Not all credit is equal. Not all credit strategies are equal. In fact, not all credit has any strategy behind it at all…

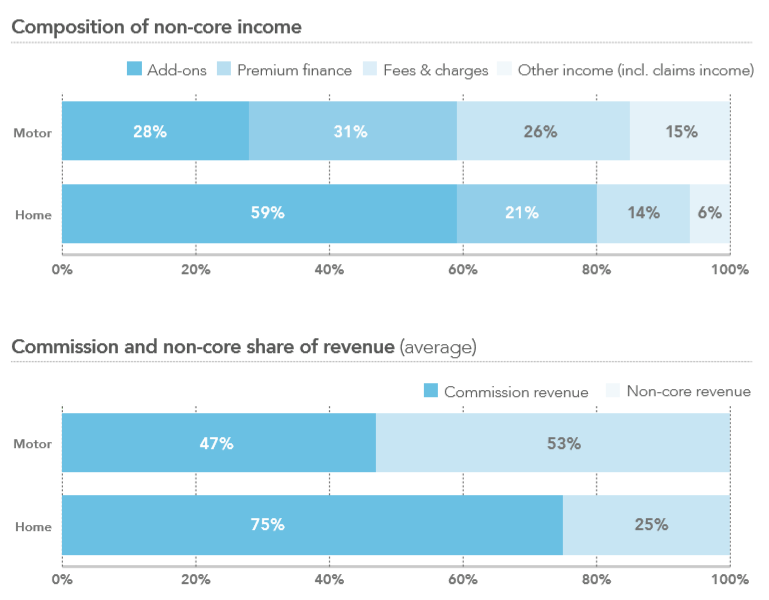

Credit is clearly more important to some brands than to others. In fact lending money can be more profitable than selling insurance – and it accounts for 16% of intermediaries turnover. It even beats add-ons and fees as a source of non-core income – 31% vs 28% and 26% respectively.

Source: FCA General Insurance Pricing Practices Market Study Interim Report, October 2019

But many brands still don’t treat credit as a product in its own right. It doesn’t have the oversight, strategy or governance of its non-core counterparts. Perhaps most telling is that more than half of brands – 53% - apply a flat credit rate across all customers and all risks.

If you are not varying the cost of your credit, you may not be treating customers fairly, and at some point (probably sooner rather than later) that’s going to put you firmly in the sights of the FCA. Fairness, especially when it comes to pricing, is a current hot topic, and credit is now very much part of the pricing picture.

While rates many not vary enough, costs across the market certainly do. 89% of brands have an average cost of credit between 7.5% and 17.5% of the annual premium, with directs beating brokers, charging an average cost of credit at 10.7% vs 13.9%. The highest cost of credit we found came in at a whopping 65% of the annual premium.

Clearly some brands are using the cost of credit to attract or repel certain risks. And to claw back security from higher risks, deposits vary significantly too, with 29% of brands charging 15% -17.5% of the total instalment cost up front.

So where are you in this credit picture, and why should you care?

Well if you’re not swayed by the need to comply with FCA priorities, you should be swayed by the need to compete with your peer brands. Because the cost of your credit matters now more than ever.

To demonstrate, we put the same risk into PCWs and changed whether we were paying annually or in instalments. The lists that came back were completely different…

The cost of your credit could be changing how you rank on PCWs - and could already be impacting your acquisition strategy. And if it’s not doing so now, it probably won’t be long.

Currently 32% of motor insurance customers pay in instalments. Over the next 12 months and beyond, that figure is set to rise. Our Covid tracker found that 36% of people were worried about finances after lockdown, with younger people feeling most concerned.

