Trust matters in insurance for many reasons. A policy is fundamentally a contract of trust and brands which nurture it well enjoy better renewal and retention rates. Without trust all marketing messaging seems cynical. With it, the conversation can move from price to policy benefits to becoming loyal advocates who tell their friends about you

We used our Insurance Behaviour Tracker tool, which measures how consumers feel about their provider and why they choose the brand they choose, to take a long term look at trust.

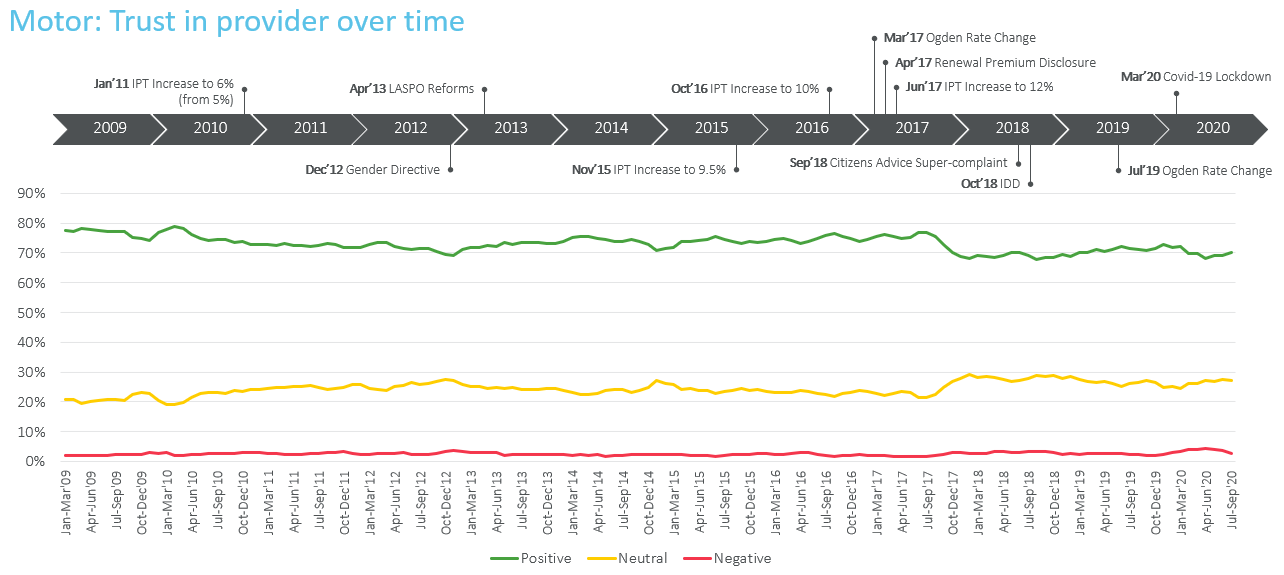

It shows that trust has remained at a fairly constant level over the past the decade, but warns that big events, if not handled and communicated well, have the capacity move the dial in the wrong direction for the whole industry.

2017 was not a stellar year in this regard. Changes to the Ogden rate and IPT led to a 10% increase in new business prices for car insurance while at the same time firms were required to disclose the previous year’s premium. For many consumers it meant seeing the loyalty penalty in black and white but often without meaningful explanation or context.

