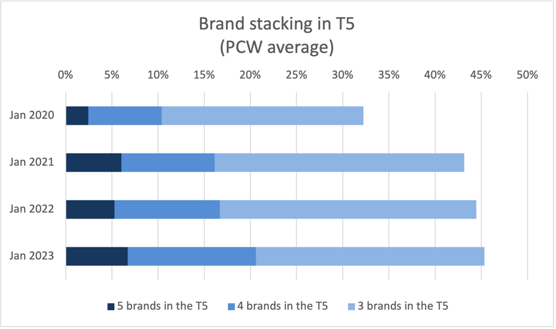

In January 2020 nearly a third (32.2%) of consumers looking for new car insurance quotes saw at least three brands from the same group in Top 5 positions. By January 2023 this figure had risen to 45.3%. Within that, the proportion of groups getting a clean sweep of Top 5 positions has more than doubled from 2.4% to 6.7% in three years.

It is partly prompted by pricing reforms putting an end to ‘free’ add-ons like legal expenses or breakdown cover to new customers (with those extra covers making their way into different levels of cover instead), partly a response to the cost of living crisis to offer a choice of cover levels, and partly a tactic to hit more of the top pricing spots for desired customers.

Either way, they are by now common to most of the big groups.

But many of those groups have a problem in curating the burgeoning suite of products.

Focusing on the top 10 most competitive groups, our Marketview tool has identified that half (3-in-6) of home insurance groups and 2-in-7 of the top 10 car insurance groups have been offering cheaper prices for their more premium tiers.

The instances are rare, accounting for less than 1% of all group quotes. Nonetheless, they are persistent in doing so.

This example from a real risk in January 2023 illustrates the problem - a customer receives a cheaper quote for a product with more features than the lower tiers are offered for – all from the same brand.

There are plenty of other examples. One insurer, for instance, quoted £15 less for a higher tier policy with higher contents cover and home emergency cover included than the tier below.

No correlation is obvious. Sometimes the brands are stacked next to each other with minimal price difference, sometimes they’re really far apart. Some of our real risks received the same topsy-turvy results consistently for three months in a row, others saw it some months but not others. Nor is it restricted to some parts of the market – we see it across age groups and property size.

The low prevalence suggests accident over conspiracy. But those inconsistencies could cause concern. Is it a mistake in pricing or a mapping error? And from a product governance perspective, how is it fair value?

Whatever the cause, and maybe it is a deliberate experiment in nudging insurance buyers towards a different product, it is likely to confuse customers and that can’t be good for anyone.

The question for brands whether they would be able to defend, or identify and correct any pricing anomalies like this.

Understand and optimise your competitive position.

Market View is an insurance market benchmarking solution that provides a uniquely comprehensive understanding of market dynamics, competitor behaviour and brand positioning within the general insurance industry.

Comment . . .

Submit a comment