The general insurance sector is going through the biggest changes and challenges it’s ever seen, and out the other side, the market is going to look very different.

In our latest webinar, ‘7 days to save your 2022 plan: Coming face-to-face with the FCA challenges ahead’, a panel of experts from Consumer Intelligence and Insurance DataLab, emphasised how being prepared to re-evaluate your strategy and plan will be crucial throughout next year, as the home and motor insurance market move through volatility and turbulence towards a new competitive landscape.

Three frames of change

The current changes in the market and periods of intense price deflation can be seen through a number of frames.

The biggest of these is GIPP (General Insurance Pricing Practices), which the panel predicted will have a ‘tsunami-like effect’. GIPP, of course, is more than the end of dual pricing. It is also the introduction of fair value assessments of all products, including add-ons and premium finance.

“This is the first time we’ve seen a major change that effects every single player, not just how they do business, but how they invest and how they deliver service to their customers,” Consumer Intelligence CEO, Ian Hughes, said.

The changes will usher a transition period of 2-3 years, where the market moves from a pricing-led to a value-led approach, the panel predicted. Although, price will remain an important element of competition, and PCWs the dominant distribution channel.

Consumer behaviour has been affected by the pandemic too, changing buying behaviours and pattern. As the UK faces a ‘winter of discontent’ with rising gas prices, and even gas and food shortages, that’s going to feed through and change spending priorities and behaviours again.

Then there is a changing competitor landscape. There’s been a huge amount of investment coming into the market; lots of mergers, acquisitions and new entrants backed by serious capital. Home in particular is seeing smaller brands making a grab for growth, and more new entrants in home and motor are expected, each deploying new technology to make different decisions around risk.

It all means that external factors which brands could previously pre-empt and bake in have changed.

Staying close to the data can provide some insight into the next year and beyond.

Big books, little books, cardboard (out of the) box

One might assume that younger brands with smaller back books won’t be as greatly impacted by GIPP - but that’s not the whole picture. In reality, there’s pros and cons for both big and little, impacted by all three of our frames.

The smaller players with fewer legacy policy holders may well find it easier to be nimble and reactive, with new systems and technology to turn on a sixpence on things like their pricing strategy. But they may not have the resources to put behind ALL changes they want to make. Some, for instance, will have been under-pricing policies to grab new business volume, or over-using premium finance as a revenue stream – possibly at the expense of both customer service and overall profitability. With GIPP curtailing that avenue, that could leave some with a considerable income gap.

Meanwhile, the bigger players may have old systems and tech they might struggle to migrate and integrate, and are traditionally slower-moving and slower to change. They may have worn governance and culture grooves they cannot easily step out of, or a massive back book that is now going to have renewal prices slashed and new business pricing rising to meet it. On the other hand, they do have the resources to throw behind change.

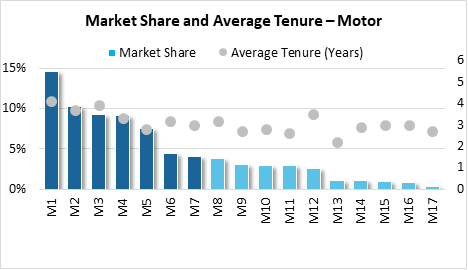

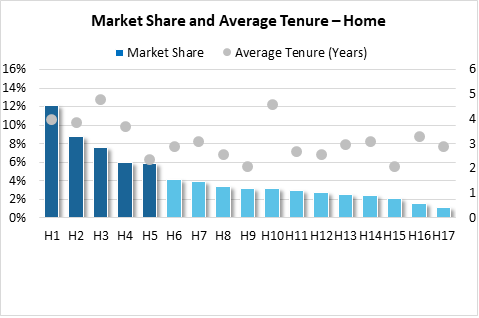

Looking at market share and average tenure, we know motor customers shop around more than home customers in what is a more disruptive market. There are a lot of relatively new players in motor that have had just enough time to find both their feet and considerable market share, making the most of their tech advantage.

Bigger brands in general have higher tenures, but smaller firms with large back books – particularly in the more stagnant home market – could be far more exposed to market changes, especially in terms of GIPP.

Motor

Home

Consumers

The consumer reaction to insurance pricing changes from GIPP remains to be seen. Will long-tenure customers, for instance, be grateful for a price reduction at renewal, or will they feel like they’ve been ripped off and express their disapproval by voting with their feet?

