Insurers recognise that growth for individual brands must primarily come from taking market share from other competitors whilst maximising existing customer retention. Using additional unique insights from our Insurance Behaviour Tracker (IBT), we have been able to generate further insight to explore what differentiates brands that win at retention.

In our previous blog, we looked at the relationship between renewal premium change and retention rate.

This insight demonstrated that in many cases, brands that put through a higher than average price increase at renewal still had a significantly higher retention rate than those brands that put prices up by less.

But what differentiates brands that win at retention?

To answer this, we gained a deeper understanding into what the relationship is between how 'engaged' a customer is with their insurance provider and their renewal intention and behaviour.

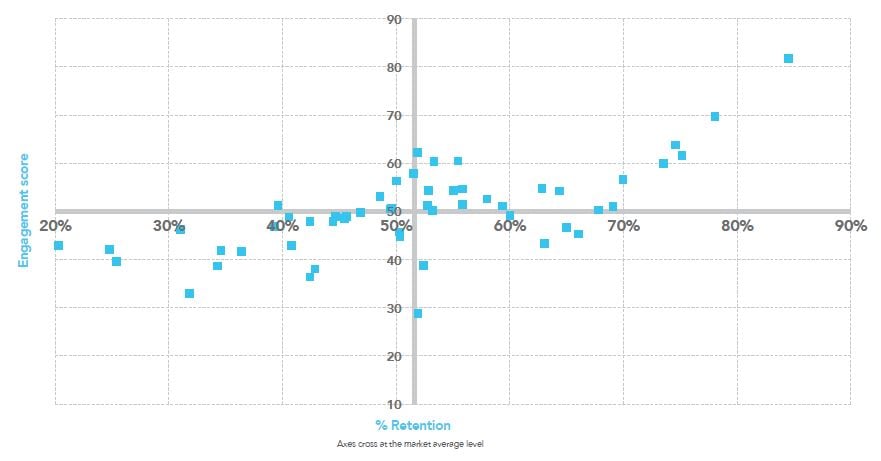

In Figure 1, a ‘customer engagement’ score has been mapped against a brand’s actual insurance retention rate.

Figure 1 — ‘Customer engagement’ score mapped against a brand’s actual retention rate

The horizontal axis is the retention rate and the vertical axis the engagement score. Each data point represents a brand’s position between both axes. Brands that are in the upper right quadrant have above average retention and customer engagement scores.

The above chart demonstrates a clear relationship between how ‘engaged’ a customer is with their insurance brand and their renewal intention and behaviour.

What makes up customer engagement?

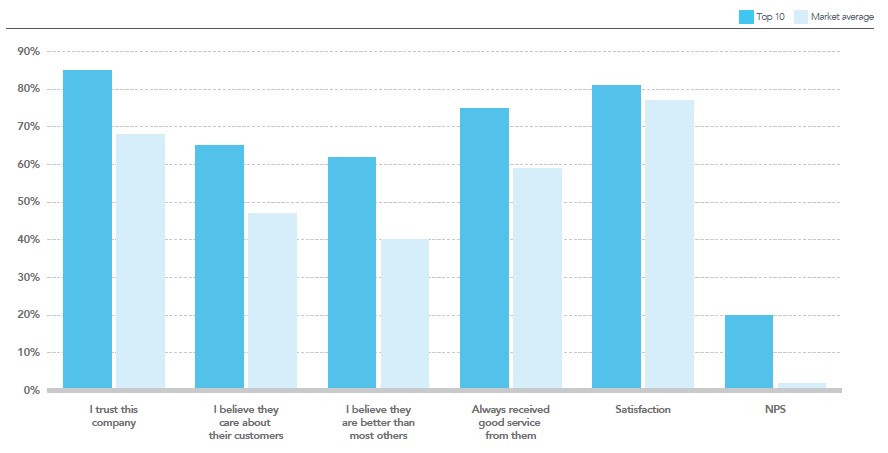

In order to understand what makes up 'customer engagement', Consumer Intelligence tracks various measures concerning the attitudes of consumers towards their insurers.

These include:

- Expectation of good service

- Belief in philosophy of customer service

- Belief in being better than most other insurers

Figure 2 shows how customers rate their insurer across a number of engagement measures. The top 10 brands that have the highest scores can demonstrate a clear difference when compared to the market average.

Figure 2 — Example customer engagement measures

“It’s clear that brands that have engaged customers focus on factors other than price, and that having engaged insurance customers is translating into measurable retention benefits.”

In the next blog of this series, we will demonstrate how brands that focus on customer engagement and

therefore retention can create a ‘virtuous circle’ which can reduce the cost of new customer acquisition.

Generating profitable growth through customer retention

Based on analytics of 50,000 real insurance customers, we have been able to determine that profitable growth is driven by a focus on renewals and that there is a proven link between brands with strong retention rates and high levels of customer engagement.

These unique insights have been compiled into a powerful and concise free white paper report, available from the link below.

Submit a comment