Insurtech represents an opportunity create a new generation of insurance offerings that consumers can truly appreciate. Yet achieving success with insurtech isn’t a given. The winners will be those that create compelling, appealing propositions in the eyes of consumers with a focus on clear communication of the benefits on offer.

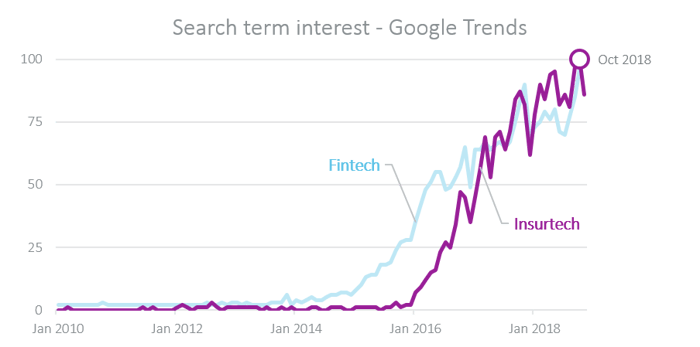

Right now, we are at peak insurtech. There are insurtech companies, insurtech conferences, insurtech awards, insurtech books. Google Trends’ relative measure of interest in ‘insurtech’ as a search term registered at 100 out of 100 in October – that means it’s being searched for more often now than ever before.

In the industry’s fervour around insurtech, and what it means for the future of insurance, it’s important not to forget what insurtech means for consumers. Whilst much of the discussion and investment focuses internally on technical and operational advantages that will lay behind the scenes, it’s worth pausing to consider the form, and not just the function, of the insurtech innovations that will visibly shape the insurance products that consumers buy.

So how do you make sure that your revolutionary insurtech-driven proposition doesn’t get overlooked when you’re convincing consumers that it’s the best choice for them?

What you want them to buy vs. what they really want

It’s the classic product-led vs. market-led question. Insurance is complex and consumers don’t want to understand the intricacies of it, so a product-led “build it and they will come” approach simply isn’t enough. We at Consumer Intelligence believe that the way in which insurtech-led products are delivered to consumers will have a significant impact on how likely consumers are to adopt them.

It may sound a little whimsical, but consumers want something that resonates with their own sense of value and need. If your offering makes your prospective customers feel secure, evokes familiarity, and, in an increasingly impersonal digital world, offers a human-feeling digital experience, they’re more likely to buy it.

Let’s look at the evidence.

Arguably, the first insurtech gamechanger has landed long ago: telematics. Remove yourself from the world of insurance and everything you know about it, just for one second. In an industry famed for not setting pulses racing, is technical-sounding terminology such as 'telematics' the best way to be engaging consumers with your latest tech-driven innovation?

Insurers have an uncanny knack of making their products sound clunky and unappealing. Imagine picking up your handheld PC and video-calling your friend using the videotelephony app, as opposed to Facetiming your friend on your smartphone. Yes, this is just semantics, but it matters.

How do you feel about the word ‘telematics’?

To me, it sounds like something straight out of an engineering textbook rather than something that I’d want and buy year-after-year. How about ‘black box’? That’s conjuring up some troubling memories of plane disasters – not a positive association for the young and inexperienced drivers that make up the primary target market here. Is language and lack of understanding or trust the reason that many consumers scroll past a cheaper telematics offering to buy a non-telematics car policy?

Shouldn’t insurers be using terminology and referencing concepts that resonate more positively with consumers? Picture a customer experience made up of seamless quotes (chatbots), informed cover (API feeds), smart devices (telematics), and active prevention (connected sensors).

Should insurers be using terms like telematics or black box at all? Should we simply let the technology speak for itself, delivering seamless customer experience, lower prices and tailored cover?

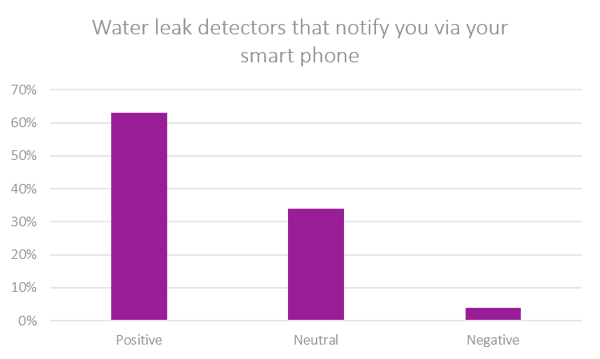

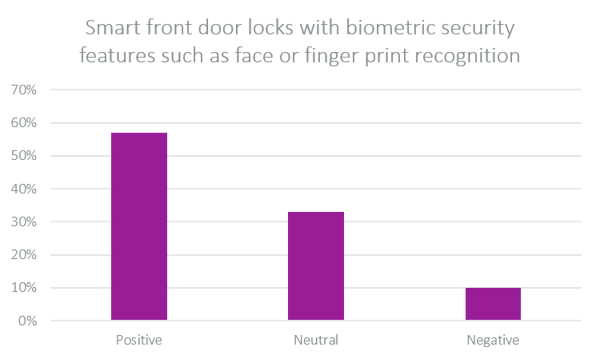

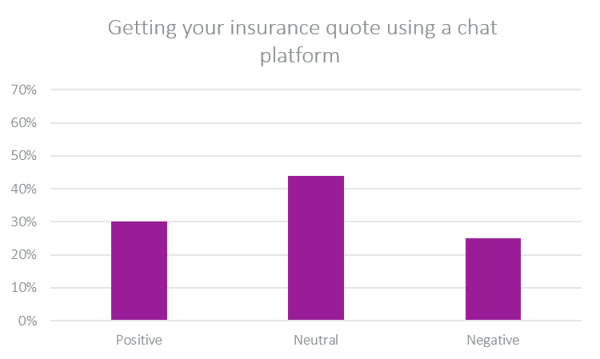

We asked our Viewsbank panel how keen they were on a variety of connected device technologies – the results show that technology that blends practical risk management and benefits are the best.

How do you feel about the following products and services?

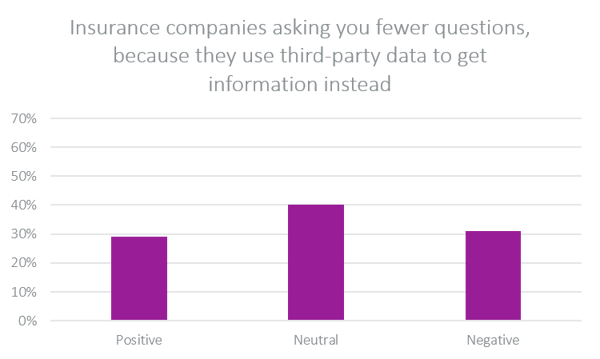

But look how much the results change when we asked how the same people felt about the proclaimed insurtech benefits.

How do you feel about the following products and services?

So when it comes to showing off your new quote journey that uses a chatbot agent and API data feeds, or the latest connected devices that identify real-time loss risks like water leaks and break-ins, it’s important to frame and present them in a way that makes a consumer think: “I want that. That will make my life better.”

[INFOGRAPHIC] Identifying future trends and planning for them

Consumer Intelligence is already helping some of the UK’s leading insurance brands with horizon scanning with its unique approach and insight. In these times of extraordinary change being forewarned is forearmed has never been more relevant. Isn’t it time you looked to the future with Consumer Intelligence?

Comment . . .

Submit a comment