Next week marks another milestone in regulatory changes for firms.

As we’ve written about previously, insurance brands have until 1 October to change their sales journeys for add on products.

One of the changes the FCA has issued guidance over is that it would like to see additional covers being sold earlier in the sales process.

Getting an insurance quote can be a very passive process, driven by the way the questions are ordered and how they are presented.

The FCA’s view is that consumers’ ability to make informed decisions “declines rapidly” though the sales process. When they move on from ‘obtaining a quote’ to ‘transacting a purchase’ they become less likely to shop around and evaluate the product on its own merits.

The regulator’s behaviour experiment found that where add-ons were introduced after the initial quote had been given, 70% failed to shop around to compare quotes for that specific cover and that 65% bought an add on, compared to just 16% when it was introduced at the beginning of the process.

In its guidance, the FCA has asked firms to ‘consider bringing forward the introduction of add-ons’. It continued with the suggestion that at least three of the most common add-ons purchased by the firm’s customers should be introduced as part of the initial question set so the customer considers them fully through their purchasing journey.

If not introduced in the question set, the FCA says they could be introduced at the latest on the first results page or when the customer receives a first quote.

The most popular add-ons

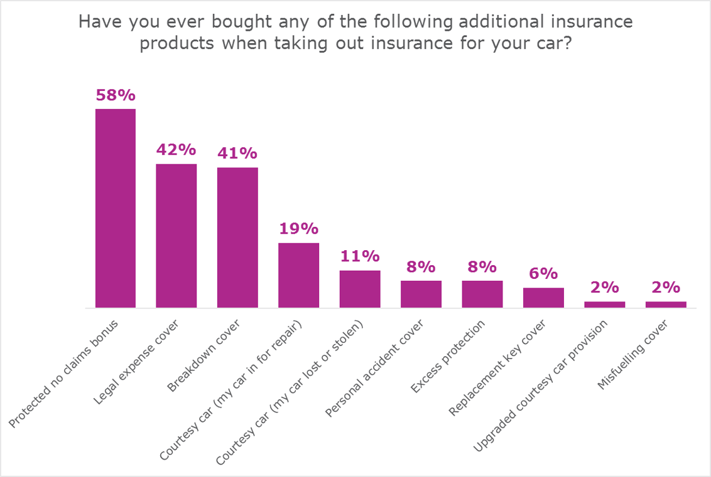

We surveyed 424 drivers which add-ons they had bought in the past, and found a wide difference by age group and gender.

The most popular three add-ons overall were protected no claims bonus (bought by 58% at some point in their lives), legal expenses cover (42%) and breakdown cover (41%)

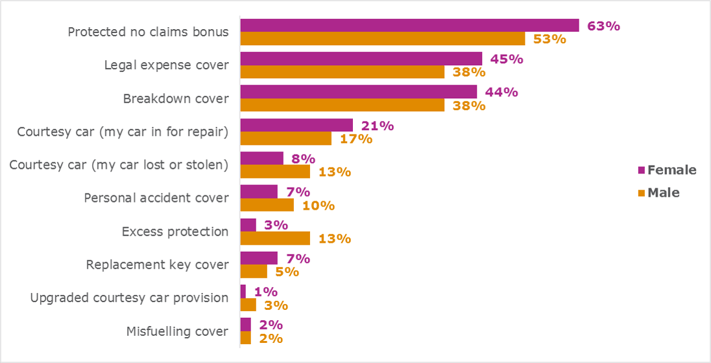

Women more likely than men to buy add-ons

Women were more likely than men to buy add-ons for most products, particularly protected no claims bonuses, but we found a strong male preference for excess protection and courtesy car provision if their vehicle is written off or stolen.

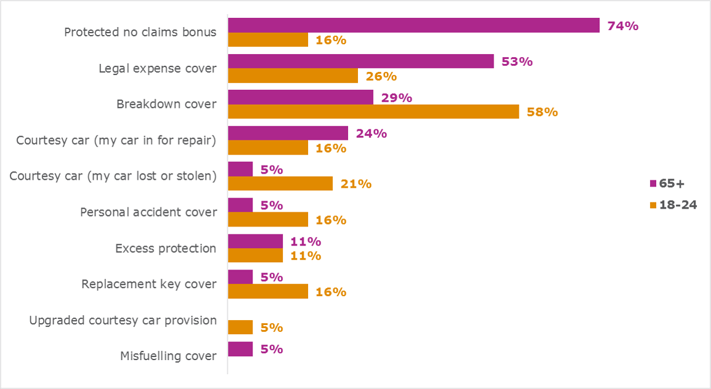

A big discrepancy by age demographic

There is also a big discrepancy by age demographic. To look at the most extremes, the top three products for young drivers were breakdown cover followed by legal expenses and courtesy car if lost or stolen.

For older drivers, they are protected no claims bonus, legal expense cover and breakdown cover.

So if your brand is targeted at older or younger drivers, which add-ons you highlight will be different to other providers.

Source: Viewsbank survey of 424 drivers

We are gathering data on how different providers respond to the latest rules

There are other considerations that will further refine which add-ons are offered earlier, such as the age of the car and how it is used.

We will be closely watching and gathering data on how different providers respond to the latest rules from 1 October, how much information they disclose and at what point in the sales journey.

The winners will be the brands that don’t take a scattergun approach and offer everything all at once, contact us to use all available information to bring consumers a sales journey designed specifically for them.

Submit a comment