Lockdown presented both unique challenges and opportunities for reinvention of telematics brands. Closed driving test centres and a ban on driving lessons reduced the steady supply of new drivers looking for their first policies that had become their core customer.

Lockdown also opened a new conversation around fairness and usage. Road travel fell by over two thirds during the first lockdown, while many households found themselves having to scrutinise and reduce outgoings like never before.

Covid consumers are driving less, driving differently - and looking to save money.

Against that backdrop, usage-based insurance has risen in prominence with new brands either launching or increasing their visibility and footprint. This isn’t insurtech talking to itself – it’s brands responding at pace to changes in customer behaviour and circumstance.

An increasing number of products are taking telematics technology and building propositions that go beyond the conventional ‘pay how you drive’ assessment of consumers’ driving habits.

Pay as you go

One approach is to put a focus on transparency, linking part of the premium directly to the number of miles actually driven.

Established products taking this approach include By Miles and More Than Low Miler. Zurich recently entered the market with a minority investment into telematics provider My Policy, providing underwriting capacity to its usage-based policy JURNY, while RAC have just announced their own 'Pay By Mile' product.

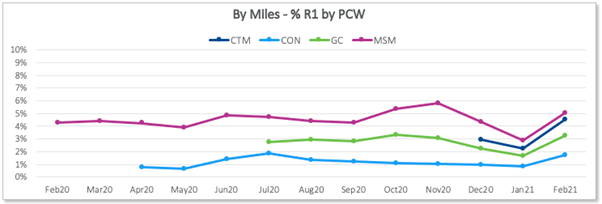

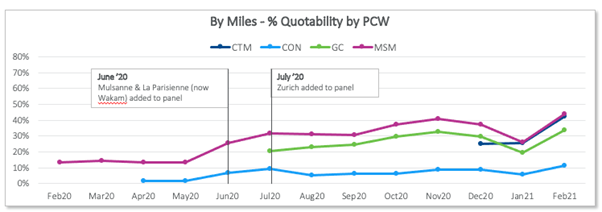

By Miles in particular stands out for its improved quotability and competitiveness in the last month.

It is on four major PCWs, compared with just one a year ago, and has added new underwriters to its panel, while its share of Rank 1 quotes increased notably in February.

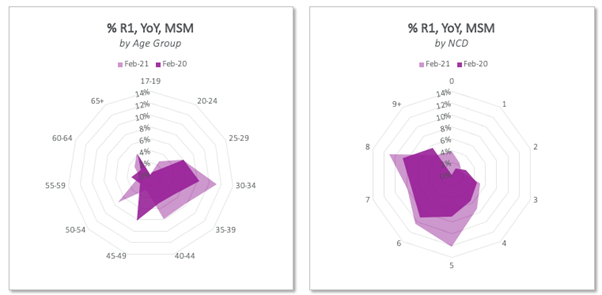

The major drivers for its competitive expansion have been drivers aged 30-44 and low-mid levels of NCD, while it continues to avoid the youngest drivers.

The expansion of its footprint ties in with a logical target market of city-based millennials, who perhaps don’t commute by car and only drive at weekends. They may have only recently started to drive to accommodate changes such as moving out of the inner-city or avoiding public transport.

One to watch

Meanwhile, Vitality is expanding from life and health insurance to car. Its incentives strategy will be familiar to its health customers who can earn incentives for being healthy. They already trust the brand with intimate details like weight, cholesterol levels and where they’re going to work out - so the reluctance of ‘being watched’ by their insurer that puts some off telematics products will likely be less applicable. Risk-reducing incentives including discounted Uber rides and car servicing will presumably also make data sharing more palatable.

Vitality has form overseas too, where parent company Discovery Insure has successfully grown Vitality Drive in South Africa.

Beyond young drivers

Young drivers remain the focus of most traditional telematics policies, with these types of policy behind 58% of the top 5 cheapest quotes offered to under 25s in the latest quarter.

However, telematics is a growing area for older drivers too as the cost of black box technology reduces, allowing brands to offer prices that can compete with standard policies for those with more experience.

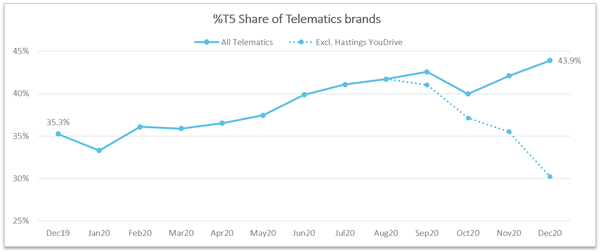

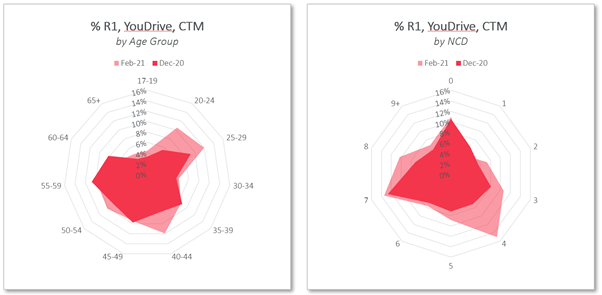

Hastings YouDrive, which launched in November with tech from Massachusetts-based Cambridge Mobile Telematics, has been making waves here.

It was the most competitive telematics proposition across all PCWs in its first full month of operation and has driven telematics T5 share in the market overall.

Initially Hastings YouDrive mirrored the competitive footprint of Hastings’ core Direct product – primarily ranging from ages 35-64. In early 2021, YouDrive has been increasingly competitive in the more conventional telematics footprint of drivers in their 20s.

Cracking telematics will give underwriters access to valuable data that no one else has about more segments of the market. For pay-as-you-drive brands, the prize is also a long term customer relationship based on transparency and high engagement and interaction levels.

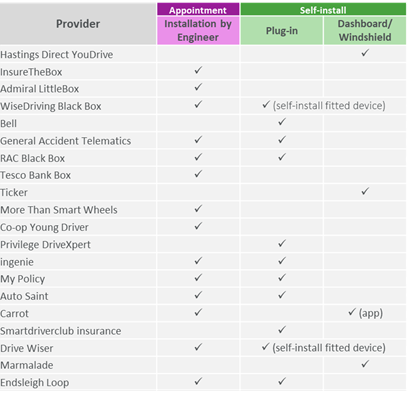

Self-install technology makes that easier and more affordable, and the daily rush hour commute looks to be a thing of the past for many. Are the stars aligning for more brands to get plugged in?

Optimise your competitive position in a fast-moving market

Understanding and optimising your product mix, particularly in your competitive context, can make all the difference when it comes to winning new business. To learn more about our pricing insights, please click below.

Comment . . .

Submit a comment