Consumer Intelligence Ltd is a wholly independent company that monitors and benchmarks the prices of General Insurance. This work is carried out entirely independently by Consumer Intelligence in order to give an unbiased, nationally representative sample of data. This ensures that price claims provided by Consumer Intelligence are truly unbiased and accurately reflect a company’s position in the UK market.

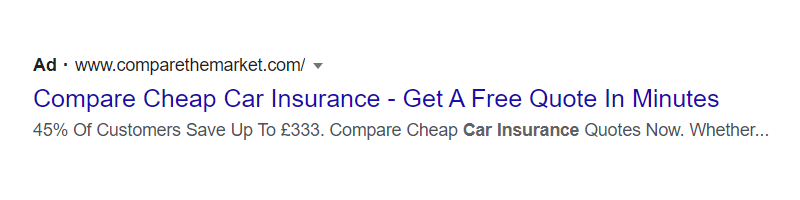

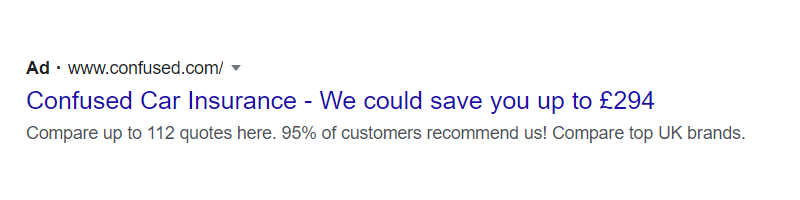

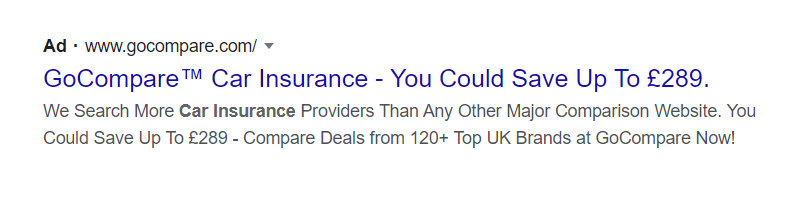

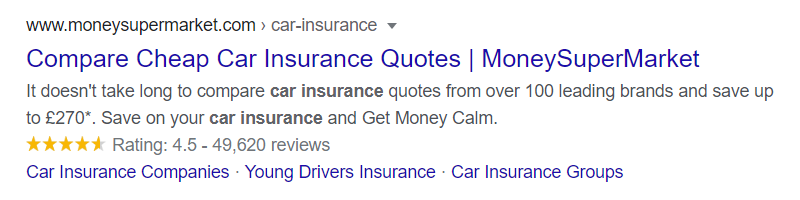

Examples:

Making your marketing budget go further is the biggest challenge every marketer has. And yet, there are some companies that have a simple secret to their marketing success that makes their money go further, so they spend less and get more business. Executing on strong marketing messages give brand marketing credibility and can drive business.

We hold unique data on customer journey and pricing behaviour, our data can be used to substantiate marketing messages across all channels (web, online, direct, television, radio).

This is in the form of a "Save up to message" which is extremely powerful for your brand communications.

Our data is using an unbiased, nationally representative sample of data. This ensures that price claims provided by Consumer Intelligence are truly unbiased and accurately reflect a company’s position in the UK market.

Brands have used our marketing messages to achieve the following results from just a single campaign using our data:

In order to validate the claims our clients make about their insurance products we have created an independent and fair means of evaluating companies. Our research across the whole market identifies the leading companies, and we use this information to monitor, at all times, companies that account for over 80% of all the General Insurance sold, giving a comprehensive comparison.

Our tests are based on a representative sample of the UK population derived by consumer research.

We use a fair and balanced means of collecting prices. All insurers are contacted on a like for like basis, so the quotes can be compared.

The use of price claims within General Insurance is regulated by both the Financial Conduct Authority (FCA) and the Advertising Standards Authority (ASA). In general terms advertisers need to make sure that the advertisement is clear, fair and not misleading to the person reading it.

In the FCA's words*:

“ (1) This guidance applies in relation to a financial promotion that makes pricing claims, including financial promotions that indicate or imply that a firm can reduce the premium, provide the cheapest premium or reduce a customer's costs.

(2) Such a financial promotion should:

(a) be consistent with the result reasonably expected to be achieved by the majority of customers who respond, unless the proportion of those customers who are likely to achieve the pricing claims is stated prominently;

(b) state prominently the basis for any claimed benefits and any significant limitations...”

Where possible either our logo or asterix should be used, according to our brand guidelines referenced. Where not possible our brand should be referenced as follows, with the details of the substantiation.

Any use of our marketing messages and brand name or logo need to be signed off by the Consumer Intelligence marketing team prior to go live. This needs to be provided with a 48 hour turnaround time.

Referencing Consumer Intelligence:

Data provided by Consumer Intelligence Ltd, www.consumerintelligence.com

Exciting Insight by Consumer Intelligence Ltd www.consumerintelligence.com

Consumer Intelligence marketing messages - Guidelines and methodology

TAKING A LEAF FROM THE RETAIL BOOK FOR SAVINGS-BASED MARKETING MESSAGES

Insurance brands could benefit from taking a leaf out of the retail book when thinking about effective marketing messages to attract consumers in a heightened era of price awareness.

LIES, DAMNED LIES, AND MARKETING CLAIMS

In the brutal battle for customers and attention, advertising is everything for insurance brands, particularly price comparison websites (PCWs).

BUILDING A CREDIBLE BRAND IN THE AGE OF THE AGGREGATOR

Financial Services marketing teams face their toughest challenge yet when it comes to improving the way their brands are perceived by customers.

We passionately believe in fusing data and insights in order to better help our customers... so we felt that Consumer Intelligence were exactly the right partner to work with

Ian Rowlands Vice President of Partnerships, GoCompare

[fa icon="quote-right"]

Drive growth and ROI through brand credibility

We are an insight partner for financial services, inspiring confident decisions that build consumer trust. At the heart of every business are customers. At Consumer Intelligence, we gather unique data and intelligence about consumers and companies to understand the market.

[fa icon="phone"] 0117 317 8181

[fa icon="home"] Consumer Intelligence, Temple Quay, 3 Temple Back East, Bristol, BS1 6DZ