Pricing gathered by Consumer Intelligence across price comparison websites and direct channels shows that overall motorbike premiums now stand at £314

Pricing gathered by Consumer Intelligence across price comparison websites and direct channels shows that overall motorbike premiums now stand at £314

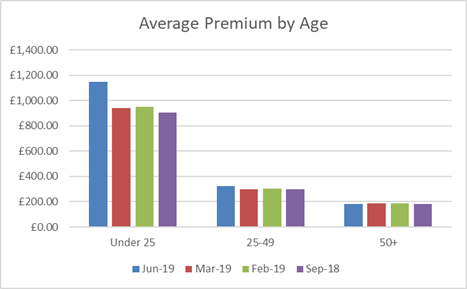

However there is a big gap depending on the rider’s age. Young motorbike riders looking for new quotes saw average premiums of £1147 in June whilst premiums for those aged over 50 were just £182. Young drivers have also experienced a higher rise in premiums – premiums were an average of £908 just 9 months ago, whilst prices for the over 50s have remained static.

The flat pricing for older drivers may be reflective of the downward trend in serious injury. Provisional Department for Transport figures have recorded a 7% decrease in bikers killed or seriously injured in the year to June 2018. However bikers accounted for 22% of all those seriously injured or killed on the roads. And according to the latest data available, riders aged 17-24 accounted for 30% of the 18,042 motorcyclist casualties in 2017, including 53 fatalities (down from 61 the year before). The figures for 2018 will be released in September.

Bike insurance comparison sites

Looking at distribution channels, both Compare the Market and Money Supermarket witnessed an increase in insurance brands on the price comparison websites from 20 to 24, and 37 to 41 respectively, with Go Compare dropping from 33 to 30 brands.

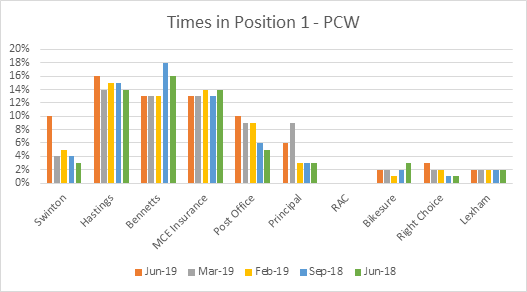

Looking deeper into the price comparison websites, the top performing brand based on price was Hastings with 16% of the top quotes. This is closely followed by former leader Bennetts (15%) and MCE (13%) which have held a consistent presence on PCWs throughout the year.

The biggest gain was from Swinton, acquired in January by the Ardonagh Group, which has leapt up the charts to deliver 10% of the lowest priced quotes in July. This is the biggest change we have witnessed from only 3% one year ago.

Of the remaining top ten, the Post Office brand stands out for its increase from 5% to 10% of the top quotes whilst the RAC has come from nowhere into 7th place at 3%

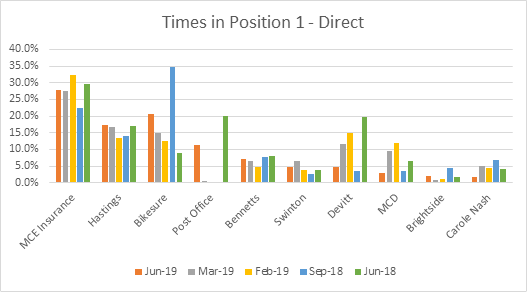

MCE Insurance which ranked fourth on the PCWs for price has however continued to dominate for sales via the direct channel for another year, remaining in the top slot with a 28% share of the top quotes. New in at number 2 is Bikesure which has leapt from 9% to 20%. Hastings has been consistent and gave 17.4% of the top quotes in June, vs 17% at this time last year.

The changing prices by age and channel show that motorbike insurance is far from static. The winning brands will be agile enough to adapt to changes in competition on all fronts.

Motorbike Insurance Market View

Optimise your competitive position in a fast-moving market by accessing uniquely comprehensive and market leading motorbike insurance pricing insights.

Market View gives you a uniquely comprehensive understanding of market pricing behaviour within the motorbike insurance industry. Using brand visible data, it contains actionable insight which will enable you to make informed decisions around pricing strategy, based on your current competitive position across the whole market including aggregators.

Submit a comment