Pet purchases or rehoming has been one of the few growth stories to emerge over the last 12 months, with more than 10% of households getting a new pet since the pandemic began.

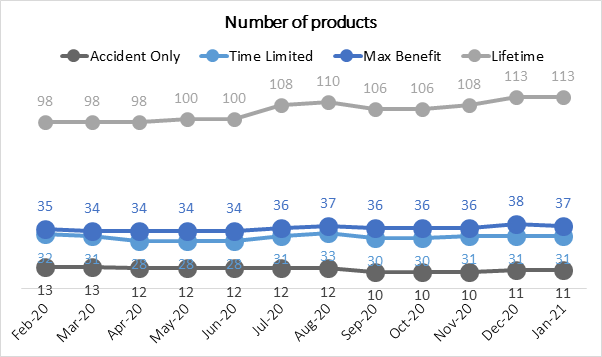

Pet owners are keen on pet insurance and the upward trajectory in the number of products reflects customer demand for the most comprehensive cover available. This is not a stagnant market.

Our close monitoring of the market reveals that the number of lifetime products has increased over the last 12 months, with 15 more lifetime products available in Jan-21 than Feb-20.

People might be cutting back on all sorts of discretionary spending, but insurance policies that provide ongoing cover (Lifetime) are the most prevalent in the market, perhaps as a result of brands reacting to consumer demand.

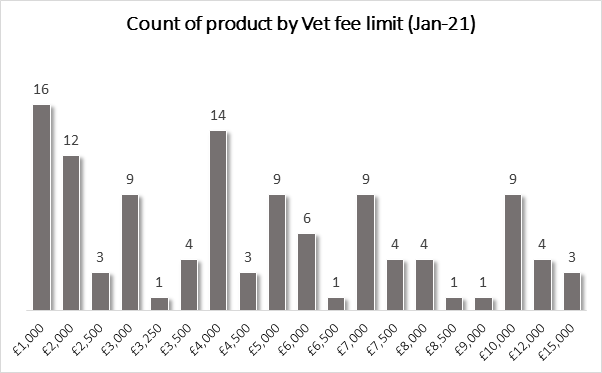

However, there is a big divide between the cover limits on lifetime products. Some 16 policies only cover vet fees up to £1,000 (either per condition or for the full year), and the same number cover £10,000 or over.

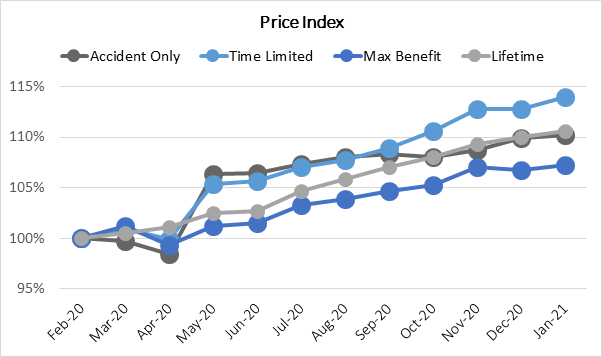

Our Pet Marketview tool tracks premiums, which brands are quoting, and their competitive position, for 1200 risks on PCWs and 1200 risks on Direct channels. It shows that premiums have risen steadily for all policy types over the last year at a rate well beyond inflation.

This all presents a conundrum to brands which are battling for the top spots on PCWs, but also want to demonstrate genuine value.

One way of bringing down premiums, even for the higher end of lifetime cover, is varying the excess levels to co-payment.

This isn’t a new thing, but it is being done differently of late.

Last month we saw Bought By Many presenting co-payment levels of excess as different product tiers. Essentially it cloned each of its Value, Regular and Complete products to add 20% of the claim amount to its £99 excess. The naming of the product clearly communicated the co-pay element and means it has more tiered product offerings which it can use to achieve brand dominance for targeted customers.

|

PCW Product |

Vet fees |

Excess |

Co-pay |

|

Bought By Many Value |

£3,000 |

£99 |

|

|

Bought By Many Value 20% |

£3,000 |

£99 |

+20% of the remaining claim amount |

|

Bought By Many Regular |

£7,000 |

£99 |

|

|

Bought By Many Regular 0XS |

£7,000 |

£0 |

|

|

Bought By Many Regular 20% |

£7,000 |

£99 |

+20% of the remaining claim amount |

|

Bought By Many Complete |

£15,000 |

£99 |

|

|

Bought By Many Complete 20% |

£15,000 |

£99 |

+20% of the remaining claim amount |

There are many other brands which include co-payments. Some make them mandatory or increase them for older pets. They align pet owners’ consent to expensive diagnostics and treatments with the insurer’s, and more importantly they bring down the price on PCWs to improve positioning. We can see some brands making co-payments optional on direct channels but mandatory on PCWs to help deliver a competitive quote.

However, it is only Bought By Many & 4Paws which present all excess options on the PCWs as separate products.

The FCA’s flagship financial lives report this month found that 33% of adults with insurance products are more likely to shop around in the future. Honing the message and positioning grows ever more important for all.

Optimise your competitive position in a fast-moving market

Understanding and optimising your product mix, particularly in your competitive context, can make all the difference when it comes to winning new business. To learn more about our pricing insights, please click below.

Comment . . .

Submit a comment