Christmas 2020 is going to look, at the very least, a little different.

By any standards, it’s been one hell of a year. As it draws to a close that also makes it a great time for brands to take stock of where consumers are, what they’re thinking and planning - and what products, services and support they’re going to need over the festive season, and beyond.

In our latest Viewsbank survey, we asked if consumers knew it was Christmas time at all. Here’s what we found out.

Brits aren’t dreaming of a ‘normal’ Christmas

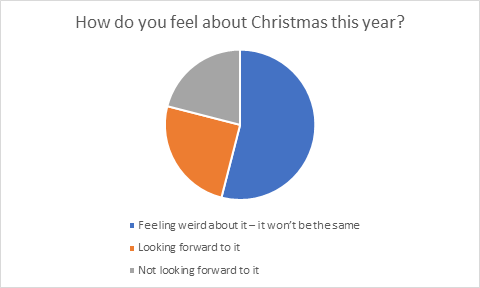

In fact, 54% of people said Christmas just wasn’t going to be the same this year, and only 25% are looking forward to it.

Any brand manager planning a bombardment of cheer should take immediate heed.

Nor are we feeling optimistic about restrictions being lifted in time to celebrate it.

54% don’t think the current lockdown will end in early December, and 80% expect there to be some kind of restrictions on what they can and can’t do on Christmas Day. 1 in 5 say they aren’t looking forward to Christmas at all.

We’re (mostly) planning to stay off the naughty list

If restrictions DO stay in place, nearly half of us say we won’t break the rules. A further 32% are wavering – saying whether they stick to the rules will depend on what they are and the spread of COVID at the time.

It’s ALREADY beginning to look a lot like Christmas

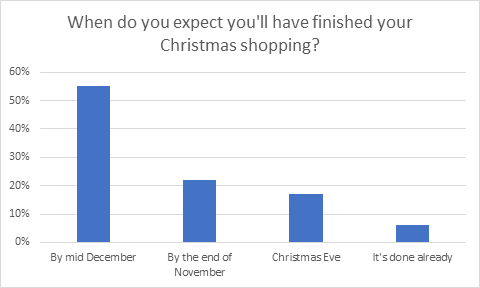

In a potentially rare bit of good news for the economy, we’re getting the shopping done early. Some 44% of us plan to do it early this year, with 22% saying they’d be finished by the end of November, and a further 55% by at least mid-December.

However, this could be bad news for small independent retail businesses, which don’t have the ability to sell online, whilst the likes of Amazon line their pockets. As a result, our highstreets could start to look very different as we move into 2021.

We’re going to town on decking the halls

Nothing lifts second lockdown spirits better than sparkly lights. A dedicated 4% of Brits have already put up their Christmas decorations, and a further 12% will be avoiding a bleak November with plans for decorations up before the end of the month.

It’s not the geese getting fat

We’re going into the season of over-indulgence already over-indulged. Over the course of the pandemic 41% of us have put on weight, 40% of us are exercising less, and 23% of us are drinking more.

It’ll be lonely this Christmas

COVID has clearly had a huge impact on people’s physical health, even if they’ve not had the virus itself. It’s also impacted mental health, with nearly half of us reporting feeling more stressed and anxious. Isolation is a huge factor in that, and it’s going to be worse than ever over Christmas.

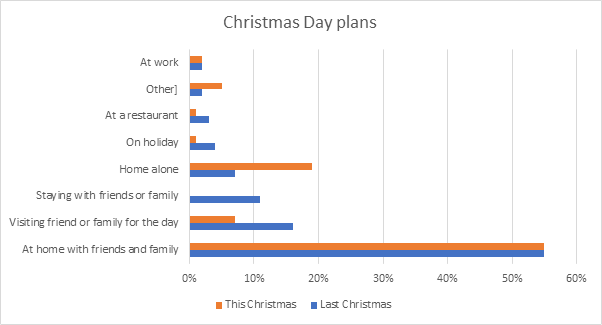

This year it’s not just Kevin home alone. Nearly 1 in 5 Brits – 19% - will be spending Christmas by themselves, compared to just 7% on Christmas Day 2019.

It’s a Blue Christmas for burglars

Another group NOT set to enjoy their usual Christmas is burglars. In the year to June, burglary was down 16%, with more people staying home and less opportunity to gain stealthy access.

That seems set to continue through the Winter months, with only 17% of people planning to be away from home visiting or staying with family and friends this Christmas, compared to 27% last year.

So what does it all mean for insurance brands?

Ian Hughes, Consumer Intelligence’s CEO says: “Clearly consumers are realistic about the challenges this Christmas is going to pose, but there’s also signs they’re going to be doing their best to enjoy the season.

“One thing we can see is that people will be travelling less and staying home more, and that’s good in terms of risk profile for both car insurance and home insurance. On the flip side, consumers are beginning to want something back as a result.

“All your customers really want for Christmas is value… Given the reduction in burglaries, 51% thought insurers should offer lower premiums to reflect the lower risks, with a further 27% saying they should actually give some money back to anyone who’s now at home more often.

“We’ve seen huge success in terms of PR, consumer trust and loyalty for Admiral’s car insurance rebate earlier this year, and while that’s not something every brand can do, adding value, returning value, is going to be a key theme for next year in terms of both regulation and consumer expectation. Now’s the time for brands to think about where and how they can do so.

“It could, for instance, look like offering an increase in contents insurance over the festive period – noting that people are buying earlier and therefore storing gifts for longer. An automatic December contents rise may need to move back into this month, and you need to let your customers know about it now.

“It could also look like a reminder on fire safety for those doing the full-on home illuminations to brighten up their neighbourhoods, or basic security as the long nights draw in. It might be shopping voucher incentives for new customers this month and next, or it might be a timely booster in call-centre training to help frontline staff identify vulnerable, isolated customers struggling with what most definitely isn’t the most wonderful time of the year for everyone.

“We know that trust in insurance has been badly damaged in 2020 as a result of the pandemic. Christmas is definitely a time to get back in touch with your customers, re-learn their priorities, and give something back, too.”

Feed the Word

A quick reminder that we’re here every day of the year to feed your business with the word on the street, what YOUR customers are doing, thinking, buying, and planning - and how you can use that information to build products, services, and customer trust. For more insights like these, contact us

Understand the needs and motivations of your customers or target audience

Viewsbank is our in-house consumer research panel. It’s a large, responsive and community driven panel that conducts both quantitative and qualitative research.

Our Viewsbank panel helps our customers with a wide variety of projects ranging from detailed mystery shopping to demographically targeted research surveys. The research helps our clients make informed decisions based on true understanding of the consumer’s voice.

Submit a comment