It doesn’t matter what age we’re living in, or what sector you’re operating in — keeping your customers happy is the one true route to building a sustainable business.

Customer satisfaction reflects the experience as a whole: the product, the price, and the brand experience at different touchpoints. Bringing all these things together is no easy task, and requires a relentless focus on understanding customers’ needs and responding to their feedback.

We are delighted, therefore, to announce the top 10 companies in the UK for customer satisfaction*, as voted for by the most important judges — consumers.

Top 10 brands for customer satisfaction

| Home | |

|

|

|

|

|

|

|

|

|

|

|

|

*Listed alphabetically

| Motor | |

|

|

|

|

|

|

|

|

|

|

|

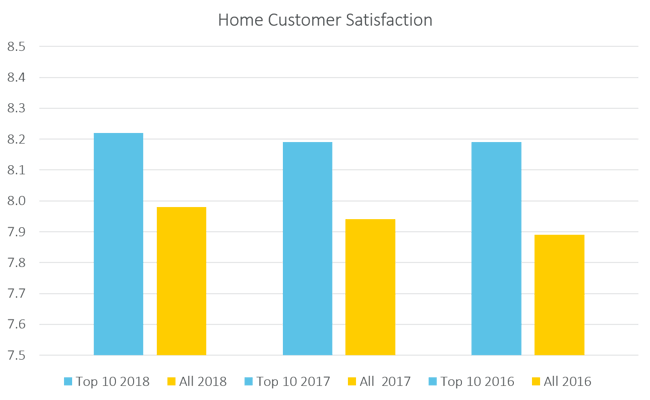

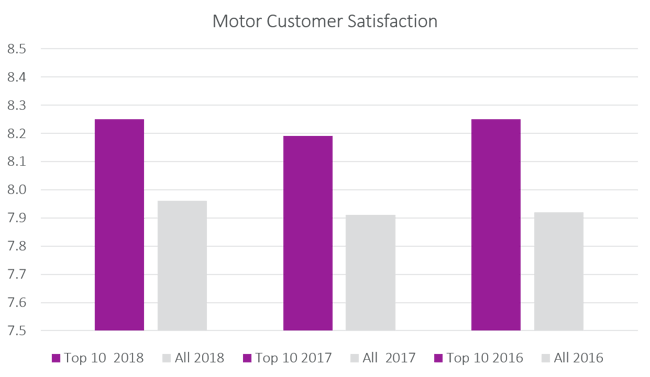

The average scores for the Top 10 brands were 8.2 for Home, and 8.3 for Motor. Across the market we saw average scores of 8, with the top performing brand for Motor and Home scoring 8.9 and 8.5, respectively.

Overall performance scores have seen little change over the past three years, with just a slight improvement for Home.

Several brands improved their scores significantly to bring them up in to the Top 10. For Home, newcomers this year are Lloyds Bank, Prudential and Swinton. Motor also sees three new additions: RAC, Direct Line and Nationwide.

More so than any of our other categories, we see a broad mix of brands making the top 10. This includes high street brokers, direct insurers, partnerships and digital-first propositions. It is testament to the fact that customer need is highly varied, and opportunities exist for brands who can find their ‘golden space’ in any market segment.

1. Check you are delivering on your brand values

Customer expectations are informed from a variety of sources, not least previous experiences. For a brand to be able to deliver on its values — whether its value, speed, or a personal touch — it must do this not only consistently, but consistently across all consumer touchpoints. Assuming a long-standing customer is easily pleased is a dangerous game to play, and research consistently shows that the vast majority of consumers who leave because of a bad experience do not explain to their insurer why they left — but they absolutely explain to their friends.

In our telephone mystery shopping research, 9 out of 24 home insurance brands scored lower for service than the level customers had expected. Some customers expressed dissatisfaction with aspects of the service, and sometimes disappointment specifically with the brand:

“I felt as though I was just another number to be dealt with.”

“I've had nothing but positive experiences in the past with {insurer}, and have found they're usually great at customer service — but found it lacking today.”

“They left a poor impression on me, even though I have other products with them. An expensive quote a no personal touch — left feeling empty by this experience.”

The customer is paying for a service, not a policy. It’s a long-standing industry challenge, but the onus is on brands to find ways to communicate the limits of their policies to their customers. Efficient and clear messaging at all points of the customer relationship (not just at the point they sign) is essential, as well as opportunities to engage in dialogue with questions and comments — a requirement that is increasingly being delivered using technology like chatbots.

Research we recently conducted showed that a significant proportion of consumers do not understand how their cover works, including the application of excesses and no claims bonuses. In a broader sense, we note that far more consumers think they know the details of their cover than those who actually do.

Reducing the length of your terms and conditions is a good start to improve consumer understanding. But it doesn’t, nor shouldn’t end there.

The customer experience a brand aims to deliver does not begin and end within the organisation itself, particularly when partners are involved in service delivery. From a customer perspective, the experience should be the same regardless of whom is delivering it. In general, consumers do not recognise it’s a different company — and nor should they particularly care.

Holding your existing partners to your same rigorous standards is part of the solution. But that will come to nothing unless you select the right partners in the first place.

In the digital economy, keeping the customer at the heart of the organisation — and ensuring this reaches all components of your business — has never been more important. So we congratulate our top 10, and all those who have made steps to improve their customer satisfaction in the past year.

A guide to making the most of your award

It can be hard to convey to consumers that your brand is about much more than just price. Our awards can help you reinforce messages about what it’s like to be a customer of your brand.

Find out how to highlight your achievements and grab the attention of your customers.

Submit a comment