In the ever-evolving landscape of home insurance, a noticeable shift has occurred over the past year: the fall in the number of competitive underwriters in the market. The decline we’ve observed is most pronounced when we look at three-bedroom properties — a staple of the UK housing market. Here, we've observed a significant reduction in the diversity of underwriting options, however most concerning is the 30% reduction in the number of different underwriters represented among the top five most competitive insurers.

Our Insurance Insight Manager, Max Thompson, comments on what this could mean for the insurance landscape, “There will be pressure on brokers. Many of these are smaller firms, with less resources than direct insurers. They’re seeing more overheads with inflation, more compliance through Consumer Duty, and potentially now fewer competitive opportunities with the need to be on top of the market to compete.

“Additionally, there will be greater focus on MGA relationships, where the intermediary has underwriting authority with an insurer. Insurers could use the greater flexibility allowed by MGA underwriting to target areas, rather than different panel members”.

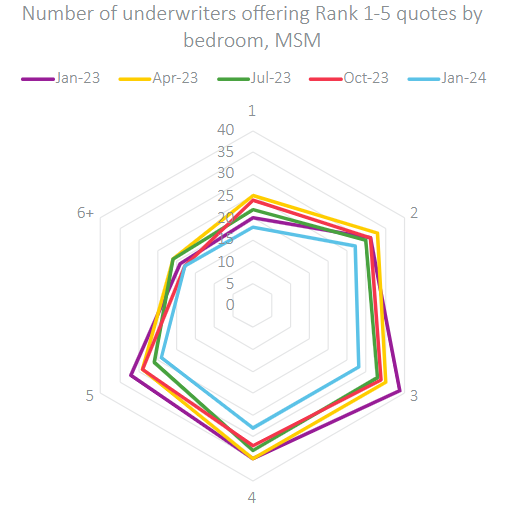

Our price benchmarking data collected from MoneySuperMarket indicates a stark reduction in the total number of underwriters — from 45 in January 2023 to just 34 in January 2024. This trend suggests a tightening market, where fewer financial backers are willing to take on the risks associated with insuring homes.

Max adds, “We haven’t seen many new entrants in the past year or so. If this was driven by the uncertainty in claims costs, though, with inflation steadying we might have a more stable market that could bring capital in”.

The concept of managing risk seems to underpin much of this shift. For instance, looking at the data from January 2024, we find that the number of underwriters available for claimants has dropped significantly. Where there were once 45 underwriters eager to manage claims, only 32 remain. This decrease is particularly noticeable in water damage claims, which have seen the most notable decline in underwriter appetite.

With this trend set to evolve, it is imperative that all players in the insurance market – directs, brokers and underwriters alike – keep on top of these movements, which have the potential to significantly impact both competitiveness and quotability. We have seen this happen over the last few months, with some brands no longer being able to quote competitively and diversely enough to remain at the forefront of the market, and others rising to the top of the competitiveness charts. Using our Market View tool, you can ensure your brand avoids being hit by unexpected changes in the underwriting landscape, whilst fuelling confident decision making.

Insight that will enable you to optimise your pricing strategy

Download our Home Insurance Price Index to gain insight into market movements, benchmark the major home insurance brands and help you understand the data behind the results.

Comment . . .

Submit a comment