The Great British Holidaymaker is a pretty hardy and determined species - but they’ve certainly not been immune from the cost of living crisis.

3-in-5 of us have either booked or are planning to book a trip abroad in the next 12 months, according to our survey of 1,000 adults across the UK. Another 20% will take a break in the UK while 1-in-5 said they just couldn’t afford to go away at all this year.

Source: 979 adults who travel outside the UK. Online research by Consumer Intelligence conducted March 2023

Source: 979 adults who travel outside the UK. Online research by Consumer Intelligence conducted March 2023

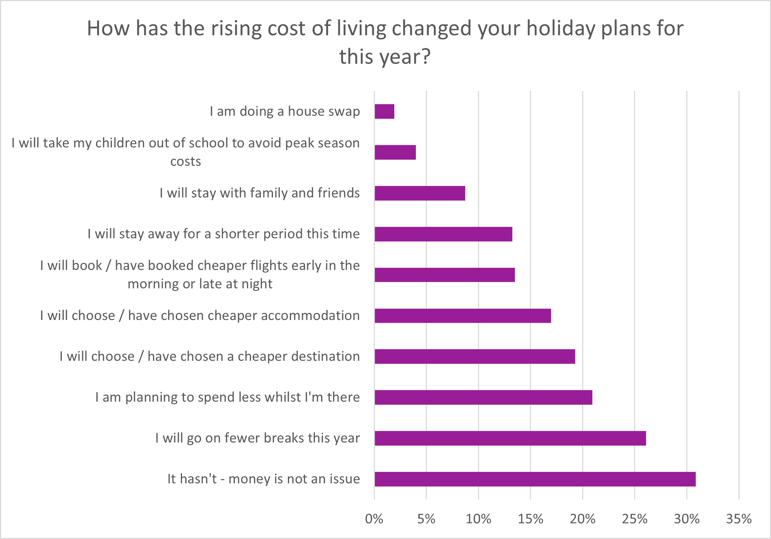

Furthermore, the cost of living crunch has changed the plans of 70% of those who are planning to go on holiday this year.

1 in 5 are giving up things like excursions and meals out, 19% are heading to cheaper destinations, 17% are booking cheaper accommodation, and 13% are even going for red-eye flights to make holiday budgets go further.

A quarter of those planning to travel will take fewer breaks this year, and 13% will stay away for fewer days/nights.

As many as 7% of adults aged 25-54 admitted that they were planning to take their children out of school to avoid peak season costs.

Only 3 out of 10 said money was no object to their travel plans.

Source: 778 adults who have booked or are planning to book a holiday in the next 12 months. Online research by Consumer Intelligence conducted March 2023.

Source: 778 adults who have booked or are planning to book a holiday in the next 12 months. Online research by Consumer Intelligence conducted March 2023.

Travel insurance popularity

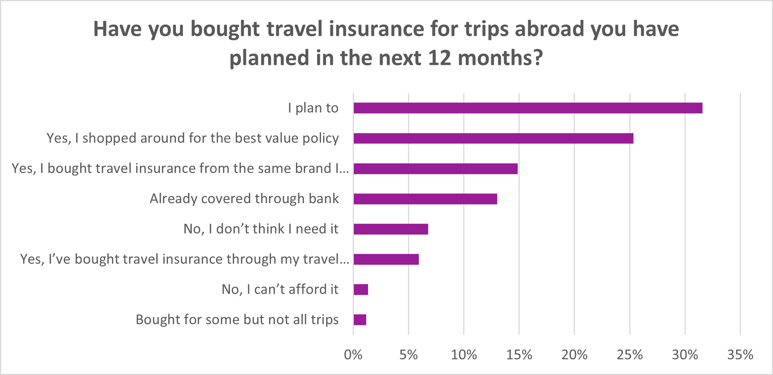

In good news for travel insurers, it appears that the one thing people aren’t going to be skimping on is insurance.

Post pandemic, people aren’t taking any chances with their health – or their hard-earned holidays – and travel insurance is almost universally valued.

