Political and economic events always impact on currency rates, but what will coronavirus do to the pound?

While Brexit talks and the Conservative election victory have provided much of the newsflow that has moved sterling in recent months, the spread of COVID-19 promises to take over the baton as the virus’ spread continues.

As the virus moves around the world, different currencies are being impacted. At the time of writing, news out of Italy concerning measures taken to attempt to contain the virus was weighing on the euro. It was enough to persuade some analysts to put a positive spin on the pound. Nordea Markets, a large European lender, said that the virus spread ensured that Brexit negotiations were no longer a “short-term theme, and that the coronavirus reports were having more of an effect on the euro than the pound.

“Brexit was the big theme for currency until recently, but coronavirus is now having the biggest impact on rates,” said Jade Edwards, head of banking at Consumer Intelligence.

“This illustrates how quickly news can impact foreign exchange rates. Travel money companies need to ensure that they help consumers to keep on top of the changes.”

The GBP/EUR rate during Brexit

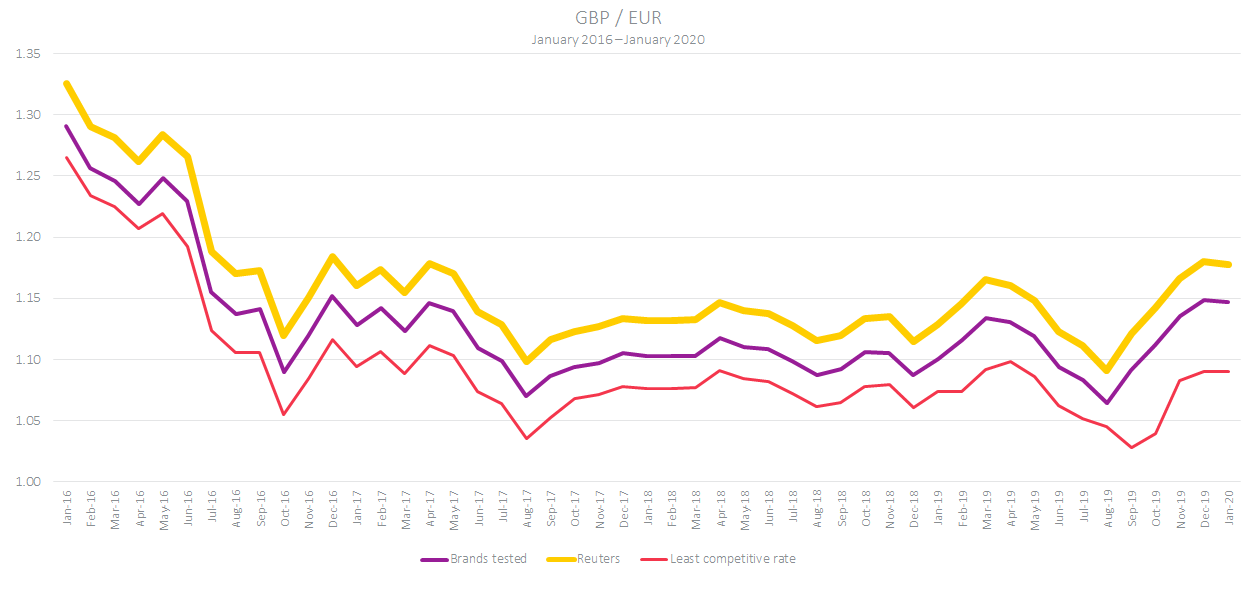

As the graph above shows, the pound/euro rate has been impacted recently by a post-election bounce in confidence. Brexit has been the major factor behind the pound’s performance against the euro since October 2016.

Consumer Intelligence’s analysis, shown in the graph above, highlights major dips for the pound at several points in the Brexit process. These include a drop of almost five per cent when the results of the referendum were first announced, followed by a further drop in October 2016 when it was announced that the UK would start the formal process to leave the EU by March 2016. August 2017, when Brexit negotiations commenced, saw a further dip, with the pound at €1.098 against the euro. After a period of relative stability, the pound hit a low point again in August 2019 as the deadline to leave the EU drew near and Article 50 was extended.

‘Remarkable confidence’

However, the election of Boris Johnson as Prime Minister caused the pound to rise steadily.

“BoJo’s victory at the General Elections provided remarkable levels of confidence to the markets,” says Riccardo Piccini, foreign exchange expert at Consumer Intelligence.

“For those who have become accustomed to lower pound euro rates during August’s summer season, this easing will be a welcome addition to their holiday spending.”

The next big thing

While trade talks between the UK and EU begin next month, and the outcome of these may impact the pound euro rate, the coronavirus is now taking centre stage.

“It’s hard to say how the pound will be impacted,” Jade says.

“With factories shuttered and travel limited, economies across the world seem set to slow. The pound euro rate looks set for further volatility. Providers should be ready to inform prospective consumers when rates are good and perhaps to inform them of the advantages of prepaid cards in locking in good rates before the holiday season.”

[FREE REPORT] The Travel Money Market Today: When Digital Becomes Necessity

Consumer Intelligence's bi-annual travel money survey which gives you a snapshot of the market today, and while change in the travel money industry might seem slow, customers are gaining confidence in new methods and brands.

This edition contains data on how British holidaymakers spend while travelling. It reveals differences between generations and destinations, and a growing reliance on technology from British travellers spending abroad.

Submit a comment