The coronavirus crisis has left many people worried about their finances, while branch closures mean that vulnerable customers are unable to access the services they need.

Meanwhile, banks are being asked to step up to the plate, providing both personal and business customers with the help they need, with Lord Mervyn King calling for branches to reopen - telling a webinar conference

"What we now need is the banks and the people who work in the branches to be there both on the telephone and in person if necessary.”

Consumer Intelligence asked over 1000 people how they felt about their own banks’ responses to the crisis, with many saying that they felt that they had not received guidance, or that they had had to ask proactively before finding out.

“We know that banking customers are very loyal, but this is a time in which they are feeling particularly vulnerable,” says Jade Edwards, head of banking at Consumer Intelligence.

“Banks have both a duty and an opportunity to communicate with the public and help with access and financial difficulties at this time.

“When the pandemic ends - and it will end - customers will remember which banks were helpful - and which weren’t. It’s particularly important to be close to your customers right now and to give them the help they need.”

Communication

Consumer Intelligence’s study shows that, although many people have heard from their bank about the organisation’s own response to coronavirus, a far smaller percentage feel that they have had guidance or support.

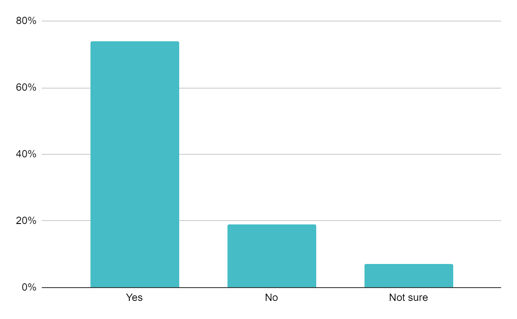

Nearly three quarters (74 per cent) of respondents, said they had heard from their bank in relation to how they are responding to coronavirus, although nearly a fifth said that they had not.

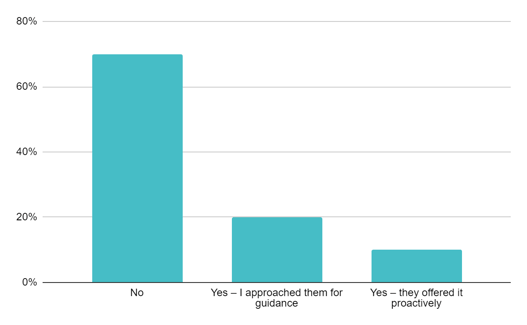

However, 70 per cent said they had had no support or guidance from either their bank or their mortgage provider in relation to the difficulties relating to the disease, and, of the remaining 30 per cent, only 10 per cent had received this proactively.

Have you heard from your bank in relation to how they are responding to Coronavirus?

Have you had support or guidance from your bank or mortgage provider in relation to Coronavirus?

Are the customers satisfied?

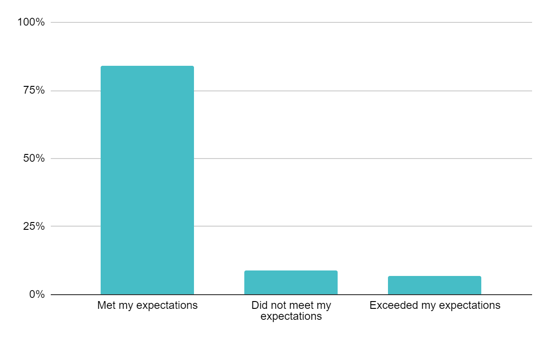

Despite a lack of proactive guidance, the majority (84 per cent) of respondents, said the communication and support from the bank had met their expectations. Nine per cent said it did not, and seven per cent said it had exceeded expectations.

Those who were disappointed, said that emails were “vague” and “generic”, while one respondent said they had just received a text about the changes, and had expected more.

There was also disappointment that some banks had not proactively frozen or removed overdraft charges.

Those who were impressed with bank responses cited reasons such as offering financial help with overdraft charges when needed, as well as good advice about accessibility for those used to using a bank branch.

Has communication or support from your bank in relation to the Coronavirus situation met your expectations?

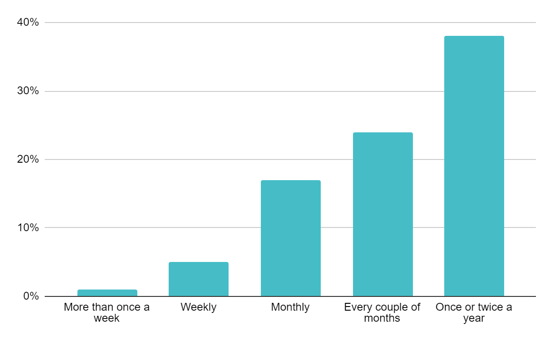

How often do you visit a bank branch?

Changing customer behaviour

The study also shed light on how many customers will have to change their behaviours because of the coronavirus. Widespread branch closures are particularly tough on elderly and vulnerable customers, so Consumer Intelligence asked how respondents and their family and friends might be impacted.

Only 15 per cent of respondents said they never visited a bank branch, but most only visited infrequently - either every couple of months or once or twice a year. Although 67 per cent said the closures and isolation measures would make no difference, 17 per cent said they would have to find new ways of banking, and 12 per cent said they wouldn’t be able to do some things they normally would. Five per cent said they would not be able to bank at all.

However, many said it would have a higher impact on friends and family, with 10 per cent saying they wouldn’t be able to bank at all, and 20 per cent unable to do the things they need to.

Over a third (36 per cent) of respondents said they knew someone who uses a bank branch regularly.

“In this brave new world of online meetings, and Zoom calls, it is easy to forget the technologically isolated, and banks must make sure they do not do so,” Jade Edwards says.

“They must step up to the plate with better communication, high standards of accessibility and as many financial measures as possible to help their customers to get through this. They will reap the rewards in terms of customer loyalty and brand recognition in years to come if they do the right thing now."

Coronavirus communications

Consumer Intelligence hold or have access to a multitude of accounts across the banking sector. We’ve been collating the customer communications around Coronavirus from these providers in order to assess the response from the industry to the pandemic. We are happy to share this content during this difficult time.

If you would like access to these communications please contact Charis Selwood, Banking Business Development Manager on charis.selwood@consumerintelligence.com or 07881 951830

Submit a comment