Despite technological advances and new entrants to the market, there is still one major travel money provider that knocks all of the others out of the park. What is more, it shows no sign of giving up its dominant position.

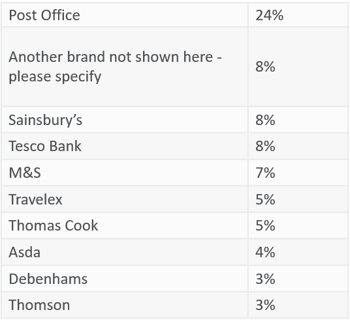

The results of the Consumer Intelligence Biannual Survey into Purchasing Foreign Currency are in, and once again one provider has nearly a quarter of the travel money market, and its nearest named rivals have just 8%. It has even increased its market share by one percentage point, despite challenges from new card and app providers who are utilising the best of modern Fintech.

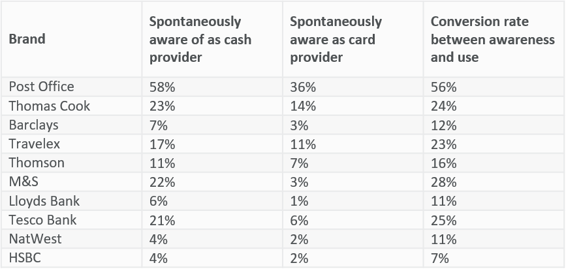

Britain’s most popular travel money provider is The Post Office, a position it maintains year on year. Not only do 24% of people use The Post Office to buy their travel money, but also far more people are aware of its position as a travel money provider than they are of any of its rivals. Over half of respondents — 58% — identified the Post Office as a provider of travel cash, while 36% know that it provides travel money cards, a far higher percentage than any of its rivals.

What is The Post Office doing to keep its customers, and how can others learn from it? For a start, as Consumer Intelligence’s travel money expert, Andy Buller, points out, they are simply the biggest on the market. “The Post Office has more locations than all the other Travel Money providers put together,” he says. “Customers look for brands that they know and trust.”

Innovation yet to dent top brands

The Consumer Intelligence top ten shows that innovation is still failing to make much of a dent on consumer behaviour in the travel money market. The most popular brands, with the exception of Tesco Bank, are retailers or large travel money specialists. Even the big high street banks lose out.

The travel money survey asks people which travel providers they are aware of, as well as which they use. While many are aware that the likes of NatWest and Barclays provide travel money, they don’t opt to use the service, preferring to rely on retailers including Asda and M&S, as well as the Post Office.

Most popular travel money providers

An analysis of the conversion rate — the ability to turn awareness of a brand into actual purchase of travel money — shows high street retailers are a clear customer preference. “Traditional banks will continue to provide Travel Money but only as a supporting service, they won’t invest,” Andrew Buller says. This leaves the field wide open for challenger brands who can persuade travel money customers that there are more convenient digital ways to get the best possible rate for their cash.

How brands convert awareness into sales

What will happen next?

Change in the travel money market might be slow, but it is coming. The Consumer Intelligence travel money survey shows that many more people than previously are using new brands such as Revolut and FairFx. These providers are still too small to show up on the best buy lists.

However, analysis by age suggests that younger people are already embracing change in the travel money market, change that is likely to begin to filter through to older generations in the coming years.

“Customer’s continue to rely on trusted high street brands for their Travel money needs and the trend won’t change significantly in 2018.

However, savvy Travel Money organizations will recognize that consumers buying habits are changing and the high street dominance will start to decrease,” Andrew Buller says. “The introduction of borderless accounts, prepaid services and reduced Debit/Credit card fees will slowly chip away at the Post Office and high-street retailer’s dominance.”

To be successful in the coming years, businesses need to be thinking about what makes customers choose one provider over another. Our study of how customers choose their travel money shows that customers value convenience and good rates as well as (increasingly) technology.

Insight that will optimise your travel money strategic planning

We can help you understand where your brand fits in the market and how this impacts your strategy for 2018. To find out more, get in touch today.

Submit a comment