After five years in the making, the long-awaited whiplash reforms came into force in England and Wales on 31 May 2021, with the Ministry of Justice’s headline claim that the changes to how personal injury claims are made and assessed would save drivers up to £35 a year on their insurance.

Introducing a self-service online portal for road traffic personal injury claims of up to £5,000, a ban on settling claims without medical evidence, and setting a tariff for injury compensation would deter exaggerated claims and reduce what the government described as “the unacceptably high number of whiplash claims made each year.”

Three months in, our Market View pricing insight tracker shows that there have indeed been reductions in premiums, though the signs are tentative.

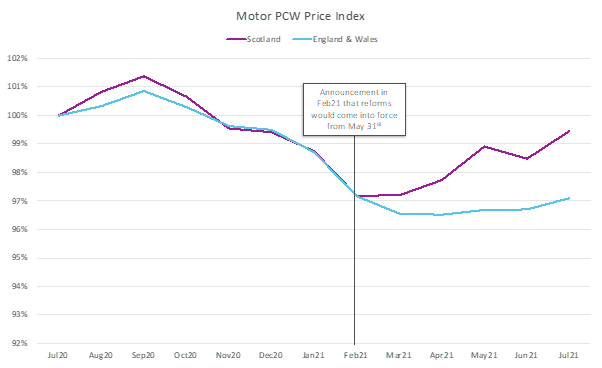

Premiums in England and Wales and Scotland had followed a similar downward trajectory until the date for the delayed reforms was finally confirmed in February. At that point prices for new business in England and Wales to fall, whilst in Scotland they levelled off and then began to rise at a faster pace.

Motor insurance market pricing factors do not operate in isolation, of course. It is hard to unpick how much of the pricing deflation is due to reduced road traffic from successive lockdowns or preparation for the FCA pricing reforms. However the differences between Scotland and England & Wales do indicate some brands are factoring in lower RTA claims costs south of the border.

Companies remain cautious. Sabre CEO Geoff Carter described the reforms as bringing “additional complexity but little material change.” Noting a potential backlog of claims and the unknown impact of lockdown easing on traffic, Carter said predicting claims costs for the second half of 2021 remains challenging.

That caution is borne out at market level with cautious decreases in England and Wales not yet approaching £35. At £858 the average premium in England and Wales is the same as it was in February 2021, whilst premiums in Scotland have risen over this period but not by so much as to have returned to the pricing seen a year ago.

It remains to be seen if that saving is worth it for customers and for the potential impact on customer’s experience.

A recent survey undertaken by Consumer Intelligence for Post found that 94% of people in England and Wales who have not made a claim since 31 May 2021 have not heard of the portal. Over two thirds of the public said they would not know how to make a minor injury claim.

And whilst it is early days and a small sample size, of the 39 drivers in England and Wales who have brought a claim since 31 May, only 27 started off with the portal. Of those 16 completed the process without help whilst 10 did not finish the claim and ended up instructing a claims management company or solicitor instead.

For brands who want to deliver an excellent claims experience, there be some frustration at losing control of the process and directing people to an online portal with an infamous-in-insurance 64 page user guide. It may also present an opportunity to remind customers of the benefits of motor legal expenses policies which can assist with the portal if that’s something they may feel uncomfortable with completing themselves.

The government will review the portal’s success in 2024. These are early days, but important ones for setting the tone in customer communications and care as well as ensuring brands pricing remains aligned with strategic intent in England and Wales and Scotland.

Insurance market pricing insight to optimise your competitive position

Understanding and optimising your product mix, particularly in your competitive context, can make all the difference when it comes to winning new business. To learn more about our insurance market pricing insights, please click below.

Comment . . .

Submit a comment