Nearly 60% have already got some sort of travel insurance in place for their planned trips, with another 32% planning on getting cover before they go. Only 7% of travellers felt they didn’t need travel insurance, and only 1% felt they couldn’t afford it.

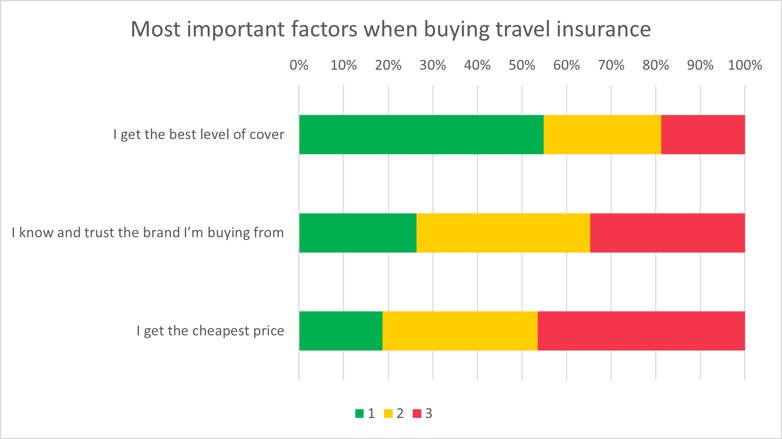

In fact, despite ongoing and deepening cost of living struggles, price is not the main consideration for most travel insurance customers. More than half make getting the best level of cover top their top priority. Most then prioritise a quality brand they recognise, with price coming in a paltry third in their list of considerations.

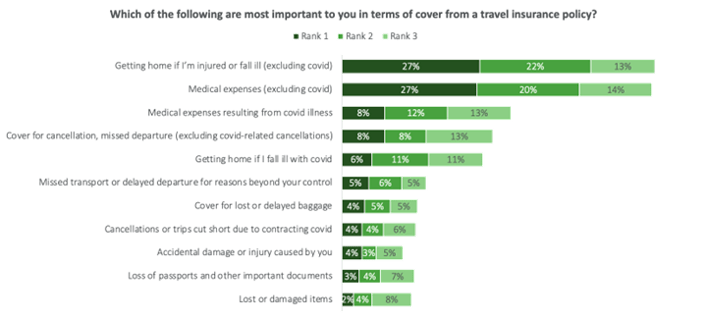

When we asked people to rank the most important policy features, medical expenses and repatriation were the most important things people want from their travel insurance.

And when they have bought a policy, trust in travel insurance is relatively buoyant. 87% believe the level of cover offered by their policy is fair in relation to what they paid, and 81% trust their provider to pay out in the event of a claim.

And when they have bought a policy, trust in travel insurance is relatively buoyant. 87% believe the level of cover offered by their policy is fair in relation to what they paid, and 81% trust their provider to pay out in the event of a claim. However, it’s worth noting trust is lower for younger consumers. Only 70% of 18-24 year olds said they trust their travel insurer to pay out if they made a claim, compared to 93% of those aged 65+.

Confusion reigns

Understanding of exactly what is and isn’t covered continues to vary.

- Nearly half of policyholders aren’t certain if they’re covered for accidental damage or injury they cause themselves

- 43% are unsure if they’ll be covered to get home if they get ill with Covid

- 38% aren’t sure if their policy would pay out if Covid cut their trip short

- 35% weren’t sure if covid related medical expenses would be covered.

For travel insurers and brokers, the Consumer Duty-fuelled mission is clear: education and communication is needed to boost consumer understanding.

People want to travel.

They want insurance.

They want value, not a bargain basement policy.

The challenge for providers is to make sure customers understand what they’re getting, so they can manage expectations, prove fair value, and build that all important trust even further.

Viewsbank is our in-house consumer research panel. It’s a large, responsive and community driven panel that conducts both quantitative and qualitative research.

Our Viewsbank panel helps our customers with a wide variety of projects ranging from detailed mystery shopping to demographically targeted research surveys. The research helps our clients make informed decisions based on true understanding of the consumer’s voice.

Comment . . .

Submit a comment