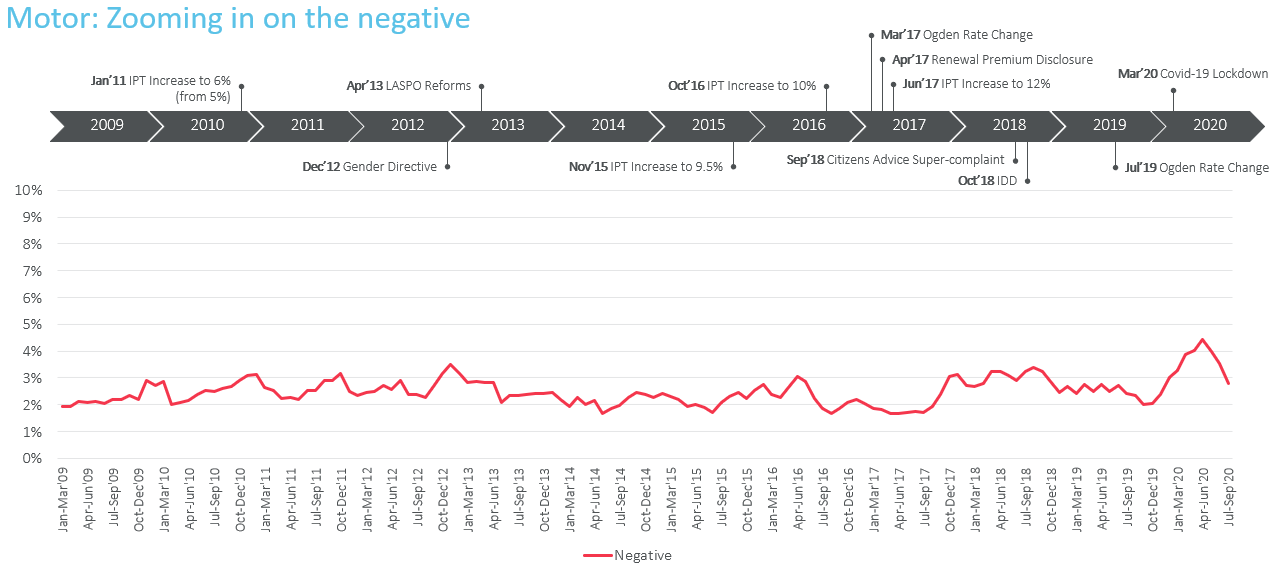

Trust dropped accordingly with the proportion of positive trust scores given by car insurance customers dropping from 76% to 68% and negative trust assessments jumping up from 1.7% to 3.1%.

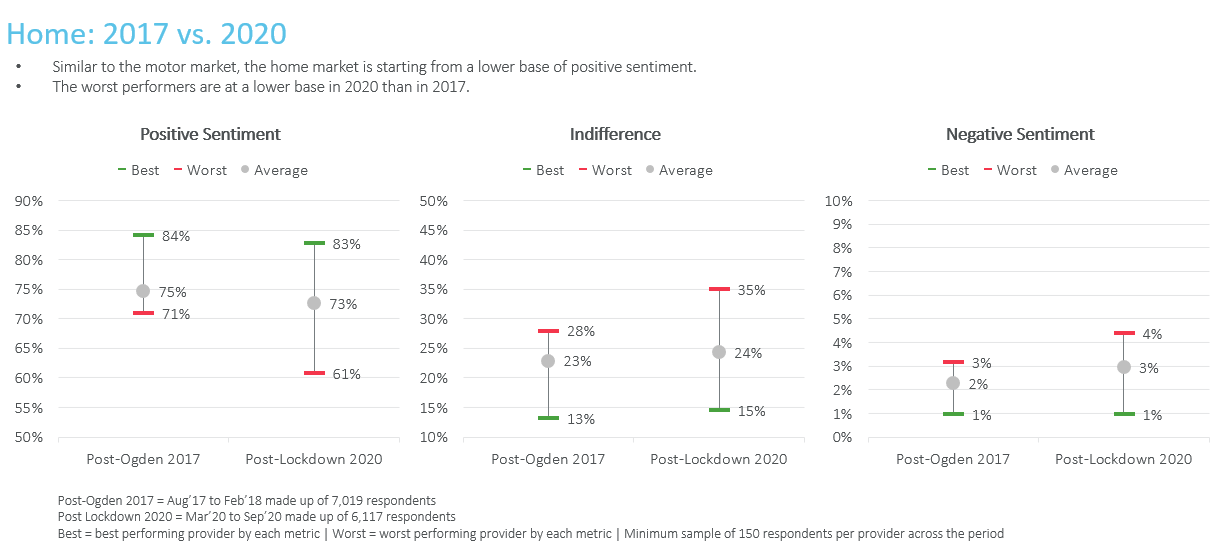

Home insurance was unaffected by Ogden but trust suffered a similar fate, falling from 77% to 70% in just a few months.

The sentiment never really recovered and mistrust spiked once again during lockdown, rising to 4.4% for motor and 3.5% for home for customers who renewed their policies between April and June 2020.

That’s an all-time high for distrust and there is another potentially lethal cocktail of events on the horizon with the FCA’s shake up of pricing and fair value rules.

As we prepare for the FCA’s radical changes, the decisions made by brands now could be their making or breaking.

