Insurance brands could benefit from taking a leaf out of the retail book when thinking about effective saving based marketing messages to attract consumers in a heightened era of price awareness.

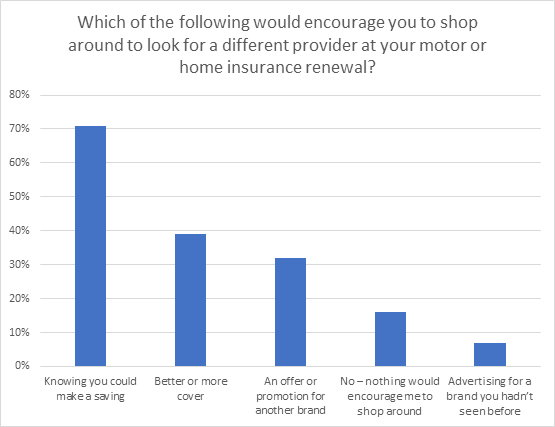

In our latest Viewsbank survey 71% of consumers said they’d shop around for home or motor insurance at renewal if they knew they could make a saving – putting saving money head and shoulders above more cover or a giveaway from a third party brand.

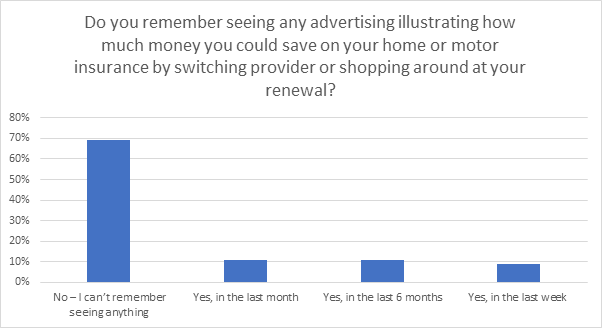

However only 31% of consumers can recall seeing a marketing message telling them how much they could save from shopping around for their home or motor insurance at renewal.

When they did see them, the messages were effective. One-in-five took direct action to see if they could get a better deal and 55% said the information was helpful but they haven’t yet taken action, probably because their insurance hasn’t yet come up for renewal.

One-in-three consumers who could remember advertising around the potential to save money recalled a specific Price Comparison Website, whilst an impressive 24% recalled either Direct Line or Churchill, both DLG brands. Admiral chalked up 13% of spontaneous recalls. But several big brands didn’t feature at all.

This presents a missed opportunity for many. Especially because price looks set to be a bigger priority for many in the coming weeks and months. Our Covid-19 tracker shows that more than a third of Brits are worried about their finances right now – and that figure is only set to rise as furlough ends, unemployment rises and the true economic impact of coronavirus hits home.

Verified savings

The message ‘We’ve price-checked your weekly shop and you could save £X!’ is a familiar - and effective – one that we’re used to seeing from supermarkets, but is under-utilised in insurance.

Credible messages about how much people can save on their policies could give your brand the edge over competitors in a changing market and marketing space. Not least when giveaways like cinema tickets, retail and restaurant savings are less relevant than they were before Covid-19.

Rightly, the FCA requires claims of savings to be achievable to the majority of customers who respond and for the basis of the claims to be clearly stated.

Using verifiable, third party information helps here - and it helps with consumer credibility too. People are can clearly be moved to look around at renewal based on price, but they have to trust the saving they’re being sold.

That’s where Consumer Intelligence comes in. We hold unique data on customer journey and pricing behaviour that means we can create ‘save up to’ marketing messages, and substantiate them.

For the clients that have used CI’s services for price benchmarking and messaging, marketing budgets have gone up to 25% further. For Go Compare motor insurance it became the foundation of a recent campaign.

Improve your marketing ROI

Secure an uplift on your ROI for marketing campaigns by taking advantage of independent validation and customer advocacy to gain new and retain existing customers.

We create marketing messages using a nationally representative and statistically robust data samples, ensuring that price claims provided by Consumer Intelligence are truly unbiased and accurately reflect a company’s position in the UK market.

Comment on blog post . . .

Submit a comment