THE way in which we buy our holiday currency varies by gender, with women more likely to value a face-to-face experience, Consumer Intelligence research has shown.

Analysis of the Bi-Annual travel money survey, which conducted 1498 interviews in Spring of this year, throws up a number of differences in the behaviour of men and women when it comes to buying travel money.

“These findings should motivate providers to ensure that they’re putting together an appealing proposition for all segments,” says Rajeev Aggarwal, banking expert for Consumer Intelligence. “As always, building propositions based on a deep understanding of customer needs and preferences is a key drivers for new business acquisition and retention.”

Finding one: Women buy more travel money face to face.

The study revealed a marked difference in the method in which women and men buy travel money. Women are still more likely to buy travel money face-to-face in a branch, with 60 per cent choosing this route, compared with 44 per cent of men.

They are less likely to use other methods such as online ordering or collection, as well as mobile apps, and are also less likely to use an ATM abroad.

Table One: How women and men buy travel money

-2.jpg?width=668&name=Chart%201%20for%20CINewsletter1%20(slanty%20version)-2.jpg)

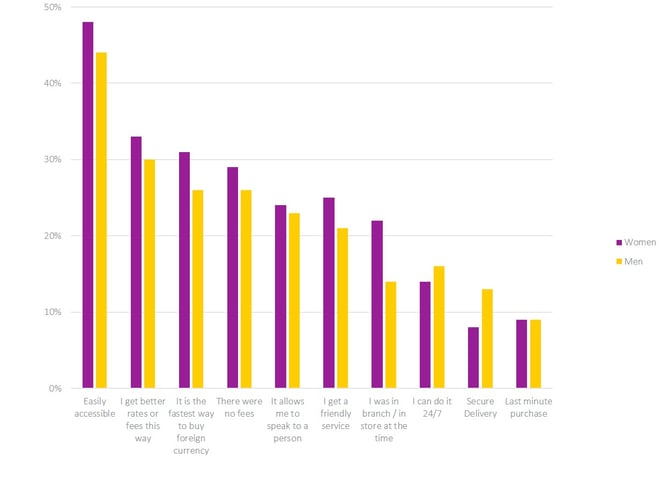

An analysis of why people chose their method of foreign currency purchase was also illuminating. While women valued easy access and rates, they were more likely than men to rate friendly service, accessibility and face-to-face interaction as reasons to purchase in this manner.

“Different segments have different needs and preferences. Not everyone wants travel money purchase to be technology led, despite the increasing digitisation of other forms of banking,” Rajeev Aggarwal says. “Face-to-face experience is still valued, with women in particular valuing the service they receive.

Table Two: Reasons for the chosen method of purchase (respondents selected all that applied)