Admiral has taken an early lead. Its £25 refund to motor customers proving a game-changer for renewals and positive sentiment.

LV= and Direct Line followed suit to offer refunds to their customers to reflect changing circumstances and driving less. In LV’s case they need to show financial hardship or loss of income. Direct Line’s refunds are linked to driving less and could add up to more than Admiral’s £25 for some customers. Both required customers to ask for the money back.

Many brands have done nothing at all beyond the minimum regulatory requirements. Some of those have painted FCA compliance as caring about customers.

Nobody has yet offered a partial refund for contents premiums for those who are not leaving their properties empty as often and therefore reducing the risk of burglary.

Bargain basement insurance

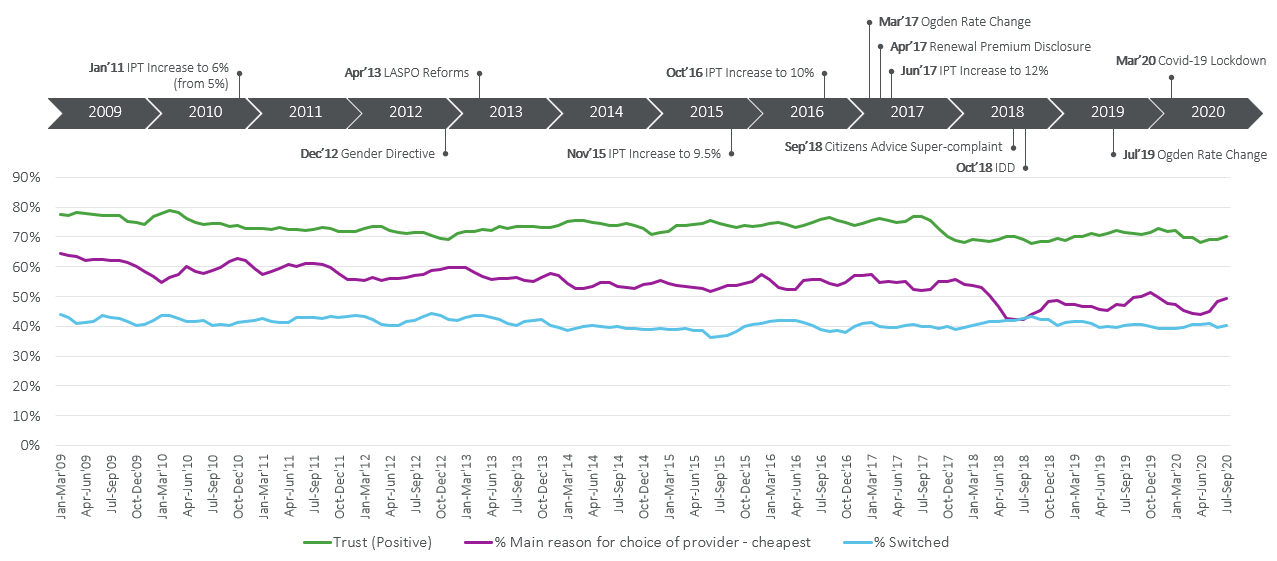

One of the more interesting lessons from 2017 is that when trust dropped, consumers cared less about price. There was a 10% drop in the first seven months of 2018 of people who chose their car insurance provider because it was the cheapest. They wanted to know the contract of trust was worth more than the paper it was written on.

That will be true again. But with a third of adults seeing a decrease in income since March, price will remain a cornerstone of the value equation. That’s an opportunity to look at tiered offers.

Those who have been price walked may see premiums suddenly reduce and ask if they’ve been ripped off for years. Savvy shoppers may ask why they can no longer make good savings from shopping around.

Communicating service, claims experience, customer satisfaction and the ease of making changes become a greater part of the conversation about where the value is.

Brands are starting from a lower base of positive sentiment and higher base of negative sentiment in 2020 they did after the upheavals of 2017. Even the most trusted have had seen their halos tarnished by the industry-at-large.

But the range between best and worst is enough for brands to know that by thinking about what trust means to their customers, they can remain in control of their own destiny.

Insight that will enable you to optimise your pricing strategy

Download our Home Insurance Price Index to gain insight into market movements, benchmark the major van insurance brands and help you understand the data behind the results.

Submit a comment