Competition is keeping down the cost of travel insurance policies as the UK heads into school summer holiday season, the latest figures from Consumer Intelligence reveal.

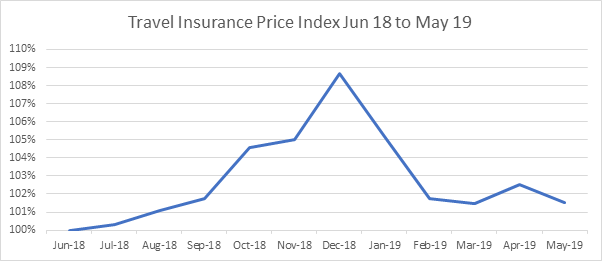

The average policy cost just 1.52% more in May 2019 than it had in June 2018, with prices falling steadily this year after rallying in December.

In December premiums peaked with prices nearly 9% higher than they had been just six months ago. This indicates that travellers may be better off buying annual policies mid-way through the year.

*Data from Consumer Intelligence travel insurance Marketview. Based on 500 nationally representative risks through Direct channels.

The rise in premiums can be attributed almost exclusively to customers over the age of 50. For this demographic, the cost of travel insurance rose by 3.37% to an average of £133.53.

For under 50s premiums fell by 0.1% to £92. This means that older holiday makers now pay 31% more for their travel insurance than the under 50s.

The average price of single trip cover rose by 5.53% in the year to £91.02, whereas annual policies fell by 1.1% to £132.77. This makes annual policies better value for money for anyone who plans to go on holiday more than once a year.

Visitors to the US faced the steepest rise compared to those taking trips to other destinations.

Worldwide policies including the US and Canada increased by 2.55% to an average of £167.33, while worldwide cover excluding US and Canada is now fractionally cheaper at

£108.71. Cover for travel in Europe remained substantially cheaper at £68.77, up 2.02% on the previous year.

And for the more adventurous traveller, cover including hazardous activities now costs an average of £141.91, compared to policies which exclude it at £100.61.

What’s the difference?

- Over 50s pay 31% more than under 50s for travel insurance.

- The gap between annual and single trip cover has narrowed. It now costs 31% more for annual cover versus a single trip policy.

- Policies including the US and Canada cost 58.9% more than European travel insurance

- Including hazardous activities cover costs 29% more

Optimise your travel insurance pricing strategy

Truly understanding your sales performance is crucial in delivering a plan and requires going beyond quotes to written policy conversion. Having a comprehensive view of the market and how you benchmark for price, product and brand gives you the confidence to make the right decisions at the right time.

That is why we are delighted to announce upgrades to our market-leading price benchmarking service, Travel Insurance Market View.

Our unique benchmarking tool will enable you to:

- Optimise your competitive positioning and execute a winning channel strategy

- Save time and money by eradicating unknown anomalies affecting your sales conversion

- Benchmark your rates, competitive position, footprint, products and brand against the market and your closest competitors

.

Submit a comment