In the first of this two part blog, we focused on the importance of understanding your customer and solving legitimate problems.

This week we consider the wider market conditions that might otherwise sneak under the insurtech radar.

4. Learn the market

If you’re fortunate enough to have created a viable product, be sure to check that it clears all the regulatory and contractual hurdles, including TOBAs (terms of business agreements). Some of the biggest players in this field have fallen foul of licensing requirements, to their great cost. Do your homework, and get input from compliance and legal experts. Above all, talk to existing players. They could become your partners and, with GDPR looming, they’re becoming all too familiar with the perils of not being ahead of the regulatory curve.

Similarly, if you’re one of the increasing number of founders entering the space from a different sector, it’s crucial to understand the specific market dynamics. For example, if you’re building a distribution or an aggregation play, remember that your target customers’ window to test your product will be driven by the renewal cycle. Customers interact with their insurance provider an average of only 1.4 times per year. This is why insurers have traditionally struggled to develop meaningful and trusted relationships with their customers. Finding ways to break the renewal cycle — as usage-based, or pay-as-you-drive car insurance has done — could be key to your success.

“Customers don’t want an app; maybe they want a human being on the phone, and a prompt visit from a loss adjustor at the moment of truth, which remains the point when insurance justifies its very existence.„

5. Understand Convenience vs. Price

It’s part of a question that preoccupies the market: what’s is the tipping point where I keep my customer without sacrificing margin? It’s also the kind of insight we’ve recently provided, and upon which the Consumer Intelligence business was built.

Technology is unlocking tremendous potential in terms of pricing agility, but that’s only one side of the coin. Many consumer-facing propositions testing the market emphasize utility and simplicity. They are hedging their bets that ease of use will trump price because to emerging demographics, time is money. We know consumers like the idea of having their insurance needs more seamlessly met, but how much will they really be willing to pay for it?

The case of Guevara serves as a cautionary tale. Reports said the insurer, which shut it doors last month, struggled because it could not price competitively. It’s a cold, hard reality that price still drives purchasing decisions. It’s something the regulator is aware of, and wants to change.

In the end, attempts to create a swish user experience are welcome and necessary, but for historic ‘grudge purchases’ it may take a bit more to shift the needle.

6. True Customer Service is Technology Agnostic

A story in POST magazine in August revealed that only 4% of leading insurers were providing digital services in their claims process for home and motor insurance. NFU Mutual ranked the lowest. Yet the Mutual have ranked first in our awards for best claims experience for two years running in both home and motor. Says who? Real customers, that’s who!

There’s no doubt that agents and chatbots are a crucial piece of the customer service experience of the future (80% of companies expect to use them by 2020) but it’s not a given that the consumers of tomorrow, let alone today, want no offline experience with their insurer.

Maybe customers don’t want an app; maybe they want a human being on the phone, and a prompt visit from a loss adjustor at the moment of truth. This remains the point when insurance justifies its very existence.

So before you get started on your latest sprint for your claims app, talk to your customers: are they ready to transact digitally in the way your business wants them to, or are you going to need to help them in the good, old-fashioned way?

7. What's Your MVP?

Some products can be shipped before the bells and whistles have been added. It’s the essence of Agile product development. But in the tightly regulated, data-driven and fiercely competitive insurance space, there are a number of proposition types that need to be honed further before they become viable. Those that look at risk and underwriting will need critical mass of data to achieve the levels of accuracy required to convince potential vendors. Tools that optimise and recommend cover for consumers must be entirely accurate, otherwise trust is lost. Founders should bear in mind that their proof of concept may be harder to obtain, and may take a lot more time than initially thought. Manage those expectations with investors. For many, in particular the B2C plays, the path to profitability will be a long one — but with the right application, and the right tools, it could prove lucrative.

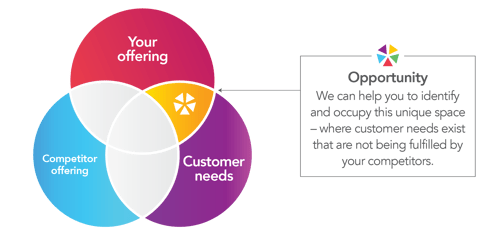

Find your competitive space

We’ve been helping insurance companies find their unique golden space for 14 years and if this is something you would like help with get in touch today.

Submit a comment