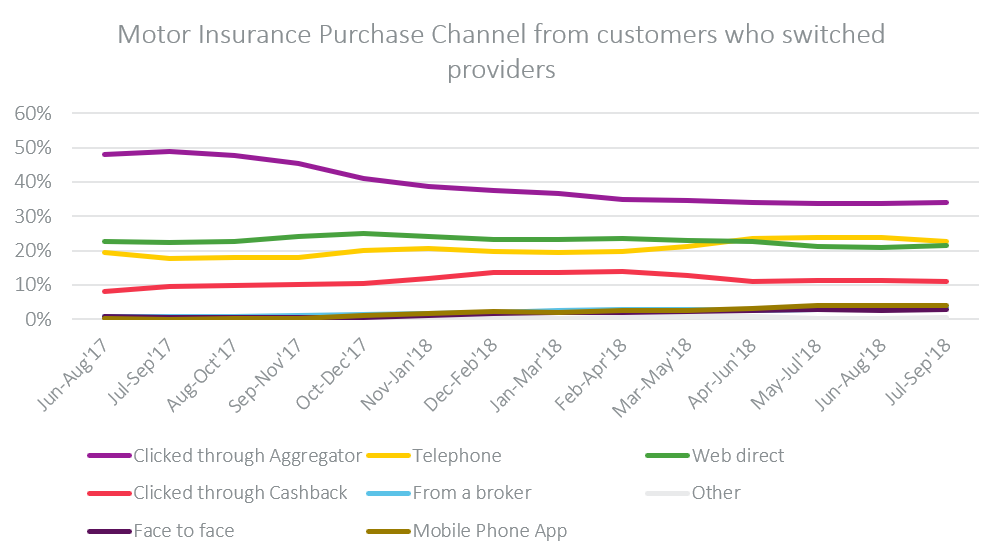

Ignore telephone service at your peril. Whilst 56% of motor insurance customers buy online, 23% complete the transaction by phone.

Whether that’s because they pro-actively preferred to speak to someone for the entire journey, or received a follow up call after getting a quote online, buying by phone is on the rise.

Whilst over 80% of people will use a price comparison site to research prices they may not complete the purchase by that channel. Some have narrowed it down to a couple of brands and want to speak to someone to finalise their decision. They could have questions about some specifics of the policy or want the verbal reassurance that they have chosen the right product for their needs. Or some brands may push a customer to complete on the phone to check or confirm specific details.

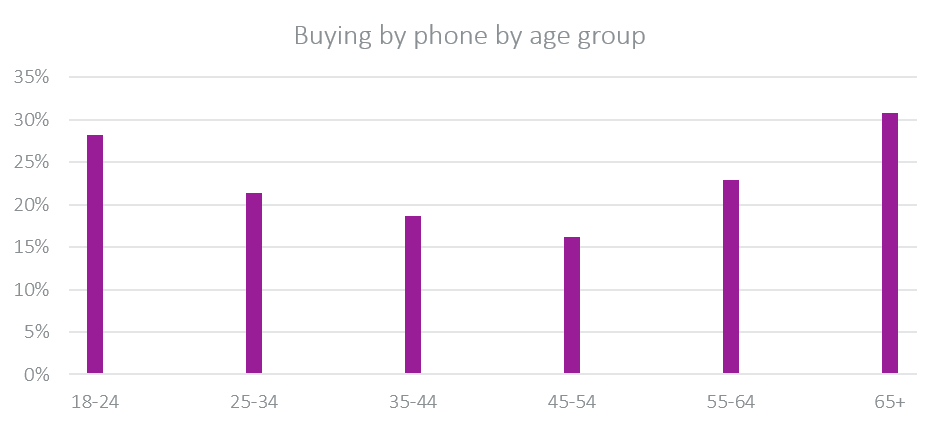

Buying by phone: Millennials like it too

Buying by phone is not the preserve of the older customer. Over a quarter of young drivers took out car insurance over the phone, a preference second only to drivers aged 65 and over.

IBT Motor March 18-Aug 18

It all means that brands have to be ready to deliver an omni-channel experience — to find a customer’s details from online and close the deal over the phone, whilst demonstrating their values consistently across those channels.

However, we are still seeing some examples through our telephone mystery shopping services of brands being ill prepared to deliver for customers over the phone.

Getting through to an agent can be a hurdle with long wait times experienced on some calls. And then the pre-recorded messages that direct customers to the right team vary in range — from 71 seconds to over 3 minutes in those we measure. The range is partly explained by whether compliance messages are included in the IVR, before a customer speaks to the call centre representative, or read out during the call by the agent, but also by different interpretations of the requirements. Either way, customers can’t just check a box to say they’ve listened to and understood the regulatory required messages.

Once through to the call centre, some brands are doing a great job bringing a personal service. Customers recognise and value this human reassurance.

As real customers reported through our Reality Check research:

“They understood what I wanted and related to me on a human level. They were not the cheapest but did customise the offer.”

“Professional and friendly service, a tailored response to my needs, made me feel like a valued potential customer.”

Other brands offer a good human service, but are still directing customers back online to purchase their insurance policy. To a customer who has chosen to speak to an agent, this is clearly very frustrating. And it be must also feel counter-intuitive to the staff to be paid to direct people to a different channel.

As customers reported:

“A very detailed call going through everything and with the agent checking with me to make sure I fully understood the cover being offered. I was informed that it is cheaper to go online but the agent would still go through everything anyway.”

“The agent tried very hard to push me towards an online quote which I did not really like.”

The nature of insurance means that regulatory and compliance requirements are key points on the agenda — all quite rightly with the aim of ensuring customers are treated fairly. However there is a lot for the agents to consider when they are going through the call and the recent changes under the Insurance Distribution Directive mean a renewed focus on ensuring firms are offering products that are consistent with an individual’s demands and needs. It is quite a challenge to turn it from just reading a script, to make it personal, to make the customers feel at ease and to be responsive to their needs.

These new rules, and the persistence of the phone channel, make it as important as ever for brands to understand how their phone agents are performing compared to those at other firms, and how customers are responding to the service they have received.

The telephone continues to hold its own, offering customers choice for a personal service and playing a vital part in the shopping journey.

[INFOGRAPHIC] Telephone service for motor insurance customer journey

These insights come from our telephone mystery shopping programme, as well as a survey we carried out using our in-house panel and our Insurance Behaviour Tracker. If you've got questions on what your customers think of your call centre service or how to improve its efficiency and effectiveness, we can help you find the answers.

Submit a comment