The insurance industry has experienced a surge in telematics-based insurance policies over the last decade. These policies utilise telematics technology to track and monitor driver behaviour, with the goal of providing personalised premiums based on individual driving habits. Especially popular among young drivers, telematics has played a crucial role in curbing inflation in the under 25s market.

Telematics has proven effective in promoting safer roads and rewarding good driving behaviour. However, the reluctance of consumers to share their data has limited its adoption beyond the youngest age group.

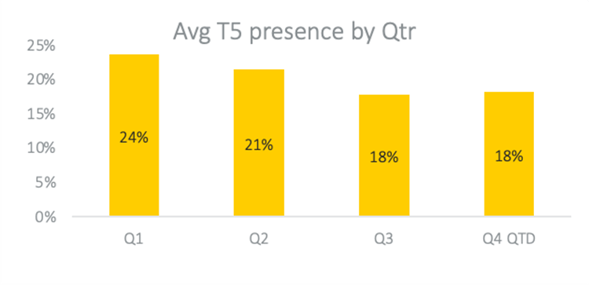

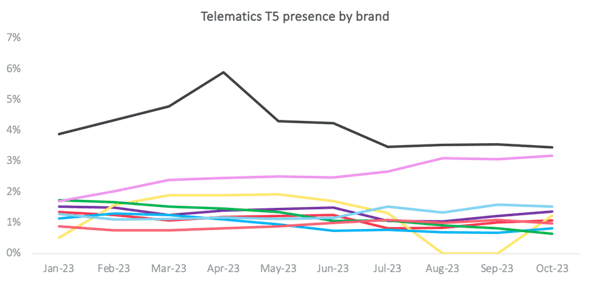

Although telematics brands have managed to remain competitive across all age groups for some time, their presence in the market is now declining. In the first 10 months of 2023, the proportion of telematics brands appearing in the top 5 results across major price comparison websites fell by 6 percentage points. The leading telematics brand experienced the largest drop in competitiveness. Nevertheless, a handful of telematics brands have defied this trend by keeping their premiums stable while the overall market sees inflation.

Considering that the competitive presence for telematics brands has remained strong for under 25s, this market level decline might indicate a strategic decision by some players to focus their efforts where they achieve the best conversion rates.

However, other factors may be at play. Over the past two years there has been a surge in tiered product offerings. This has come particularly in the form of "essentials" products, which offer lower prices for reduced coverage. These newcomers are primarily competitive for drivers aged 30 and over. It is possible that increased competition from these offerings has compelled some telematics brands to retreat from the older age groups.

Looking ahead, it is essential to consider the potential longevity of telematics as an insurance product. As technology evolves, telematics capabilities are likely to become standard features in cars, eliminating the need for standalone telematics devices. This poses both a threat and an opportunity for existing telematics insurers. While integration into cars could decrease demand for traditional telematics policies, it also presents a new avenue for collaboration with car manufacturers. Partnering with manufacturers could provide new market access opportunities and potentially reach untapped demographics. Convincing policyholders of the benefits will remain the key challenge.

Understand and optimise your competitive position

Gain a uniquely comprehensive understanding of market dynamics, competitor behaviour and brand positioning within the home insurance market with our invaluable price benchmarking tool, Market View.

Comment . . .

Submit a comment