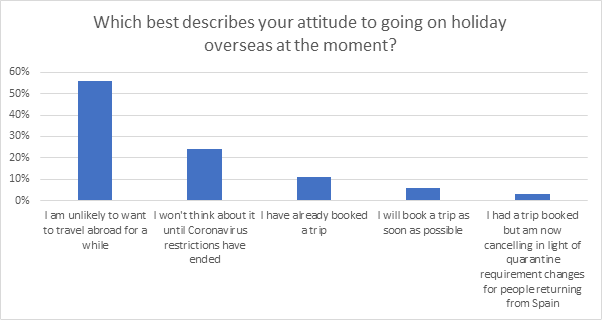

The number of people who have booked or planned an overseas holiday this summer is low - but it hasn't dropped drastically after news that those returning from Spain will have to quarantine for a fortnight.

It’s a glimmer of good news and stability for the beleaguered travel industry. Whilst most people have ruled out overseas travel for the foreseeable future, the decision about Spain hasn’t put off those who were already determined to jet.

It seems determined travellers, however, have passports, will travel…

Our poll of 1,000 adults in the UK shows 21% of people had booked holidays or planned holidays abroad on 20th July, before the rules changed. When we repeated it this weekend 17% still had those plans in place. Three per cent of respondents said they had cancelled a trip in light of the quarantine requirement changes.

Put simply, the more you engage with a customer, the more engaged they are with your brand in return, and the less likely they are to leave you.

For insurers, the ultimate ‘engagement’ with a customer is of course a claim - and it’s true that those who have had a good claims experience are more likely to stay put. But even without a claim, the users’ experience of engaging with an organisation can and will influence trust, and retention.

Source: Viewsbank interviews conducted online 31st July to 3rd August 2020

Younger people are more likely to be going on an overseas break. Over one quarter (27%) of 25-34 year olds have either booked a trip or plan to do so as soon as possible compared to 12% of 45-54 year olds and 12% of people aged 65 and over.

Geography made a huge difference to the answers too. In Scotland, 10% said they had already booked an overseas trip and 3% planned to. Nearly double the number of Londoners answered that way, with 14% already having booked a trip and 10% planning to book one as soon as possible. Scots were also the most likely to have changed their minds about travelling; 7% said are cancelling a planned trip, compared with 1% in South East England.

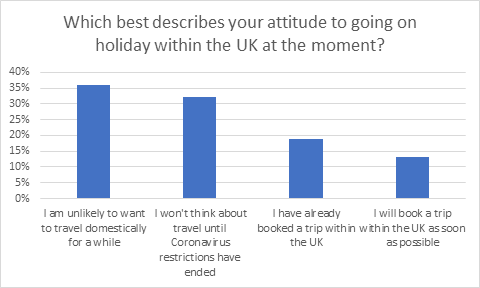

Domestic travel is more popular across the board. Our poll found that one third of Brits have booked or are planning to book a staycation in the UK. There is another age skew, with 37% of 18-34 year olds going on a domestic holiday compared with 30% of those aged 55+.

For travel insurers, there’s no doubt that this is going to be a lean summer.

Only 34% of people in our poll have any kind of policy at the moment, and only 21% have an annual policy.

However, there is a chance here for brands to understand customers, who those determined travellers are, and what priorities they have.

For instance, the Spanish quarantine has made people more keen for cover if FCO guidance changes and they can’t travel to their destination. Before the rules 50% thought it was an important feature for a policy, rising now to 55%, and likely to continue doing so.

Which of the following items would be most important for you to check were included in your cover, if you were looking to buy a travel insurance policy?

|

Medical expenses while I am away, other than Covid-19 |

69% |

|

Medical assistance overseas if I or someone I am travelling with becomes ill with Covid-19 whilst on holiday |

69% |

|

Delays and cancellations |

63% |

|

Cancellation if I or someone I live with contracts Covid-19 |

59% |

|

Cover in case a travel company ceases trading |

58% |

|

Repatriation if I or someone I am travelling with become ill Covid-19 whilst on holiday |

57% |

|

Pay-outs in the event of a serious accident or injury |

56% |

|

Lost luggage |

55% |

|

Cover if FCO advice changes after booking my trip to advise against non-essential travel to my chosen destination |

55% |

|

Possessions that were lost, stolen or damaged |

54% |

|

Cancellations due to other natural events such as an earthquake or volcanic eruptions |

47% |

|

Cancellation in the event of terrorist attacks/political instability |

46% |

|

A loved one to stay with me if I become ill whilst on holiday |

32% |

It’s also a chance for travel insurers to review their communications for clarity and their policies for suitability. All in all, our poll found that 41% of people who currently have a travel policy weren’t confident that their travel insurance policy would cover them adequately if there are complications to their trip in relation to Covid.

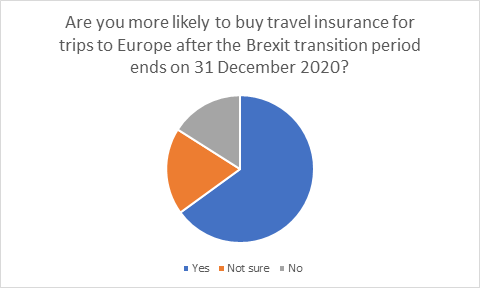

It’s not just around coronavirus that there needs to be education. 30% of Brits aren’t aware that Brexit will mean they were no longer entitled to health care assistance in the EU.

But the good news for insurers is that the combination of coronavirus and Brexit mean people will need travel insurance more than ever.

While only 11% of Brits will be buying travel insurance in the next two months, 65% said they are more likely to buy policies to cover European travel after the Brexit transition period ends.

The travel insurance industry can take some comfort in the longer-term indication of demand. The current lull could be viewed as an opportunity to examine their messages and products for what will hopefully be a post-corona, travel-starved, European bounce back.

Track changing consumer trends

Understanding how the looming recession, as well as a potential second peak of the pandemic, will impact consumers through the rest of 2020 - and beyond - will be key for insurers.

To follow the changes to come, gain insights into the next stage of the pandemic and examine how they affect consumer behaviour and attitudes, we have launched version 2.0 of the Covid-19 consumer tracker, which is now available to purchase.

Comment . . .

Submit a comment