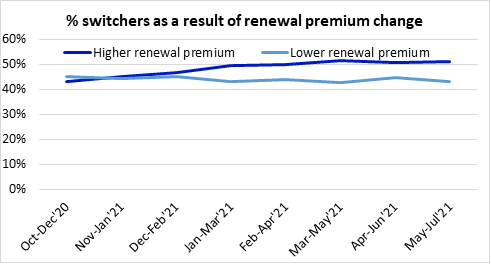

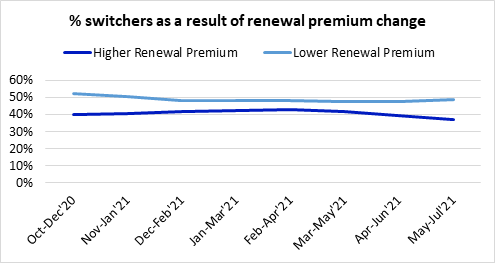

Evidence shows that price drops at renewal actually don’t stop shoppers from shopping. In fact, they’re more likely to take it as a sign there’s a deal to be found – and more so in home than in motor. That’s a warning sign for any brand banking on a boost in retention from offering lower renewal prices.

Motor

Home

The price-pre-occupied

Having a loyal customer base isn’t bad news, though.

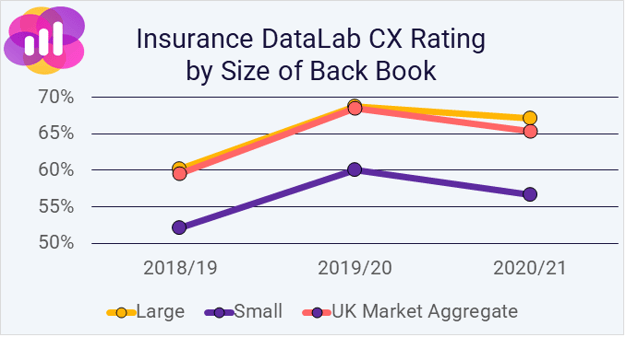

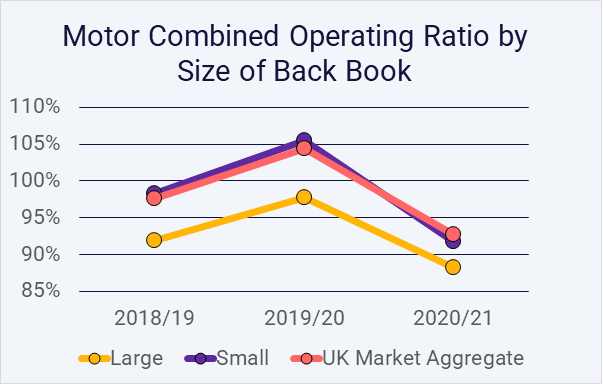

More data from Insurance DataLab shows that providers with a smaller back book often have a lower customer experience rating. It’s worth noting too that for every percentage point increase in customer experience, there’s a 0.8 percentage improvement in their COR or underwriting results.

Bigger players in the market generally have a lower COR, so a healthier ratio of claims, cost and expenses to actual premiums. That means that they can realistically offer better prices to more customers for longer.

There is an added unknown factor of the cost of claims. Insurance DataLab analysis of bodily injury claims from the Ministry of Justice RTA portal shows that motor premiums have historically increased by 1% for every £720 increase in damage payments. The new portal is expected to put downward pressure on premiums, but there are other factors at play, including the rising cost of repairs and the hardening of new business prices from GIPP.

Brands of any size or shape are going to need to play to all of their advantages moving forwards. Generally speaking, it’s those with value products, a well-thought out distribution strategy, and good customer service who are going to win-out – but if nothing else, the lesson here is about adaptability. Those writing their 2022 playbook and leaving it on a shelf are the ones that are going to run into the most serious trouble – probably sooner rather than later.

Being prepared to change is vital, and that means having the data that’s going to tell you what’s going on - and when, where and the acumen to read the signals amongst the noise.

The only way firms can prepare for so many ‘unknown unknowns’ is to know what they DON’T know, and then set about finding out.

Right now, everything you thought you understood about yourself, your customers and your competitors needs both re-thinking, and constant re-visiting, over the next 7 days, 7 months, and 7 years. There are no any longer safe assumptions. Understanding market data on a weekly or even daily basis, is more important than ever. Being able to overlay that data, and finding up-to-date insights from multiple sources that actually work together is going to be even more powerful.

Catch up on all the great content you've missed

Did you know that we now have a webinar hub?

It's a central space on our website where you can browse the archive of Consumer Intelligence webinars, and access (for free) all of our past recordings, presentations, and additional media content.

Pinpoint the topics that matter to you and catch up on what you've missed, whenever suits you.

Comment . . .

Submit a comment