The insurance industry is mind-blowingly sophisticated when connecting multiple data sources and fields to return a price to consumers in mere seconds.

Claims has lagged behind, however, with forms to fill in and in some cases post, and a wait for manual validation and payment. Some of this is necessary. Some if it is stressful and frustrating for customers and downright inefficient for insurers.

A growing parametric insurance sector is seeking to become part of the solution to both and deliver somewhat of a holy grail of insurance claims – delivering a better service and at lower cost to the insurer.

Parametric insurance provides cover for pre-agreed risks or events, and automatically pays out if one or more parameters change in a pre-defined way. Its origins are in catastrophic weather events, such as cyclones in the Caribbean, but newer applications include payments for flooded buildings if rainfall reaches a certain level, loss of revenue for retailers on a washout weekend, and more recently pay-outs to online retailers if their third-party providers like cloud or payment services go down for a certain amount of time.

It is gaining traction in personal lines too. Most recently Just Travel Cover announced a partnership with CPP group’s Blink Parametric to launch Smart Luggage.

The premise is simple. Air travellers receive an automatic £50 if their luggage is unlocatable for 30 minutes, and another £500 if it’s not found after 48 hours. The money is paid straight to the customer’s PayPal or bank account.

Blink’s white label technology has other applications such as connecting flight data with policyholders and pro-actively offering compensation or a hotel room if a flight is delayed by a certain number of hours.

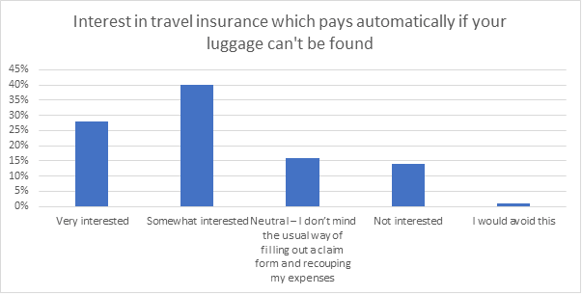

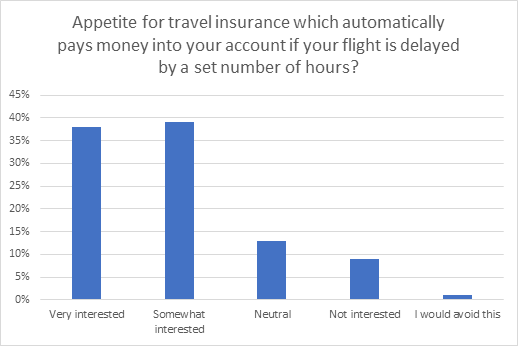

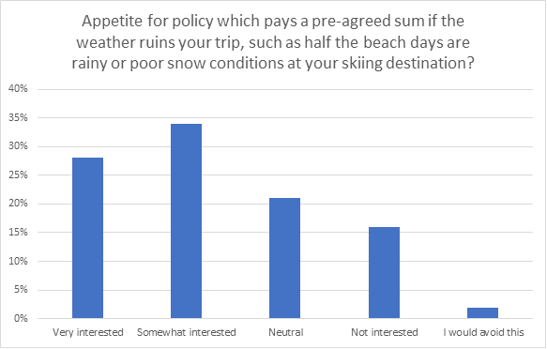

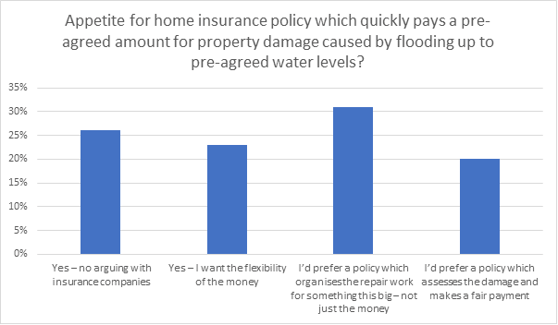

Our research shows that while most consumers haven’t heard of the relatively new concept (12%) most like the ideas in practice.

As the charts below show, consumer appetite is high for travel disruption. It wanes for bad weather on holiday, and further for complex claims such as flood payments where appetite for coordinated repairs and an accurate sum to cover the loss remains. That said, it does not have to be a binary choice; companies such as Jumpstart on the US West Coast bridge the gap with quick pay-outs for those who can’t afford traditional earthquake insurance.

Source: Viewsbank survey of 1,027 consumers. Online interviews conducted 10-12 September 2021.

As travel resumes, there are years of uncertainty to come. Brands which successfully build and communicate a value proposition which takes some of the uncertainty away with simplicity have a clear opportunity ahead.

And as data becomes ever-more available and connected, providers are likely to find more applications for a low touch policy that builds trust with quick payments before customers even think about calling their insurance claims line.

Viewsbank is our in-house consumer research panel. It’s a large, responsive and community driven panel that conducts both quantitative and qualitative research.

Our Viewsbank panel helps our customers with a wide variety of projects ranging from detailed mystery shopping to demographically targeted research surveys. The research helps our clients make informed decisions based on true understanding of the consumer’s voice

Comment . . .

Submit a comment