The motor market is fiercely competitive, and equally complex. To understand which insurers are gaining ground we ask tens of thousands of motorists who their provider is, before and after renewal.

Our latest figures show that esure currently has the greatest momentum, increasing its estimated market share by 1.2% to 4.7% in the 3 months ending July. Aviva-owned brands occupy second (+1%) and third (+0.9%) place on the list, with LV (+0.8%) and Hastings (+0.6%) rounding out the top five.

Taken together, the top ten grew their estimated market share by 6.6% in the latest period. This compares with a jump of 6.5% in the previous 3 months, and 5.6% in both Q1 and Q4 2016, which could reflect broader rating instability in the market. We are seeing the fallout from pricing pressures including claims inflation, escalating repair costs and a hike in Insurance Premium Tax, which has created opportunities for brands to experiment with pricing strategies — including some reducing rate in an attempt to gain market share.

Unlike the home insurance market, which is increasingly dominated by direct brands, we see a mix of business models in our top ten motor list. Of the top 10, two are direct brands, six use aggregators, and two are intermediated: Lloyds Bank and the RAC, both of whom are underwritten by BISL.

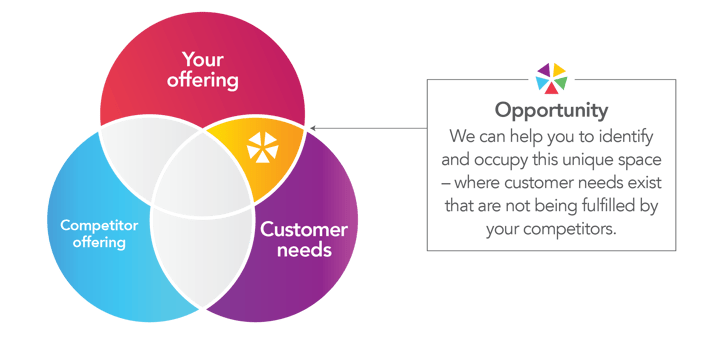

In a previous blog, we described those growing market share as successfully competing in what we call a ‘Golden Space’ — an area where customer need exist but are not being met by the competition.

In motor we see this with esure, which has long been competitive for older, safer drivers and now, according to our data, appears to be pricing more competitively across a wider range of demographics. Hastings, meanwhile, has been a leader for competitive pricing on aggregators with their Essentials product for many years. Its latest rise could also be related to its telematics product, Smart Miles, which has been testing appetite for different age segments over the course of the year.

Aviva’s continued progress also suggests brands can succeed on multiple fronts at the same time, using both direct and aggregated models. We have seen a significant improvement in Quotemehappy’s competitiveness in the summer months, doubling its share of rank one results on PCWs over that time frame. We observed a similar trend for home insurance in June, while noting the potential benefits for consumers of being an Aviva group customer.

With the CMA’s recent call to encourage consumers to shop around, and the FCA’s renewal disclosure initiative starting to show some signs of gaining traction, it will be interesting to see whether aggregated brands — and in turn, motorists — will reap the benefits.

Optimise your competitive position

Contact us today to learn how Market View can help optimise your pricing strategy and make informed decisions to improve your bottom line.

Comments (1)