One of Consumer Intelligence’s specialist areas is helping insurance brands understand how changes in the industry and consumer behaviour can impact the future of insurance. We identify the key trends that have the power to fundamentally change all elements of the value chain.

One of Consumer Intelligence’s specialist areas is helping insurance brands understand how changes in the industry and consumer behaviour can impact the future of insurance. We identify the key trends that have the power to fundamentally change all elements of the value chain.

Many of these key trends are well known tech topics (including blockchain, AI, autonomous vehicles, internet of things etc) and this is where a lot of ‘thought leadership’ around the future of insurance centres. However, much of the work done in this area tends to focus solely on technology and often just one trend at a time (for example, the applications of blockchain or the impact of autonomous vehicles).

Seeing the future through the eyes of the consumer

Given CI’s heritage in thinking from the consumer perspective it’s perhaps obvious that our future of insurance thinking takes a rather different slant. We believe that change will be due to more than technology on its own and multiple trends will come together to deliver a future of insurance that is shaped by many forces rather than just one.

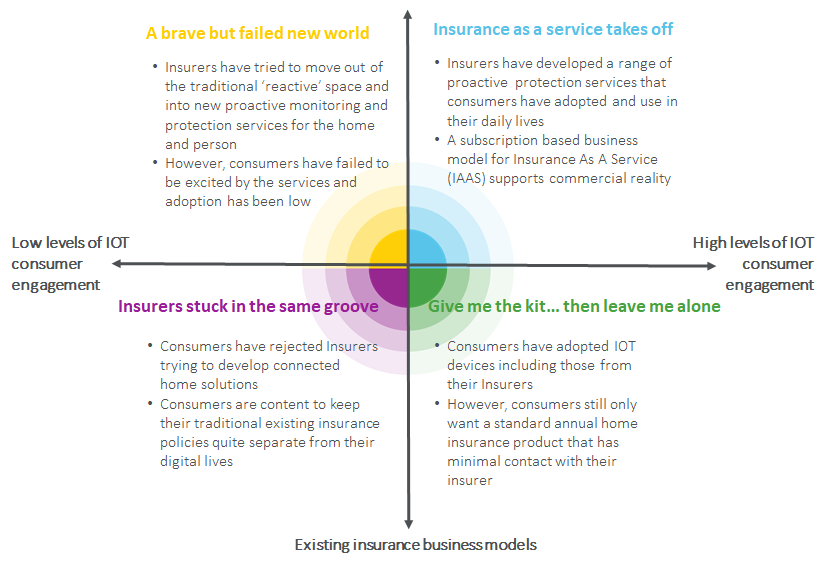

And this same approach is applied when we think about what the future of insurance could look like. For it’s very unlikely there will only be one version of the future. To illustrate this with the example of ‘connected insurance’ and consider where the huge growth in connected devices and their subsequent data footprints could lead and then overlay different reactions from consumers in terms of adoption of such services we can easily see a number of scenarios that might come true.

Take the diagram on this page. It shows four alternative scenarios for the development of connected insurance based on the emergence of new business models (e.g. a shift from insurance products to insurance services) and high and low levels of consumer engagement.

Preparing for all possible futures

The key benefit of considering different scenarios is in understanding that all four are possible and that there isn’t just one ‘future for insurance’. We’ve helped leading insurance brands understand how fast change is coming, the potential size of future markets as well as putting a quantifiable metric to the risk new scenarios can present to their existing customer book. After all, there’s more than one future for insurance.

Identifying future trends and planning for them

‘The financially vulnerable consumer’ is just one of over 100 important and emerging trends being tracked by Consumer Intelligence through its horizon scanning service that helps organisations to identify, understand and prepare for a dynamic future environment.

This insight is already being used to help some of the UK’s leading companies within the insurance market create a competitive advantage. Isn’t it time you looked to the future with Consumer Intelligence?

Submit a comment