.png?width=711&name=Untitled%20design%20(11).png)

Using unique insights from our Insurance Behaviour Tracker (IBT), we have been able to determine that profitable growth is driven by a focus on renewals and that there is a proven link between brands with strong retention rates and high levels of customer engagement.

In our previous blog, we demonstrated the ‘best’ and ‘worst’ performers across the motor insurance markets in terms of retention.

We also established that the brands that have a high level of tenure across their customer base will be incurring significantly less churn and cost than those with low customer tenure.

But let’s look at it from a different perspective.

If shopping around rates didn’t increase significantly when prices were rising, and given we are now in a period of premium deflation, a key question is: is it just about price?

To help answer this question, let’s look at renewal rates and changes in renewal premiums by brand as it should be expected that those brands that put through the highest price rises at renewal would also be the brands that stimulated the most shopping around and ultimately the highest levels of switching.

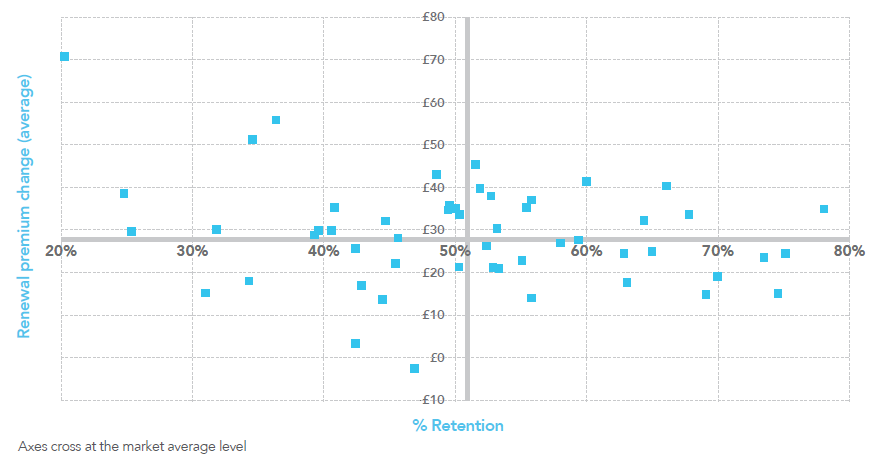

Figure 1 — Average change in motor premiums against a brand’s retention rate for over 40 brands

As can be seen in Figure 1, there are some brands where large price rises correlate with low retention and lower price increases generate high retention (for example the brand that put through an annual premium increase of around £70 and had a 20% retention rate; and the brand that implemented only a £10 increase on renewal premiums with a circa 75% retention rate).

“...price cannot be the only significant determining factor for customers in deciding whether to shop around and switch.”

In many cases however, brands that put through a higher than average price rise at renewal still had a significantly higher level of retention than those brands that put prices up by less.

This insight, in addition to the previously mentioned conclusions that highlighting price changes on renewal notifications doesn’t significantly impact shopping behaviour, suggests that price cannot be the only significant determining factor for consumers in deciding whether to shop around and switch.

In the next blog of this series, we will explore what differentiates the brands that win at insurance retention.

Generating profitable growth through customer retention

With the overall size of the UK general insurance market remaining relatively flat over the past few years, insurers recognise that growth for individual brands must primarily come from taking market share from other brands whilst maximising the retention of their existing customer base.

Based on analytics of 50,000 real insurance customers, we have been able to determine that profitable growth is driven by a focus on renewals and that there is a proven link between brands with strong retention rates and high levels of customer engagement.

These unique insights have been compiled into a powerful and concise free white paper report, available from the link below.

Comments (1)