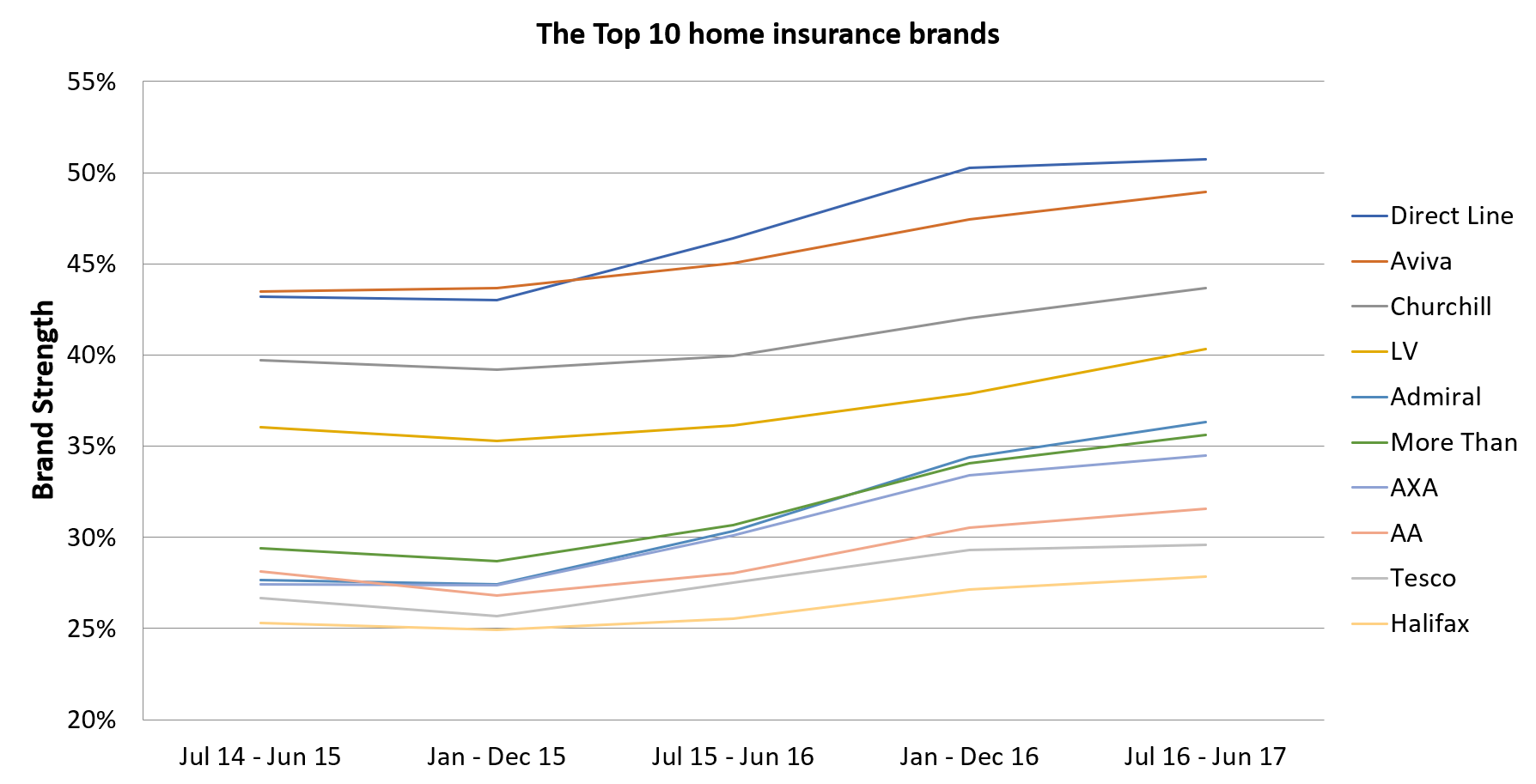

Direct Line is the nation’s biggest home insurance brand, our latest data shows.

