Whilst the rules won’t apply to products until 31 July 2023, firms have until the end of October to agree their Duty implementation plans. As we move from planning to implementation, here are 7 challenges providers face in turning the FCA’s Consumer Duty theory into their own real-life practice.

1. Getting to grips with Outcomes 3 and 4

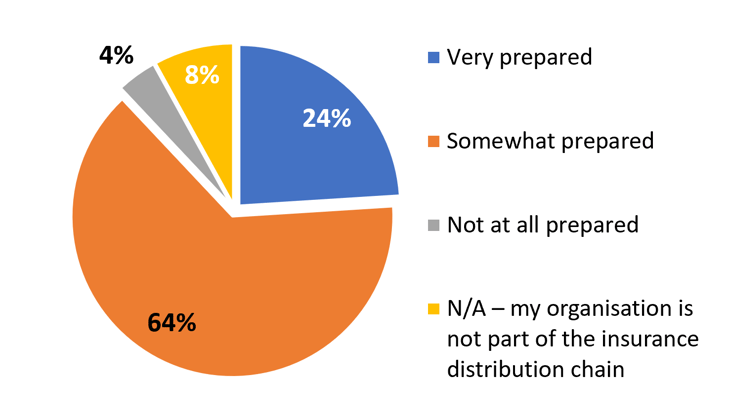

An encouraging 88% of providers say they are very (24%) or somewhat prepared (64%) for the Consumer Duty – and 4% say they’re not prepared at all. And it appears Outcomes 3 and 4 of the Duty (Consumer understanding and Consumer support) are where people feel the most uncertain.

How prepared is your business for the Consumer Duty regulation?

In a snap poll of the delegates at our recent Consumer Duty webinar, it was these areas where firms’ confidence clearly wavered the most.

For many general insurance firms, Outcomes 1 and 2 (Products and services and Price and value) will feel pretty familiar, following all the work done to meet the requirements of the regulator interventions on pricing and Fair Value.

But Outcomes 3 and 4 on communications and support are brand new for all financial services firms. Assuming GIPP compliance puts you most of the way there on the road to Consumer Duty would be a mistake – and it could be one many firms who’ve asserted ‘readiness’ are about to fall into…

2. Minding the void

The second key challenge for firms is how to evidence compliance against a void of an industry standard measurement for customer understanding and support.

Firms have very much been left to interpret what they should be delivering in hard and practical terms – but should be aware that the lack of prescribed measurement is NOT a get-out-of-jail-free card. Make no mistake, the FCA want real evidence, and they want it in some sort of context…

3. Not marking your own homework

What we do know is that it’s no good looking at what your own organisation is doing in isolation. The FCA is expecting a view that shows how and where firms sit within the market – which means looking outside in, and benchmarking yourself against peers. The FCA has said that “the rules and guidance must be interpreted in line with the standard that could be expected of a reasonably prudent firm.”

Firms won’t know what prudence looks like in that context. They need to measure themselves against an external objective standard, not an internal subjective one.

That’s going to be a particular challenge across the market, and it’s a data gap that Consumer Intelligence is looking to help fill with granular and market-level data.

4. Understanding your customers

As a starting point, we’ve been looking at what communication and support general insurance customers are receiving now.

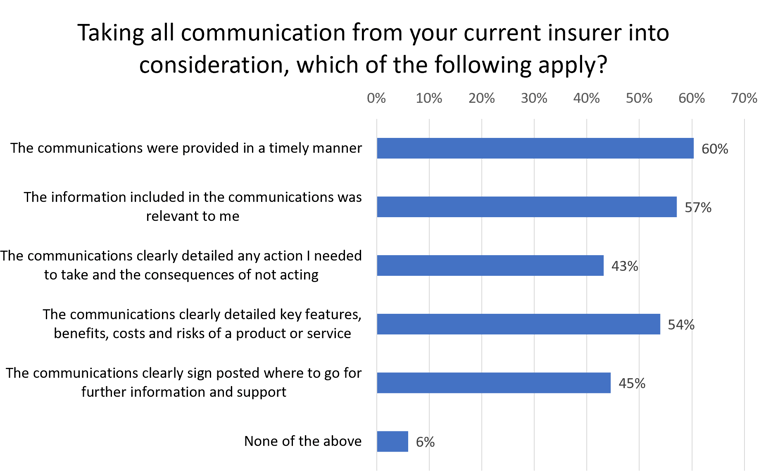

Perhaps most worrying is how few people said communications from their provider met the five criteria set out by the FCA in the Consumer Duty.

Only 60% felt communications were delivered in a timely manner, only 57% thought they were relevant, only 54% felt they clearly detailed key policy features, only 45% felt they’d been signposted to further information, and only 43% felt communications left them clear about what actions to take next.

