The insurance industry is routinely and cynically bashed for making a profit and accused of not passing on savings to customers.

But as the latest car insurance price index shows, average prices are down 9.1% in a year. That figure alone is worthy of pause and consideration.

With the Consumer Price Index showing 2.7% price inflation in the last 12 months, cheaper car insurance is a welcome respite for shoppers. Indeed, of the 126 items used by the Office for National Statistics’ to officially calculate inflation, only two items fell by more.

Part of the annual decrease is a hangover of comparing to the extreme post-Ogden post-IPT rises last year. But it also tells us that competition is working well, and, in the absence of other influencing factors in this period, suggests that most insurance brands are already following up on a public pledge to pass on anticipated savings from the Civil Liability Bill. Before those savings have even materialised.

Not every brand responded in the same way, and it can be very useful to see how your price reductions or increase compared to rivals’ and how it fits within the broader sector range.

Over the three months to 31 August, 82 out of 125 brands (65.6%) available through Price Comparison Websites (PCWs) reduced their prices. The biggest reduction was 5.2% and the biggest increase was one brand correcting its rates with a 12.8% rise. The highest rise behind this was 4.2%.

.jpg?width=1161&name=Average%20Rate%20Change%20(PCW%20Brands).jpg)

Another emerging trend is the fight-back of motor brokers. Insurers have dominated the top spots for price for over a year now. On PCWs, the 10 largest price reductions seen in the last three months all came from broker brands, including two brands offering more basic or essential entry-level insurance products to become more competitive.

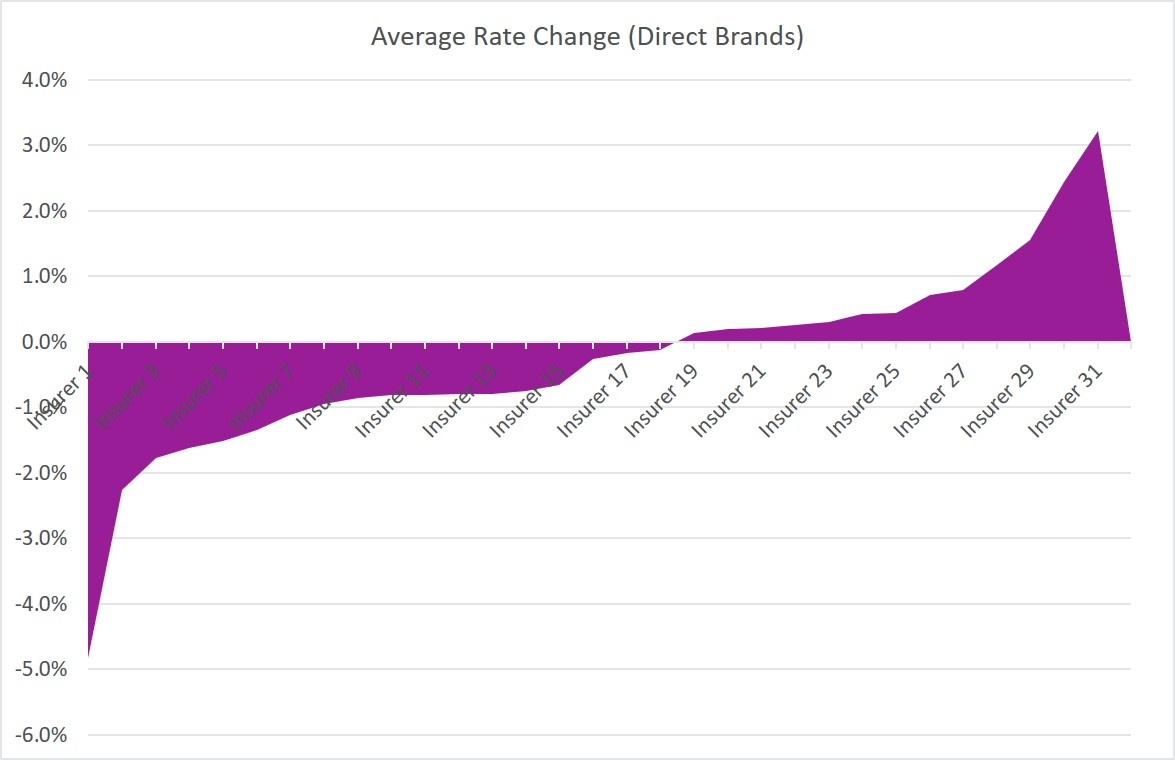

For the brands selling through their own direct channels, where coming top of the chart is less critical, 58% reduced their prices, with the biggest reduction 4.8% and the largest increase 3.2%

All food for thought for insurance brands jostling for position, and good news for the consumers who take the time to shop around.

Insight that will enable you to optimise your pricing strategy

Download our Car Insurance Price Index to gain insight into market movements, benchmark the major van insurance brands and help you understand the data behind the results.

Submit a comment