The iconic insurer is top dog in both major personal lines markets, scoring 51% and 54% in our brand strength index for home and motor, respectively. Its lead is narrowing, however, with Aviva closing the gap in home from 2.8% to 1.8% over the past year.

The home market is dominated by direct brands, and the two non-aggregated giants have battled for the leading position in both awareness and consideration for many years.

It is a prize worth attaining, given home insurance buyers are less promiscuous than in motor, with 25% not shopping at renewal versus only 14% of motorists. At 35%, switching rates are also lower — partly because premiums, and potential savings, are smaller.

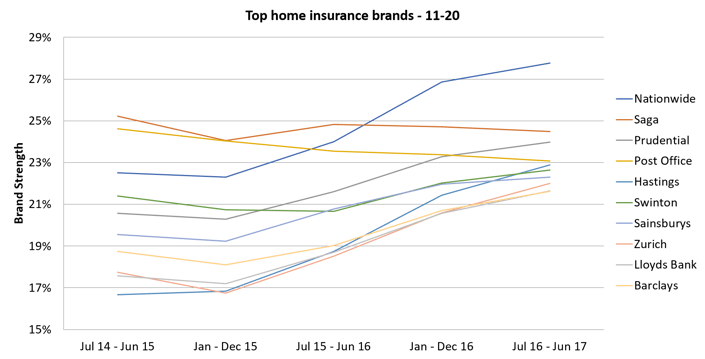

Tesco is the only retailer in the top 10, leveraging its additional customer touchpoints to promote its insurance products. Similarly, the company experiencing the biggest brand uplift in the past year also has access to an enormous customer base of over 10m — British Gas.

|

|

|

Brand Uplift |

|

1 |

British Gas |

2.56% |

|

2 |

LV |

2.43% |

|

3 |

Admiral |

1.93% |

|

4 |

Policy Expert |

1.79% |

|

5 |

L&G |

1.70% |

|

6 |

Churchill |

1.68% |

|

7 |

MoreThan |

1.57% |

|

8 |

Aviva |

1.47% |

|

9 |

Hastings |

1.44% |

|

10 |

Zurich |

1.41% |

The energy giant, which has a solus deal with AXA, is making significant strides, albeit from a low base. It has been pricing competitively on aggregators, and we expect to see the upward trend continue as it becomes more known for providing insurance services.

The remainder of the top 10 fastest growing brands is dominated by household names with significant marketing budgets, although notice the inclusion of intermediary, Policy Expert which also appeared in 7th place in our home momentum report in June. Admiral, which is currently advertising its combined motor and home cover, is also rising fast.

As with our recent survey of the motor market, we see overall market growth in terms of brand recognition, with only four of the top 40 brands experiencing a decline since 2016.

According to our head of research, Stuart Peters, the insurers in the top five of our biggest brand list, which also includes Churchill, LV and Admiral, have traditionally been among the leading spenders in above the line advertising.

“The really interesting one for me is Churchill,” Peters says. “They have significantly dialled down their advertising, relying on their brand strength via aggregators to generate quotes. “It shows you how powerful latent brand strength can be.”

While a strong or growing brand does not correlate entirely with growing market share, it remains an important measure of longer term potential, and drives retention. Brand affinity is key for both attracting and retaining customers, and with home shopping rates rising 2.9% between January and July, this assumption is being tested at almost unprecedented levels.

The continued growth of direct channels, the rise of new, non price-driven forms of aggregation — itself part of broader, innovation-led attempts to improve customer experience — mean that brand experience is increasingly significant.

“The challenge for the brands who don’t have a seat at the top table is how do they compete without a long, consistent and expensive advertising campaign?” Peters adds.

Smaller brands must think differently. Rewarding loyalty (as opposed to only offering incentives), developing new product features that are both innovative and respond to genuine need (such as Policy Expert’s fixed renewal premium) and developing customer touchpoints that are personalised, more frequent and more frictionless are some of the keys to success.

How strong is your brand?

If you would like to know where your brand featured on the list, or to find out how our consumer tracking tools can help your business, please get in touch.

Submit a comment