Using a unique blend of insights from our Insurance Behaviour Tracker (IBT), we have the ability to track customers’ renewal intentions and get a view into the performance of most of the major brands across the general insurance market.

In our previous blog, we demonstrated that there is a proven link between brands with strong insurance retention rates and high levels of customer engagement.

We have also previously established that the brands which have a high level of tenure across their customer base, will be incurring significantly less churn and cost than those with low customer tenure. Combined with this insight, we now also know that shopping rates don’t necessarily increase when prices rise.

This raises the question: how many brands are seizing this opportunity?

General insurance companies find it difficult to know whether a policy holder that renews has had to be reacquired and paid for again, or whether they simply and cheaply renewed, with little or no cost.

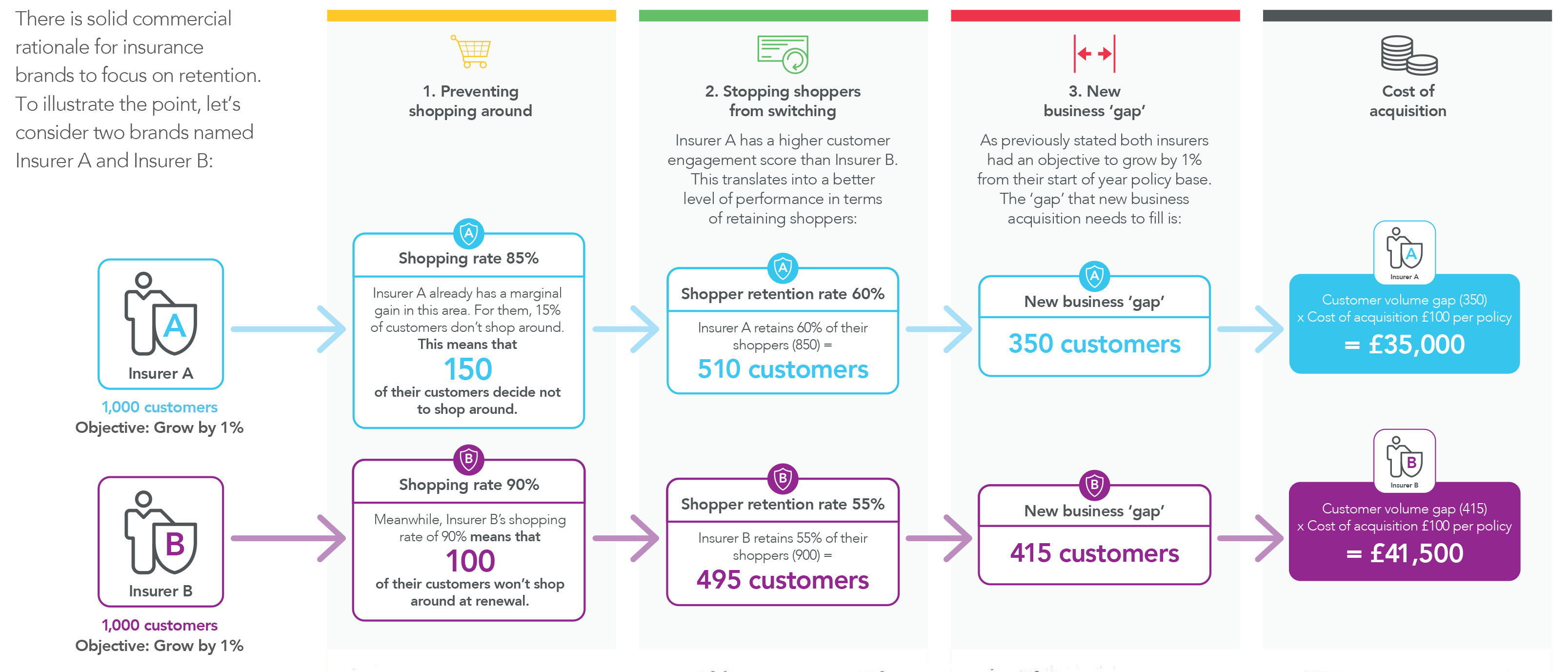

Our findings show that there is value of striving for good customer retention. In figure 1, you’ll see the solid commercial rationale for insurance brands to focus on retention.

To illustrate the point, let’s consider two brands named Insurer A and Insurer B.

Figure 1 – the commercial benefit

Another consideration is how the cost per acquisition could be used to drive even higher levels of retention, as the cost of acquisition could be used as a renewal optimisation discount for the original customer base of 1,000.

For example, Insurer A could discount each renewal by £35, and Insurer B by £41.50. Of course, it is recognised that that this calculation works well in theory by assuming that 100% of customers would renew, with new business acquisition generating only growth, as well as the fact that with some customers renewing anyway, giving these customers renewal discounts is ‘leaving money on the table’.

Obvious, right? So why does it all go wrong?

The rather simplistic maths of the difference between Insurer A and Insurer B proves a point, but why doesn’t it appear to come through in the numbers that insurers have? The answers are probably mis-attribution and short-term pricing strategies.

So, we know that general insurance companies find it difficult to know whether a policy holder that renews has had to be reacquired and paid for again. This means that they look at anyone that was a customer last year and say they were a renewal, but if a customer has gone and shopped and then switched back to the insurer via a new business route, the insurer will mis-attribute the customer as a renewal. Insurers can also decide to price on a short-term basis to hit immediate targets rather than taking a longer view led by expected customer life time value.

Without comparison to the market, it is almost impossible for them to realise that to grow from 1,000 polices to 1,010 they have had to spend significantly more than a company with a good renewal base.

[WHITEPAPER] Generating profitable growth through customer retention

With the overall size of the UK general insurance market remaining relatively flat over the past few years, insurers recognise that growth for individual brands must primarily come from taking market share from other brands whilst maximising the retention of their existing customer base.

Based on analytics of 50,000 real insurance customers, we have been able to determine that profitable growth is driven by a focus on renewals and that there is a proven link between brands with strong retention rates and high levels of customer engagement.

These unique insights have been compiled into a powerful and concise free white paper report, available from the link below.

Submit a comment