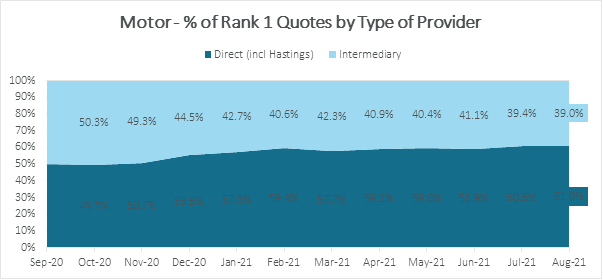

Change is afoot in the perennial battle between brokers and direct insurers. In the last 12 months the proportion of direct insurers providing the most competitive quotes has risen from 49.7% to 61%.

Note on methodology: In motor we are treating Hastings as a direct provider, because 99-100% of their rank 1 car quotes over the period have been underwritten by their own capacity, Advantage.

Note on methodology: In motor we are treating Hastings as a direct provider, because 99-100% of their rank 1 car quotes over the period have been underwritten by their own capacity, Advantage.

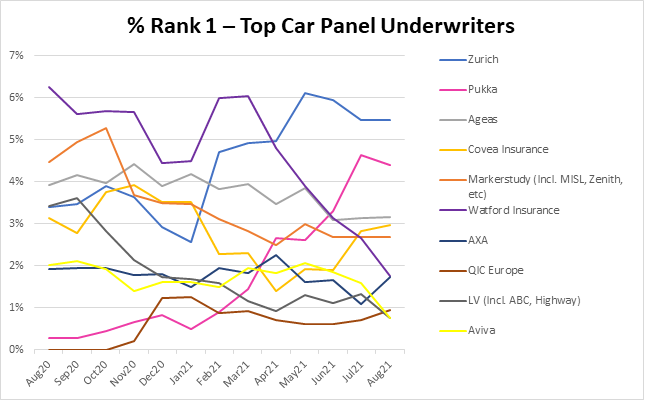

The composition on brokers panels have changed too. Pukka is resurgent after bringing in new capacity providers. In August it sat behind 4.4% of Rank 1 car insurance quotes on MoneySuperMarket, up from just 0.3% a year ago. Zurich has risen up the charts too, though its 5.5% share of rank 1 quotes is entirely due to its being By Miles’ capacity provider.

Covéa dipped and then began a rebound in April 21 through Atlanta Group and BGL affinity partners such as Lloyds Bank, Post Office and M&S.

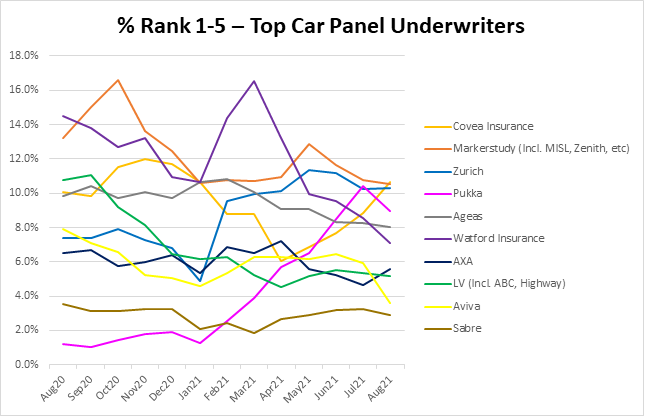

But the growth on aggregate has not been enough to offset declines in the likes of Watford Insurance, which announced its sale to Arch Capital in November 2020, or replace some of the last year’s market exits. The only new entrant to the top 10 most competitive panel underwriters is QIC Europe, which is currently exclusively behind Policy Expert’s motor push.

