Six months after the implementation of the FCA’s new Consumer Duty, the pressure on insurers to put customers first continues to intensify. However, this pressure isn’t solely coming from the heavy hand of regulation – it’s also coming from consumers themselves.

If you think about it, the Consumer Duty couldn’t have arrived at a more appropriate time. Over the last 12 months, we’ve seen record breaking premium hikes, consumers financially squeezed by the deepening cost of living crisis and complaints hit a five year high. This is a perfect storm that puts consumers at greater risk of financial detriment.

As a result of this concoction of factors, what customers expect from their insurers is changing. And only those that seek to understand how to meet these changing expectations will succeed in a Consumer Duty world.

But where to start? By understanding your customers, of course…

Rising expectations

Over the last year, we’ve seen unprecedented premium inflation. In the twelve months to November, motor insurance premiums rose an average of 67%. Home insurance also went up almost 40%.

Research conducted in July 2023 revealed that 69% of consumers have felt the impact of the cost-of-living crisis, and 66% are worried about being able to afford their bills.

This combination of factors is pushing more people to shop around for insurance at renewal. However, with the world of dual pricing and widespread new business discounts a forgotten memory, and many are left unable to find a better deal.

When left in this predicament through no fault of their own, consumers are going to expect more for their money. And these expectations are going to continue to increase alongside rising premiums.

What do customers want?

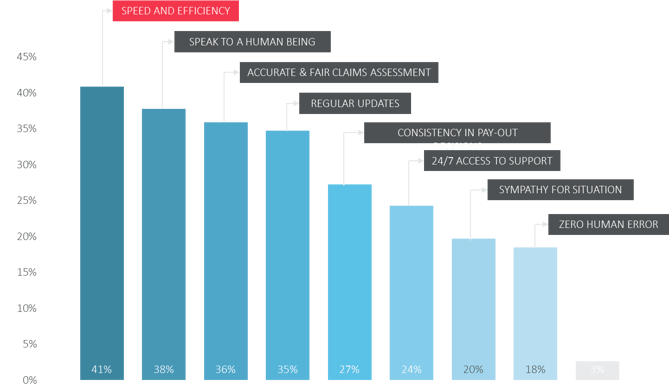

To answer this question, we surveyed over 1000 insurance customers to find out what they expect from the experience of submitting an insurance claim. 41% said cited speed and efficiency in processing a claim top at the top of their list of wants – unsurprising given the hike in home and motor complaints driven by delays in payouts reported by the Financial Ombudsman Service earlier this year.

However, more interestingly 40% selected an additional option – ‘all of the above’. 4 in 10 customers expect a perfect customer experience. And who can blame them. We live in a world where companies like Amazon and Uber exist, where instant gratification seems like a right, not just a privilege. These are customers that want more and expect more, and they aren’t going away any time soon.

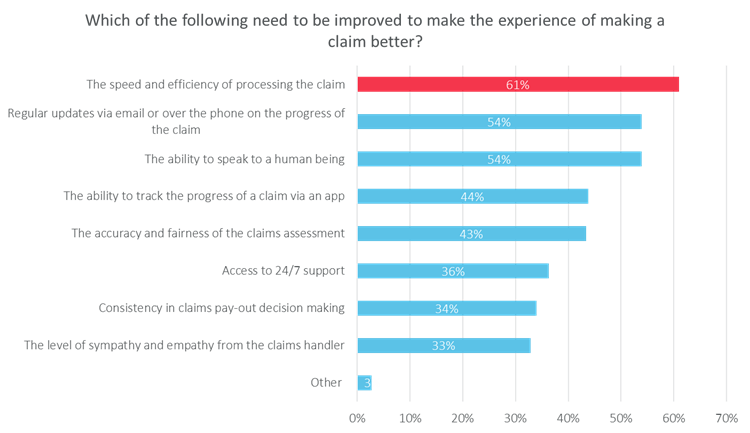

We went on to ask respondents that had previously made a claim, ‘Which of the following needs to be improved to make the experience of making a claim better?’, the top answer came in at 61% saying the ‘Speed and efficiency of processing the claim’. So, not only do customers expect speed and efficiency, claimants are recognising that this is also the industry’s biggest area for improvement where expectations are not currently being met.

What does this all mean for Consumer Duty?

It is insights like these that prove the need for such regulation.

Some might see the regulations as more of a nuisance than a benefit, however they present an opportunity for companies to think and act differently and to do what’s right for the customer. It’s permission to break time-old processes and the ‘that’s how we’ve always done it’ rhetoric. It’s a chance to create a legacy.

Customer expectations are currently not being met, and if the perfect storm continues to play out without action from the industry, this expectation gap will only widen.

Consumer Duty means that it is now imperative that the firms responsible for delivering goods and services are delivering good consumer outcomes.

To ensure customer retention and satisfaction, you need to prioritise your efforts by truly understanding the key problem areas. We have developed a Consumer Outcomes Benchmarking service that helps you measure purchasing experience, support experience, performance in meeting consumer communication preferences and service expectations, and much more.

Submit a comment