Finding two: Women are slightly more wedded to cash

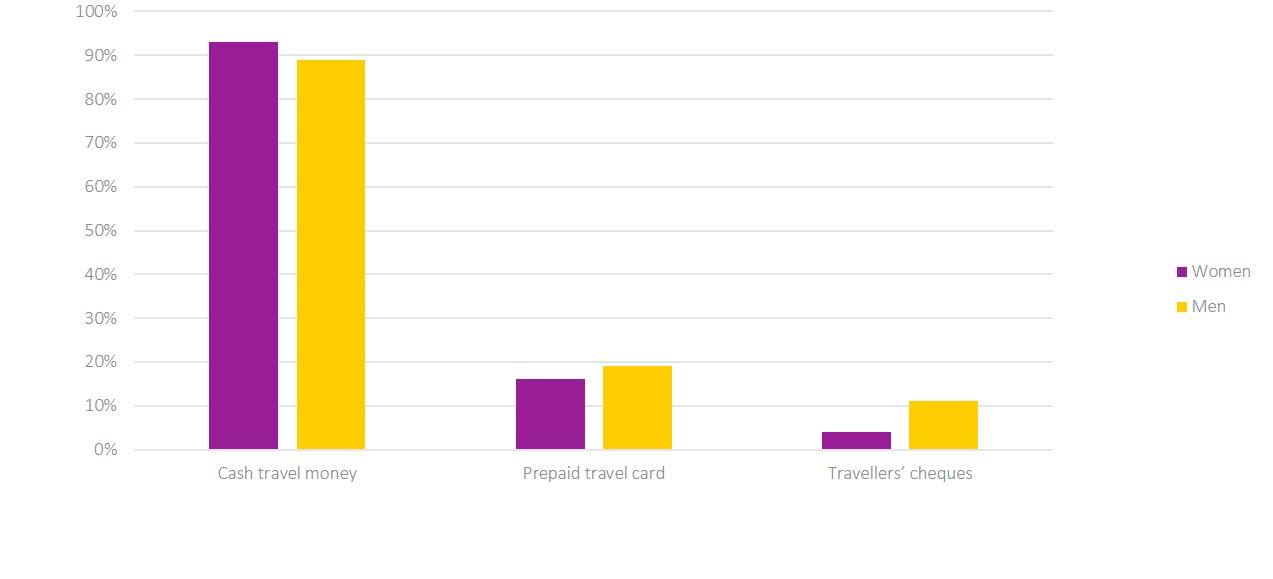

When asked in what format people take their travel money, cash is still the main component for both genders. However, women were less likely to hold a prepaid card or travellers’ cheques in addition to this, and were more likely to have bought cash.

Table Three: How did you buy your travel money? (Respondents selected all that applied)

Finding three: Women pick prepaid for safety

Finding three: Women pick prepaid for safety

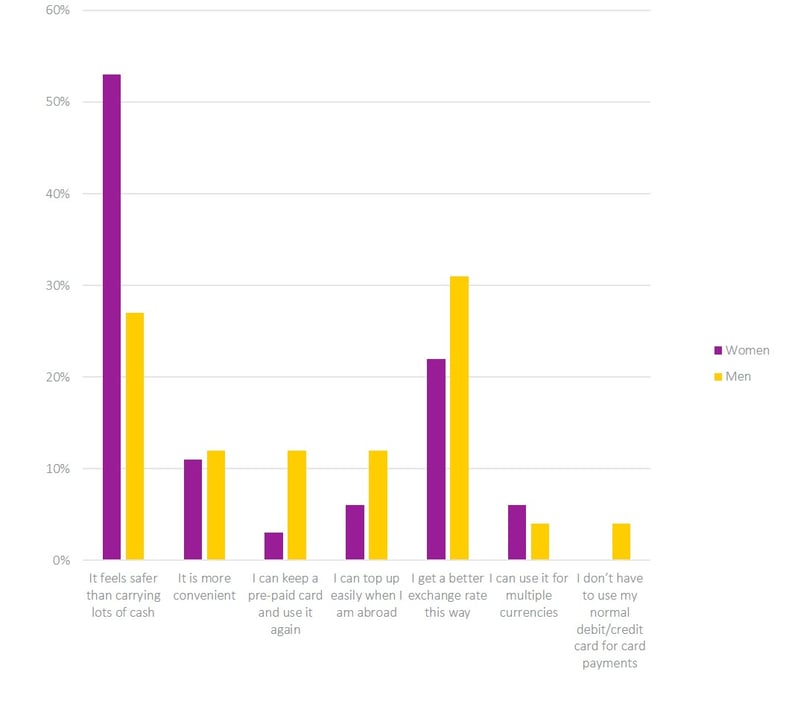

While prepaid cards are more popular with men than women, those women who do use them had a specific reason for doing so. Over half said that they had chosen the cards because they feel safer than carrying lots of cash, compared with 27 per cent of men. They were less interested in the rate, convenience and reuse aspect of these cards.

Table four: The main reason why respondents took prepaid cards not cash.

“Basing propositions on client needs is critical. For example, stressing the safety aspect of prepaid cards may be the deciding factor for many women who don’t yet use them,” Rajeev Aggarwal says.

For more insights into Britain’s travel money habits, download the Biannual travel survey from xx.

[FREE REPORT] Biannual Travel Money Survey

Consumer Intelligence’s latest travel money survey shows that the travel money market is changing in response to Fintech innovations and the growing prevalence of a cashless society.

The latest edition of the biannual survey, contains data on how British holidaymakers spend while travelling. It reveals differences between generations and destinations, and a growing reliance on technology from British travellers spending abroad.

Post a comment . . .

Submit a comment