.jpg?width=701&name=Canva%20-%20Woman%20Wearing%20Face%20Mask%20(1).jpg)

If there’s one things insurers crave, it’s clarity. And the travel industry got just that when the government advised against non-essential travel on 17th March, clearly triggering policies.

Just days after FCO issued its guidance, the ABI clarified that insurers would pay at least £275 million in claims to 400,000 policyholders who have had to cancel holidays or incurred disruption whilst abroad and trying to return.

That’s nearly double the £148m paid out when the eruptions of Eyjafjallajökull closed airspace across Northern Europe.

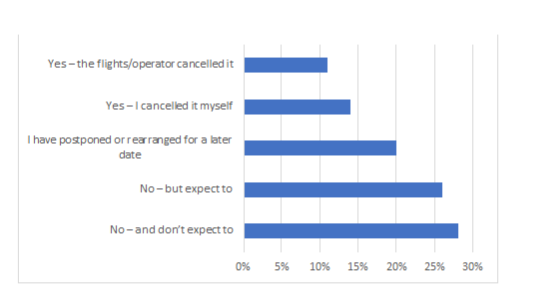

At some point, the restrictions will lift and people will travel again. More than a quarter of those with a holiday already booked are still hoping it will go ahead.

Whilst most new policies sold won’t cover coronavirus, it gives the industry a chance to clearly communicate what is and isn’t covered from the beginning as well as to reinforce the benefits of insurance against future unknowns.

There will also be a cost from that big spike in claims.

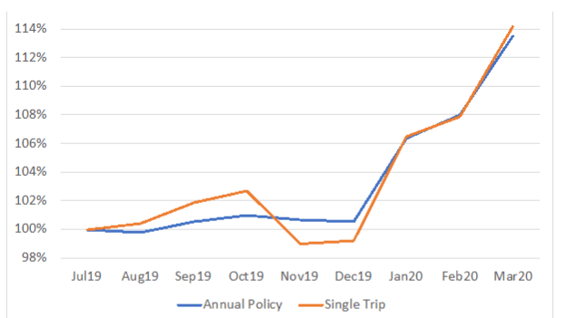

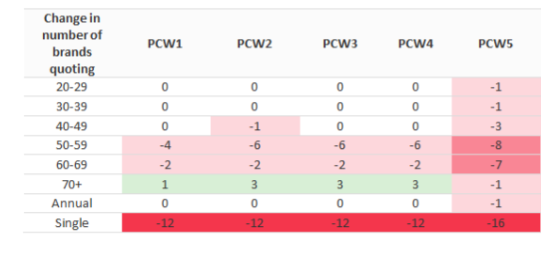

Since the start of the year our travel insurance index shows premiums have risen by 15%. The most recent changes have been driven by the more premium end of the market. The average premium for one brand’s top tier comprehensive cover increased by over 100% in a single month, compared to a still hefty 35% increase for its lower tier products. In total there were 12 brands which increased prices by more than 20% in March.

We have also seen several insurance brands withdraw their cover entirely, with the bulk of the withdrawals focused on older customers and single trip cover.

Easyjet are already trying to get people thinking about life after lockdown, with the early launch of their winter sale and discounted tickets into 2021.

But whenever we’re allowed out again, travel probably won’t feel quite as carefree as it used to.

That’s an opportunity for insurers to clearly communicate the benefits of what their policy does and doesn’t cover and to tailor their proposition to the fast changing marketplace.

Introducing the Consumer Intelligence Covid-19 Consumer Tracker

In response to the challenges faced by our clients across the general insurance industry, we have been working hard behind the scenes gathering data and insight that will help personal lines insurers and brokers navigate this difficult and challenging time.

We are pleased to announce the launch of our new Covid-19 Consumer Tracker, focusing on wider consumer behaviour trends during the COVID-19 pandemic but with a specific focus on the general insurance industry.

We are interviewing a nationally representative sample of 1,000 consumers every week to bring you timely insight on what your customers, your competitors’ customers and the general market think and are doing during these uncertain times.

Comment . . .

Comments (1)