The FCA’s communication criteria

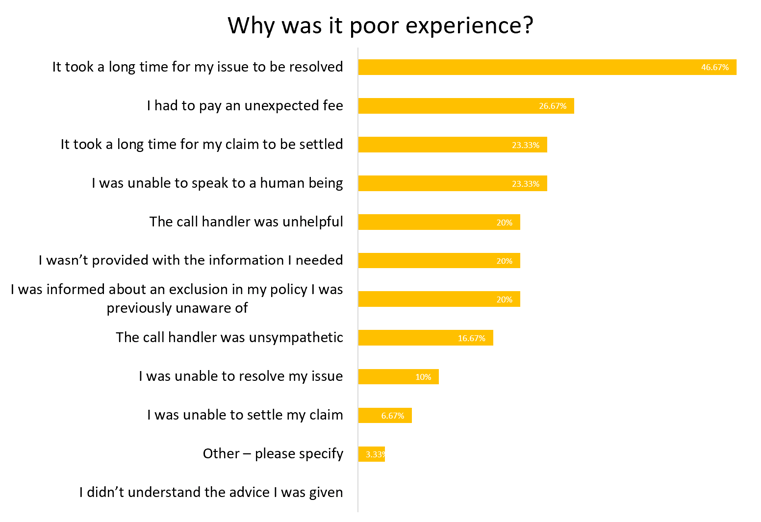

And of the 22% of consumers who had subsequently tried to access support to either update their policy or make a claim, 13% had had a poor or very poor experience.

The biggest reasons for those poor experiences were long wait times and unexpected fees and charges.

Poor experiences

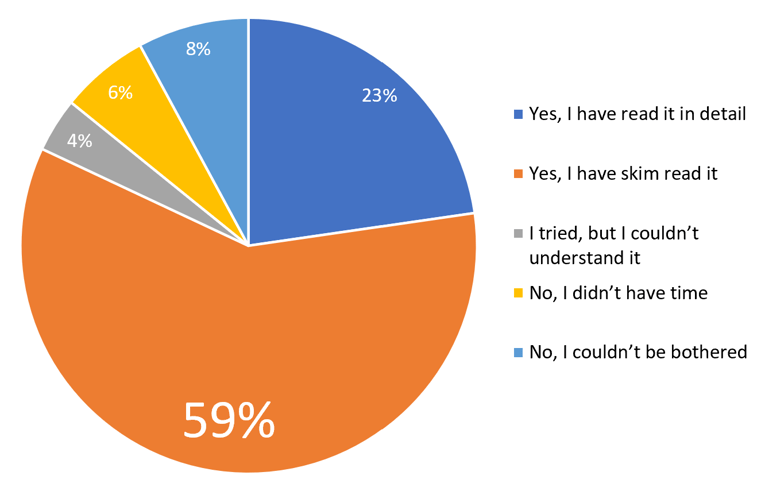

Meanwhile, understanding of insurance comms is somewhat sketchy…

While 23% say they’ve read their policy documents in detail, 59% say they’ve only skim read, and nearly 1 in 5 admitted not having read them at all. 77% of skim-readers felt they had a good understanding of inclusions and exclusions – which from experience is often an overestimation which only comes to light at the point of claim.

Understanding of policy documentation

While individual firms may sit above these averages, it’s clear as an industry there is work to be done - especially if communications are to be tailored and layered according to the Consumer Duty guidelines.

That can’t be done unless firms really get to know their customers, their potential customers, and their own customer journey on a new and intimate level.

5. Cost of living

Customers, of course, do not stay the same. And an added level of complexity on top of the Duty is the cost of living crisis – and the likelihood of more consumers slipping into vulnerability in the coming weeks and months. Under the Consumer Duty, communication with and support for these people will be more important than ever.

Currently, Consumer Intelligence figures show that 27% of consumers believe they meet the FCA’s requirements of vulnerability (as defined by the FCA), but in reality, we’ve found that’s more like 1/3 of consumers in the motor market and over half of home consumers who have the potential to be vulnerable.

Firms must be able to tailor their communications and support for vulnerable customers to meet their diverse needs.

6. End-to-end journey support

What’s more, you can’t abandon those consumers at the gates of your organisation.

You will need to ensure good outcomes for these customers, across all four outcome areas, across your distribution and delivery channels – from PCWs to claims specialists. For many firms, that’s going to mean re-examining and reframing key relationships.

7. Finding the opportunity

GIPP and Fair Value saw many firms go back to the drawing board on product and price. Now it’s time to throw the rule book out of the window and do that again – particularly when it comes to communications and support.

There is a real opportunity for customer-centric innovation which could change the face of general insurance – improving trust, delivering top quality retail-style experiences – and even, ultimately, increasing revenue for those brands that get it right first.

Help us meet your Consumer Duty needs.

We have recently set off on a journey to develop a new consumer proposition, which in part aims to support you in benchmarking against the Consumer Duty. If you would also like to get involved in helping shape and test our solution, please get in touch.

Comment on blog post . . .

Submit a comment