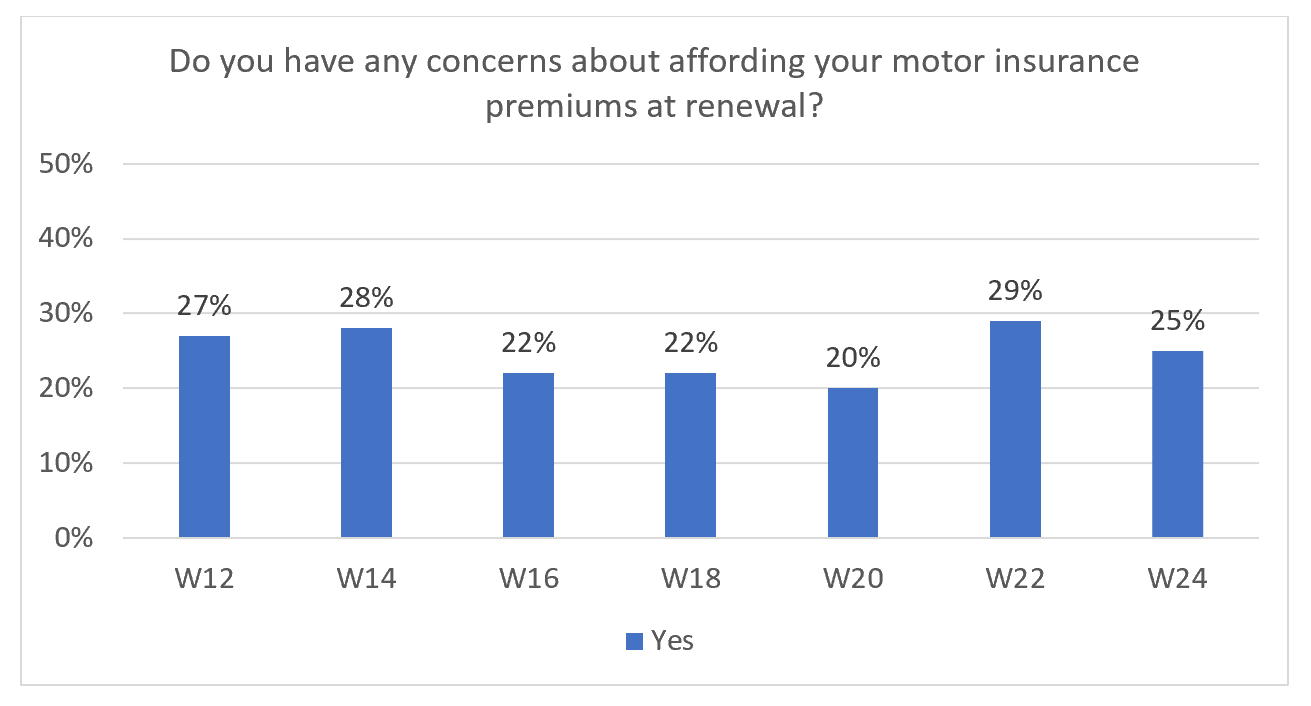

We then specifically asked if people had concerns about affording their motor insurance. 24 weeks into and through the pandemic, a quarter of motorists admitted they were worried about not being able to pay their premium at renewal.

With the average cost of car insurance for the under 25s coming in at £1,800, it’s likely more people are going to be looking for financing options. And it’s pretty safe to predict that competitive credit is likely to win you more young customers in 2021 than cinema tickets…

Credit is now integral to your product development, pricing strategy, and marketing, and by taking control of it, brands have a unique opportunity to steal a march on the competition, steal the top spots on PCWs, and steal a new wave of post-Covid customers.

If you want to find out more about how your credit looks next to other top brands, gain insight into your evolving customer base and evolving FCA thinking, you can watch our recent webinar here, or download our full Cost of Credit report below.

Take the first step in understanding your credit proposition

Credit is going to become a big issue for motor insurers in 2020, and beyond. In a volatile market and against a backdrop of recession, more people are going to need to spread out the cost of large insurance premiums. And that means all insurers and brokers need to be asking themselves some hard credit questions.

Comment . . .

Submit a comment