised the need for quarterly reviews, and annual, in-depth product reviews.

He said: “Embedding value exchange thinking in end-to-end product design is a real skill. Products aren’t just reviewed once every now and again it’s got to be an active value assessment that’s ongoing… It’s clear the regulator is asking for a revised value exchange, and that the status quo has to change.”

He went on to point out that adding ‘value’ in banking had increasingly meant speed, ease, and convenience.

More than just price

Fair value does not mean cheap. Indeed it is an opportunity to talk about more than price.

Ian said: “Value means that you can actually charge a higher price because you’re adding more value. It’s not just a march to the lowest possible price anymore - but the creation of a value ‘proposition’ for a customer.”

Sue added: “The dual pricing ban means firms can’t rely on customer inertia anymore. We may be looking at a shift in how firms compete, and that will be on service and value rather than pure price.”

What are the benefits of embracing Fair Value?

“There’s now commercial value in being able to demonstrate value in order to retain your customers and make your books more sticky,” said Sue. The clearer you are on what value your products and services offer, the better the business position you’ll be in, not least as PCWs adapt to distinguish elements of insurance aside from just the price.

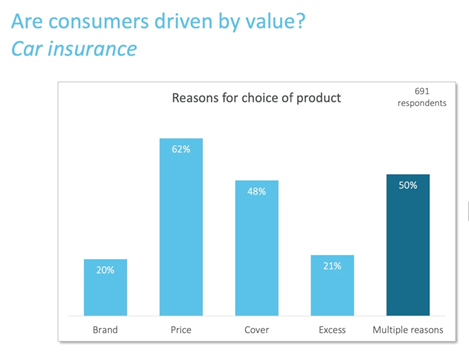

Mike Miskelly, Insight Analyst at Consumer Intelligence, showed that car insurance customers are already thinking and buying on other value vectors than price. Some 48% are looking at cover, 20% at brand, and half are going on multiple factors when they make their cover choice.

“What is your product offering beyond just price?” Mike asked. “That’s now really important to your strategy. This is an opportunity for providers to work with distribution partners to present their offerings in a clearer way so consumers understand the difference between the products being offered.”

James had already seen the benefits first hand. “The spirit of positive challenge actually enabled the banking sector to tackle some of the value exchange pieces that were not right and fundamentally needed to change” – for instance starting to treat new and long-term savers more equally, or reducing fees for international transfers. Those who moved faster actually have commercially benefited from it in the medium term.

James advised insurers at the start of the journey: “Have the confidence to see this in a positive light and look for ways to embrace it as a potential game changer.”

“Fair value clearly doesn’t have to be a negative thing,” Ian said. “It might make you a better business, it might make you more profitable, and it might make your customers more loyal. Use this as an opportunity for growth. Use it as something constructive rather than something destructive.”

So how do you know if you’re offering Fair Value?

Well, one thing you can’t do, the panel agreed, is mark your own fair value homework.

You’re not going to know what customers really find valuable unless you ask them. “Often value points aren’t understood,” explained James. “What is the value your customer is getting from this product or service? Are you just talking to yourself about what value means internally?”

“It’s only when seeing through the eyes of the customer that you realise, comparatively, you have a bit of an issue”, added Ian.

You’re also not going to be able to assess your own processes and practices in isolation from the rest of the market.

Sue introduced Sicsic’s framework to assess fair value, from market research to product design, distribution – including looking at sales incentives and targets – through to a comprehensive review of processes and MI, from claims to complaints, loss ratios to premium outliers.

The final stage is validation – peer review, external challenge, and industry benchmarking. Challenging internal assumptions is absolutely critical to the success of a fair value strategy.

Source: Sicsic Advisory

Showing your workings

Sue went on to talk about how important it was to have a structured approach, and show how fair value has been adopted into your organisation. “It’s moved in the regulator’s eyes from being a nebulous concept to very much an expected, demonstrable outcome…

“You need to be able to evidence and prove the fair value. Think about how you justify your profit margins, how they correlate to the value add that’s being provided to the customer.”

It’s also not something that can be done in isolation – end-to-end means end-to-end, and the regulators will be looking beyond your organisational borders. If you’re an insurer you need to take note of how your products are being sold. If you’re a broker you need to take note of how the products you’re distributing have been conceived, and how they’re managed. Sue adds: “You’ll be expected to have oversight of everybody in the chain.”

Why now?

The FCA first started looking into Value Measures in 2013. Since then the introduction of the IDD saw product governance brought up to scratch into line, with General Insurance distribution chain guidance following in 2019, and the pricing practices review that hit just a few months ago.

“This has been something that we’ve seen coming for a long time,” said Ian. “It’s not going away. It’s certainly not something the FCA is going to fall asleep and forget about, so the industry has to do something. The cause for concern will be if you don’t have a plan and if you don’t know how to address the issues.

Where to start if you’ve not started

“Clearly from our poll people ARE still grappling with fair, and evaluating value.

“As ever at Consumer Intelligence, our advice is to start from the customer. If you aren’t gathering data about their needs, wants, and their experiences of the service you’re already delivering, you should be.

“You’ve been given fair warning. Now it’s time to give your organisation a fair shake-up, and a fair shake.”

Watch the full Fair Value webinar discussion here.

Understand the needs and motivations of your customers or target audience

Viewsbank is our in-house consumer research panel. It’s a large, responsive and community driven panel that conducts both quantitative and qualitative research.

Our Viewsbank panel helps our customers with a wide variety of projects ranging from detailed mystery shopping to demographically targeted research surveys. The research helps our clients make informed decisions based on true understanding of the consumer’s voice.

Submit a comment