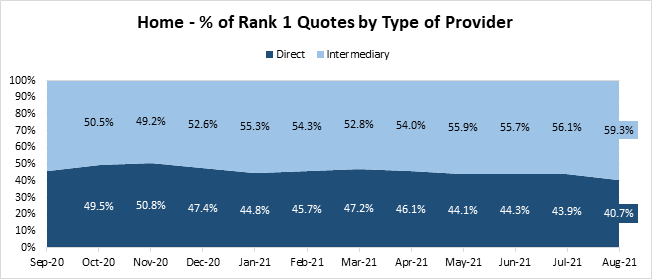

New underwriters enter home market

It’s a different picture in home, where intermediaries have grown their share of R1 quotes from 50.5% to 59.3%. This is largely due to Policy Expert which has accounted for up to 30% of top pricing slots in recent months.

Indeed Policy Expert’s share of R1 quotes is so big at 30% of R1s and 50% R1-5s that it is not shown here. They are quite literally off the chart when it comes to pricing, with underwriter QIC again giving it the edge.

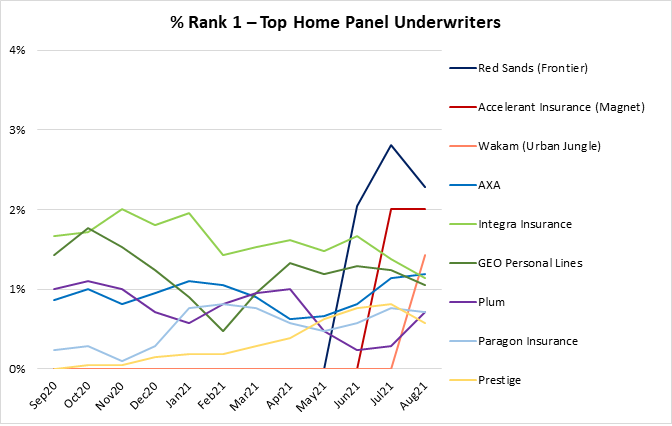

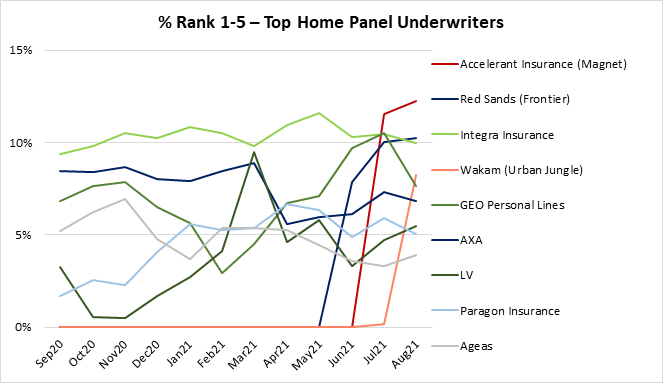

Policy Expert aside, three new panel underwriters have shot up in the last few months. They are Wakam, backing Urban Jungle’s building & contents launch, Red Sands with Frontier and Accelerant has recently become active on Magnet’s panel.

The non-standard MGA specialists by design are not volume plays but they can be extremely effective at securing the specific risk group they are targeting. Prestige, for instance, announced new capacity from Aviva for home in October 2020 and has grown to win 0.6% of Rank 1 quotes.

* Excludes Policy Expert (30%)

* Excludes Policy Expert (30%)

Nor are all panel members perusing volume at any cost.

In its third quarter trading update Sabre flagged subdued demand for motor policies from new drivers due to the back log of driving tests, and delay in new car registrations which reduced second car sales too. As a business which indexes towards new business and new drivers, Sabre says it has “chosen not to engage in inappropriate price discounting… in order to preserve the strength of the business across the medium-term”.

One business’ discipline is seen by others as an opportunity, of course, and being able to track and respond to a volatile market remains key – whatever your take.

Optimise your competitive position in a fast-moving market

Understanding and optimising your product mix, particularly in your competitive context, can make all the difference when it comes to winning new business. To learn more about our pricing insights, please click below.

Comment . . .

Submit a comment