In April, the FCA rolled out measures forcing insurers to notify customers of last year’s premium at the point of renewal, and also encourage them to shop around.

At the time, 52% of consumers told us they expected the changes to result in better deals, while some of our clients expressed concerns the move could increase churn and drive up acquisition costs. We’ve been working with a number of clients to help them understand the implications of these moves on their acquisition and retention strategies; how are competitors choosing to interpret the new regulations and what impact has this had on shopping and switching rates? The latter have shown some interesting movements.

As you might expect, insurers have adopted very different approaches and in some cases, areas have been overlooked. In June, the FCA instructed Admiral to write to customers after providing incorrect previous year prices, and just last week, M&S acknowledged it had not contacted policyholders approaching their fourth year of consecutive renewal, who now require additional messaging.

As with almost all FCA directives the guidance is principle-based, not explicit. Yet these enforcements make it clear that companies found to be sailing too close to the wind are likely to incur additional costs for resoliciting customers — costs they can ill afford given ongoing pressure on operating ratios.

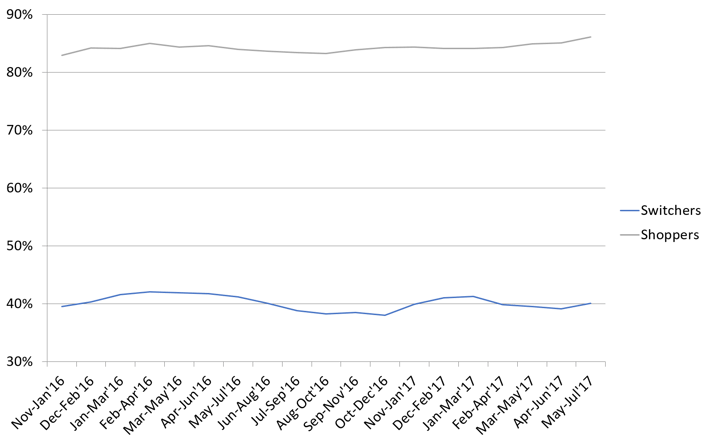

Insurers, however are making proactive moves. In the motor market, they are adjusting renewal rating and offering incentives to retain loyal customers. This could help explain why the switching rate has held around the 40% mark despite shopping rates climbing close to all-time highs in the 3 months ending July.

Car insurance shopping and switching rates

Wider influences on pricing have also created a perfect shopping storm. Against the backdrop of rising motor premiums, finding a better deal — which for many might be defined as a saving on their existing premium — is all the more elusive. In the 3 months ending July, 22% of consumers told us the main reason they did not switch was they could not find a cheaper deal elsewhere.

Yet the biggest reason consumers are staying is because the best offers are often right in front of them. Consumers are shopping, but are finding their existing provider is offering them the deal that meets their needs. 47% of them said the reason they stayed was because they were either offered a lower premium or found their insurer matched their best offer elsewhere — the highest mark since our records began.

So, the rise in so-called ‘window shoppers’ is a combination of two things: rate increases for both new business and renewals dampening appetite to switch; and insurers being more canny with renewal pricing, which could be either pre-emptive or a response to shoppers who search out the best deal with a plan to use it as leverage.

So, the FCA appears to be getting its wish for more competitive pricing — except not in the way it might have expected.

Submit a comment