Van insurance costs are continuing to race ahead with average annual costs hitting £967, Consumer Intelligence’s quarterly Van Insurance Cost Index reveals.

Our quarterly pricing study found under-25s are the biggest losers with the average costs of a new policy increasing by 4.5% in the three months to 31 July, taking annual premiums to £3,297.

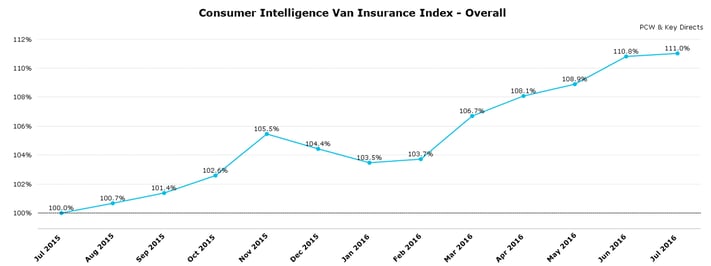

Average best-buy prices across the market as a whole have grown by 2.7% since April taking the average increase for the year to 11%. Under-25s have seen annual increases of 7.2%.

However, van drivers who opt for “carriage of own goods” cover - appropriate for workers such as builders, plumbers, carpenters and shopkeepers who commute to work – are escaping the worst of the price rises.

They pay average annual premiums of £891 compared to £1,294 for those who opt for “social, domestic and pleasure” cover.

Annual premiums for “carriage of own goods” cover are increasing slower than the rest of the market - by 2% in the past three months and 9.7% for the past year while “social, domestic and pleasure” cover has increased by 5.8% since April and 17% in the past year.

Overall: Top 5 premiums across PCWs & key directs up 11.0%, on average, over the last 12 months.

Helen Cassley, Head of Business Development, said:

“The van insurance market is seeing double digit price rises in line with the car insurance market as a whole with van drivers paying higher premiums than motorists.

“When people are using their vans for work as more and more people are doing it adds substantially to the costs of doing business.

“That means it makes sense for drivers to ensure they source the appropriate insurance for their van as there are substantial savings for those who only need carriage of own goods cover. Shopping around will also help as prices vary month on month and between providers.”

For those who choose "carriage of own goods" their cover will also include social, domestic and personal use. For those who choose social, domestic and personal use they are covered to and from a permanent place of work. A lot of people who choose this cover and have a van will probably have a past-time that suits having a van as either their sole vehicle or as a second vehicle.

Detailed analysis shows average premiums for over-50s are up by 9% in the year to July to £351 with prices rising 1.1% in the past three months. Those aged 25 to 49 have seen prices rise by 12.4% in the past year to £568.

Average prices

Please note - these should be used just as an indicator of roughly what consumers can expect to pay. The actual index above should be used to accurately see how the market has changed over the year as it directly shows how premiums have changed for common risks.

|

Segment |

July 2016 Average Premium (5 cheapest) |

|

Overall |

£967 |

|

Age < 25 |

£3,297 |

|

25<= Age <50 |

£568 |

|

Age >=50 |

£351 |

|

Vehicle usage = Carriage of Own Goods |

£891 |

|

Vehicle usage = SDP (Social, Domestic, Pleasure) |

£1,294 |

Sample size: Risks for sector = 600 each month

Methodology:

1The cheapest premiums were calculated by comparing the prices offered for 600 people by all the major Price Comparison Sites and key direct insurers. The top 5 prices for each person were compared to the previous month’s top 5, then these variations averaged to produce the index.

Van Insurance Cost Index

Understand the research behind the van insurance cost index results . . .

Submit a comment