Purchase channels matter to any insurance brand that wants to be wise with where it focuses its time and money in customer acquisition and retention. It’s just as important to understand which channels customers use when they leave your brand, and who they move to.

Brands may know some of the information about themselves already. Consumer Intelligence’s Insurance Behaviour Tracker (IBT) takes it further by allowing brands to benchmark against their peers, pinpointing where you are losing customers, who you are losing them too.

Understanding who you are losing to helps you refine your offer and product on the right channel. For example a brand may have a strong direct book, but lose customers via PCWs – understanding that begs the question of how you can improve your PCW proposition.

Equally, understanding where you are more successful at winning both at renewal and customer acquisition lets brands focus on and defend their position effectively.

Customer shopping behaviours change over time and between demographics, so it’s worth keeping up to date with how your customers prefer to shop.

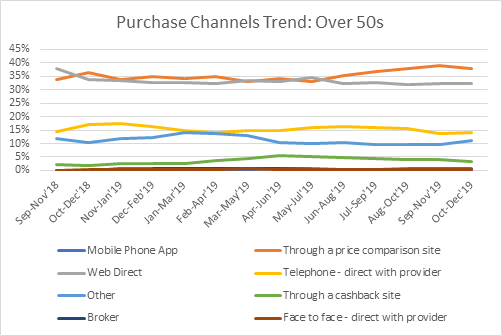

The below chart, for example, shows the growth in Over 50s using Price Comparison Websites in 2019 whilst shopping directly online dwindled. It’s a changing dynamic that Covid-19 and economic changes are set to alter for months to come.

INFOGRAPHIC: Shopping Journey

Our Insurance Behaviour Tracker (IBT) is the most comprehensive insurance focused consumer survey in the market. It provides insight and understanding of consumer behaviour throughout the renewal process, giving you a view of market trends, and brand performance.

Benefits of the shopping journey module:

- Gain an understanding of how both the market and your own customers shop

- Which channels consumers use and what influences their decisions

- By aligning your marketing and overall acquisition strategy to the market could result in more new business and so, increased GWP

Comment on blog post . . .

Submit a comment