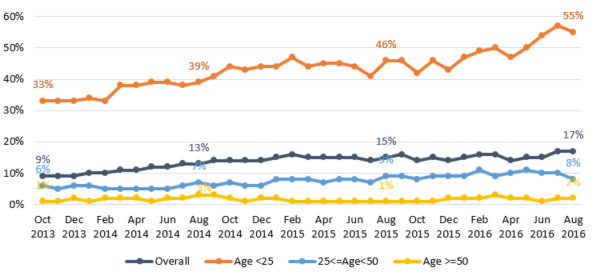

Our Consumer Intelligence Car Insurance Price Index showed a telematics tipping point this quarter, with more than half the five cheapest quotes for 17-24 year olds coming from telematics providers in June, July and August.

That’s a big increase from three years ago, when 33% of the five cheapest quotes for young drivers came from telematics policies.

While black box policies have not significantly increased amongst older drivers, their proliferation amongst under 25s means they now account for 17% of the cheapest quotes in the whole market, compared to 9% back in October 2013.

Brand Presence In Top Position On PCW's

In the last six months, the growth of telematics has been fuelled by DriveXpert, part of Direct Line Group’s Privilege brand, and iGO4’s WiseDriving.

DriveXpert took the top spot in 9.56% of quotes for under 25s in March, and shot up to 15.3% last month.

WiseDriving’s growth has been even greater, from 8.7% to 20% while Co-op Young Drivers has doubled its time in the spotlight to 7.46%.

Three new providers (RAC Black Box, Collingwood and One Call LiveDrive) have also added to the competition, achieving top spots on some occasions in August but not six months before.

So telematics providers are owning the pricing side of the market. But in terms of trust and marketing, there is some distance to travel before being happily accepted by under 25s concerned with privacy.

In March, when we asked our Viewsbank panel about telematics, some 62% of young drivers who didn’t have a black box policy said it was because they didn’t like being watched.

Selling on price only gets telematics brands so far. Rewarding safety and other benefits that make drivers’ lives better will help. Address that, and with the right place, there’s plenty more to play for.

Find out how your price compares against your competitors

Improve your sales and profit by understanding how your telematics price compares with other telematics insurance providers. Find out how you can improve profit and where you might need to tighten margins to increase policy count.

Submit a comment