Consumer Intelligence tracks customers’ renewal intentions and thus has unique insight into the performance of most of the brands across the general insurance market.

Consumer Intelligence tracks customers’ renewal intentions and thus has unique insight into the performance of most of the brands across the general insurance market.

In an earlier blog, we established the importance of customer retention in the current insurance market. With margins being squeezed as a result of premium deflation, retaining customers is more important than ever. Brands have several opportunities to maximise customer retention starting from the moment of initial acquisition and continuing through every customer touch point and communication. But the question is, how many brands are seizing this opportunity?

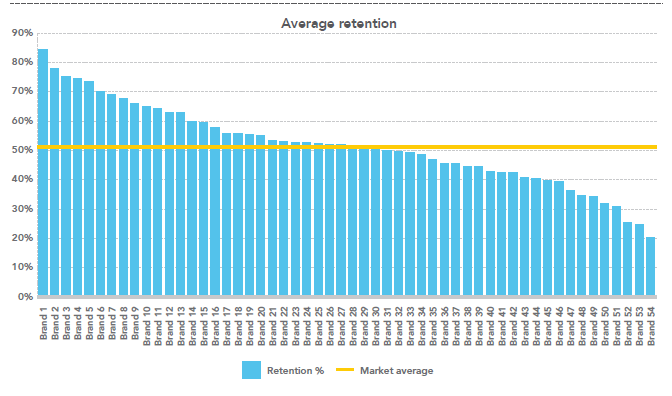

Our findings show that there is a significant variation between the ‘best’ and ‘worst’ performers in terms of retention. Figure 1 shows insurance retention performance across the motor markets.

Figure 1 — Retention % by brand

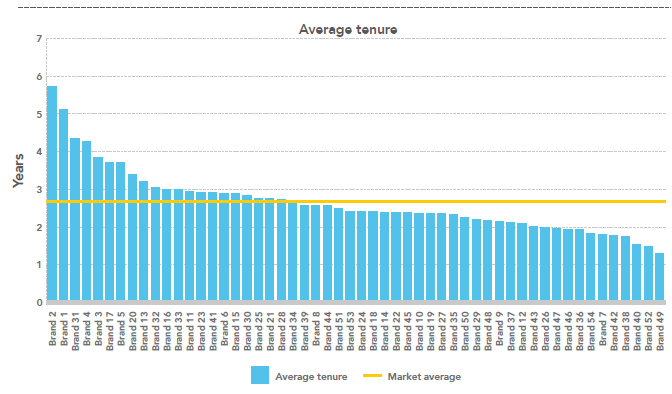

Those brands that have a high level of tenure across their customer base will be incurring significantly less churn and cost than those with low customer tenure.

Customer retention is also often linked to customer tenure, however it could be argued that tenure is an outcome of retention. Those brands that have a high level of tenure across their customer base will be incurring significantly less churn and cost than those with low customer tenure (as the departing customers have to be replaced with new, more expensive acquisition customers). As can be seen in Figure 2, there is, again, significant variation in the tenure of customers across the industry.

Figure 2 — Average tenure by brand

In the next blog of this series, we will be exploring the role price plays in customer retention.

Generating profitable growth through customer retention

With the overall size of the UK general insurance market remaining relatively flat over the past few years, insurers recognise that growth for individual brands must primarily come from taking market share from other brands whilst maximising the retention of their existing customer base.

Based on analytics of 50,000 real insurance customers, we have been able to determine that profitable growth is driven by a focus on renewals and that there is a proven link between brands with strong retention rates and high levels of customer engagement.

These unique insights have been compiled into a powerful and concise free white paper report, available from the link below.

Submit a comment