In the ever-shifting landscape of Price Comparison Websites (PCWs), GetSafe's story stands out as a vivid illustration of how market dynamics can turn the tide for industry players.

Remember when GetSafe burst onto the PCW scene, making its debut on Go.Compare, in 2020? Backed by a strong Series B funding round, they hit the ground running with some of the most competitive prices out there. It was an exciting time, and their entry certainly shook things up in the market.

As we moved into 2021, we saw GetSafe’s PCW presence spread across the Big Four, and in 2022, GetSafe expanded its offerings to include buildings and contents insurance, widening its target demographic from renters to first-time homebuyers and beyond. This move demonstrated a strategic pivot to capture a larger share of the market, and for a while, it seemed to be paying off. By early 2023, GetSafe had become one of the most competitive players in the home insurance market from both a pricing and quotability perspective.

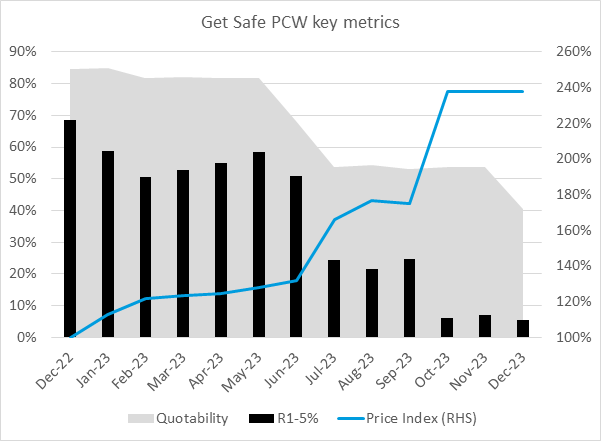

However, the insurance market is always evolving, and GetSafe's strategy started to shift mid-year. We noticed a gradual increase in their rates, which began to affect their quotability and competitive edge on the PCWs. By October, prices had significantly risen, and by December 2023, GetSafe had quietly exited the PCW stage.

Source: Consumer Intelligence Buildings & Contents MarketView, 2,100 risks per month

It was quite the development to witness. The rate changes in June were the first hint of a new direction, but it was the major adjustments in July that seemed to signal a strategic withdrawal. This came almost exactly a year since Get Safe completed their buildings and contents product roll-out, raising the possibility that there was a struggle to balance renewals and new business. The result was GetSafe relinquishing many of their top positions on the comparison sites.

Get Safe were not alone in their struggles. Fellow Wakam-underwritten brand Urban Jungle also fell in competitiveness, particularly in the second half of 2023. While their combined product continues to quote, it is far from the competitive heights seen in 2022.

Through this narrative, we’re reminded of the delicate balance required in the PCW environment. It’s not just about offering the lowest prices, but about sustaining a viable position in the market. Also clear is how hard it is for disruptors to successfully challenge the status quo in this channel. Lemonade have achieved longer-term success in contents-only partnering with Aviva. Through 2023 any new combined products on PCWs came from existing insurance groups. It is unclear where the next Get Safe will appear from.

For us as industry observers and participants, GetSafe’s experience reinforces the importance of agility and the need to constantly adapt strategies to the market's rhythm. It will be interesting to see how this will inform future approaches within the PCW space and for GetSafe itself.

Market View

Optimise your competitive position in a fast-moving market by accessing uniquely comprehensive and market leading insurance pricing insights.

Submit a comment