While nobody really wants to be in the position where they need to make a claim, it is the reason insurance ultimately exists.

For those who unfortunately must, the way it is handled can make a lasting impression. It is also an experience likely to be discussed and shared with friends and family, which could prove very good (or very bad) news for brand value.

Customers are increasingly used to shopping around, using a range of channels and sources of information. The search for insurance is no different, and knowing how they can expect a brand to perform when it comes handling a claim could play a pivotal role in their decision.

We are delighted to announce the top 10 companies in the UK for claims satisfaction*, as voted for by the most important judges — consumers.

Top 10 brands for claims satisfaction

| Home | |

|

|

|

|

|

|

|

|

|

|

*Listed alphabetically

| Motor | |

|

|

|

|

|

|

|

|

|

|

By the numbers

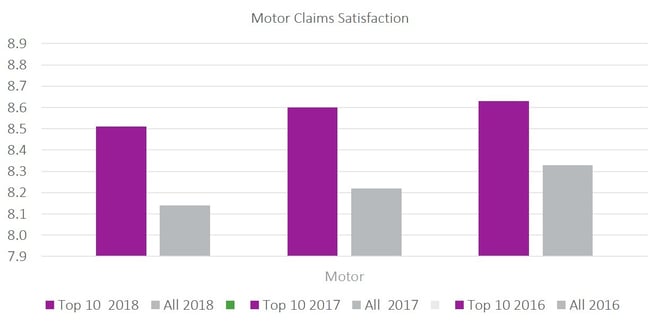

The average scores for the Top 10 brands were 8.8 for Home, and 8.5 for Motor. Across the market we saw average scores of 8.4 and 8.1, respectively.

Compared to 2017, we have seen a slight improvement for home insurance claims satisfaction, both among the top 10 group and across the wider market. The three-year trend is stable, with the market moving within a very narrow range.

By contrast, motor claims satisfaction has fallen, and for the second successive year we observe a market-wide decline. Overall, however, the decline is very slight at less than 2.5%. We will observe with great interest the impact that emerging technologies and claims management processes will have on these numbers.

There were four brands who featured in the Top 10 for both Home and Motor: LV=, M&S Bank, NFU Mutual and Saga.

There were also a number of new entrants for this particular award this year. In motor we greeted M&S Bank, Quotemehappy and Sheilas’ Wheels, and the home panel were joined by Churchill, Halifax and Sainsbury’s Bank. This is positive affirmation that their efforts are being recognised by their customers.

To become a Top 10 brand requires a consistently high performance, and a laser-like focus on customer needs. From our customer feedback and research, we have identified three key areas that have a significant impact on the customer experience, and make all the difference between an average experience and great one.

Provide regular, clear communication with customers

Customers make a claim at a time of crisis, be that big or small. It can be a difficult and emotive experience, so ensuring they are clear on next steps and progress is important to help allay fears and minimise disruption. Don’t be the brand about which one unhappy customer said:

“I had to make 11 phone calls.”

While technology has helped make this process easier, and certainly much faster, in a time of greatest need there may be no substitute for a human voice and a sympathetic ear.

Ensure your claims process is clear and easy

Some of the positive feedback from our customers underscores the value of this all too easily overlooked component of the claims experience:

“It was easy to do, and they talked me through all the steps.”

“The claim was very easy...and settlement was very quick and straightforward.”

The Future of General Insurance Conference in November focused on claims as an area ripe for disruption, and claims management is a key area within this context.

Technology will help eliminate friction while improving assessment, knowledge and communicating that knowledge to customers. Brands will need to keep innovating to stay ahead of the curve, but those who forget the focus is on customers — and delivering outstanding service to them — will fall by the wayside.

Put yourself in the shoes of your customers and see the situation through their eyes

As the New Year’s Eve fire in Liverpool showed with devastating effect, making a small concession can have a monumental impact on the customer. When we spoke to LV=, who provided a range of additional services (including hire cars) to their policyholders in an attempt to improve their claims experience, they explained quite simply:

“It all began with the question: How would a customer want to be treated at a time like this?”

With that firmly in mind, we hope to see the approval ratings rise in 2018.

The Consumer Intelligence Awards 2018

The Consumer Intelligence Awards are a marque of excellence and are unique within the insurance industry because they’re voted for by consumers for consumers.

If you are a representative of one of the 2018 award winners or would like to find out more about the awards in general, please fill in the form to register your interest and we will get back to you.

Submit a comment