A perfect storm of cancelled driving tests, the challenges of black box installation during lockdown and a push by pay-as-you-drive providers meant that telematics providers were arguably worse affected by Covid-19 measures.

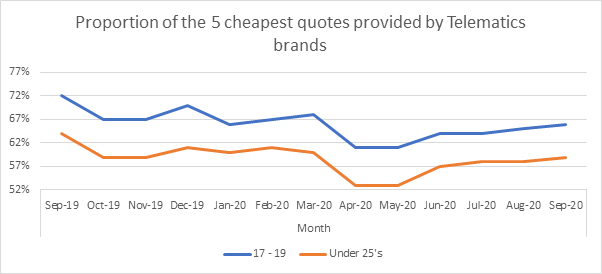

Telematics policies, which are used primarily by younger drivers to keep insurance costs down, now make up just 58% of the five cheapest quotes for drivers aged under 25 – down from 64% a year ago.

This is, however, an increase on the low of 53% during April and May when some brands withdrew from the market to focus on core product offerings.

Average quoted premiums for the under-25s now sit at £1,922. Even with telematics policies working hard to keep pricing affordable, there is still a huge difference when compared to the over-50s (£427) and 25-49 year-olds (£661).

Meanwhile new entrants, such as By Miles – which has reported a surge in sales amid the pandemic with drivers attracted to its pay-as-you-drive insurance offering – threaten to eat into the market share the telematics sector has built up in recent years.

Telematics policies are particularly prevalent for 17-19 year olds, making up 66% of T5 quotes in September. But the potential pool of new customers was all but destroyed when ban on driving tests for all but essential workers during lockdown meant just 3,448 passed practical driving tests in the second quarter, compared to 182,572 a year ago. That’s a 98.4% reduction in new drivers looking for insurance.

When driving tests recommenced in July, so did competition for customers, and providers’ appetite to acquire good businesses.

A Plan last week announced that it has agreed to buy Ingenie from Watchstone for up to £5.5m. It will join A Plan’s Endsleigh business when the transaction completes.

Endsleigh already worked with A Plan on a white label telematics solution, Endsleigh Loop, and A Plan CEO Carl Shuker has said the deal will pave the way for telematics solutions for older drivers in addition to the students that Endsleigh is targeted at.

With 31 telematics brands returning a quote in September, and a proportion of the population keen to avoid public transport, the competition for demonstrably good drivers looks set to continue.

Car Insurance Price Index [free to download]

Download our Car Insurance Price Index to gain insight into market movements, benchmark the major van insurance brands and help you understand the data behind the results.

For further information, please contact:

Consumer Intelligence

+44(0) 117 317 8181

About Consumer Intelligence

Consumer Intelligence is data analytics company that helps businesses execute great customer strategies. For over a decade, the company has been benchmarking the insurance market and retail banks in the UK and beyond. The unique combination of benchmark data, consumer research and extensive experience has helped some of the world’s major brands focus on delivering better services to customers and improving their own business performance as a result. For more information, visit the website www.consumerintelligence.com

Comment . . .

Submit a comment