There’s no escaping social media. When it comes to preferred platforms, Facebook is head and shoulders favourite.

When we surveyed 2,000 people about their social media use, some 83% said they had a Facebook account. Even three quarters of 65s had an account they accessed at least a few times a week.

In fact, for all age groups, more than four times a day was the most common frequency for checking their Facebook account.

But with most people using more than one social media channel, it’s worth noting a significant difference between demographics with women a lot more likely to use image based Instagram and Pinterest than men.

Which social media platform do you use?

| Total | Female | Male | |

| 36% | 33% | 41% | |

| SnapChat | 24% | 27% | 19% |

| 85% | 88% | 80% | |

| 50% | 50% | 49% | |

| Tinder | 7% | 5% | 11% |

| 36% | 44% | 22% | |

| 36% | 41% | 28% | |

| Youtube | 86% | 87% | 86% |

Consumers also believe that social media companies know a lot about them and their life: when asked to rank how much they thought Facebook knew about them, 51% of users answered an 8,9 or 10.

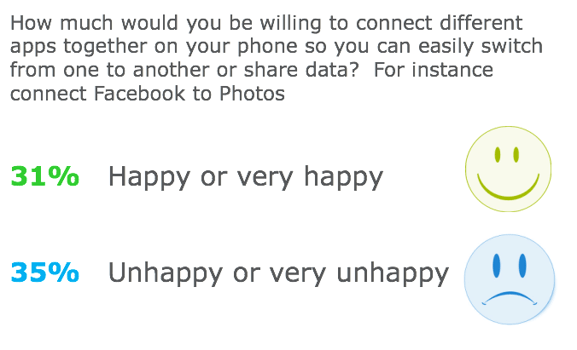

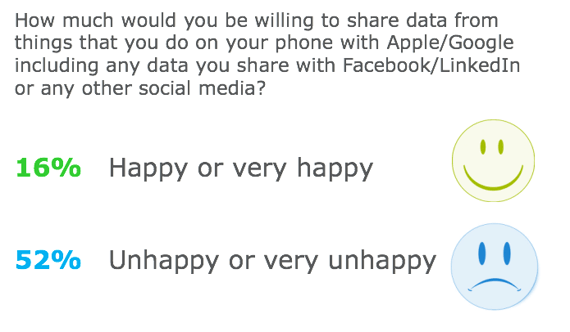

But this doesn’t mean they’re more comfortable with it, particularly when it comes to sharing information between different platforms.

What does this mean for insurance brands? Brands would be wrong to assume a targeted message would be well received in this intimate environment. A willingness to share information with friends online doesn’t necessarily mean they want to hear from a car insurance provider in a way that implies you’ve been eavesdropping.

However offering a benefit from sharing data tipped the balance – 48% of consumers said they share their biometric data in exchange for discounts on coffee, gym memberships and insurance. It is this willingness that health insurer Vitality has tapped into so well. It doesn’t just give them useful data which could be used for underwriting, it builds brand loyalty and engagement.

But consumers are a diverse bunch and it’s important to note that younger people are far comfortable with swapping personal information for discounts than the older age groups. This should provide some guiding priciples to telematics providers targeting young drivers.

How much would you be willing to wear a watch or other gadget that logs your steps, heart rate and other bio-metric data in exchange for discounts such as coffee, gym membership, life insurance, groceries and other every day necessities.

| 18-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ | |

| Very unhappy | 4% | 7% | 9% | 15% | 23% | 32% |

| 8% | 6% | 6% | 7% | 10% | 7% | |

| Neutral | 33% | 28% | 31% | 31% | 31% | 24% |

| 27% | 21% | 20% | 20% | 17% | 16% | |

| Very happy | 28% | 38% | 33% | 26% | 19% | 21% |

Several brands have successful social media engagement strategies. Aviva, for example, has over 800,000 likes. Direct Line uses its Facebook page to give useful advice on avoiding frozen pipes and stolen bicycles. Both respond to customer enquiries and complaints.

Admiral learnt the hard way that using Facebook data in underwriting, even with user permission, does not go down well.

But since then, its firstcarquote app which offers quotes online via facebook in 60 seconds has grown to have 10,000 monthly users, according to the site.

The conclusion: be on social media, give consumers something they want, but don’t be a creepy stalker.

Better understand your target customers

With our unique blend of market and consumer insight, we can help you better understand your target customers and how to devise strategies to attract them. If this is something you think we could help you with then get in touch today.

Comments (1)