With the keynote speech for Insurance 2025 just around the corner, Consumer Intelligence CEO Ian Hughes reflects on the exponential change we’ve seen in recent years in the way we consume products and services, and explores the top four emerging consumer trends insurers need to know in order to survive 2025 and beyond.

The landscape of insurance is already starting to change as leaders across the industry prepare for an imminent future of blockchain, AI and big data, amongst other things. There are so many trends on the horizon, it is a minefield for brands to navigate. How can they be sure they are preparing for the right things?

It is almost instinct to jump on the bandwagon of the next big tech development. But what if a brand invested its time and money in preparing for 5G to find that the youngest generation is the least likely to willingly share their personal data; or developed a plethora of on-demand motor insurance products for the tech savvy millennial only to find that Gen Z isn’t interested in driving?

Beyond the hype of the tech trends, it is happy customers that will lead to the success of any insurance business. So, doesn’t it make sense to start with them and what they want?

Exponential change

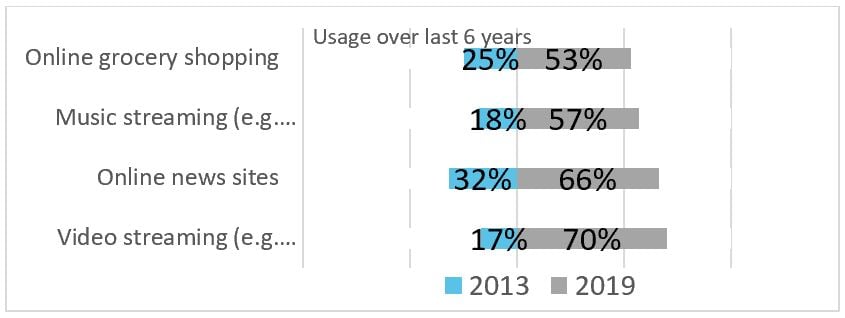

A survey conducted with 1000 consumers on their use of relatively new tech between 2013 and 2019 shows a significant shift toward an appetite for on-demand and instant access, and a move away from ownership to rental and subscription services, indicating an exponential change in consumer behaviour and expectation over the last six years.

The numbers speak for themselves, with the use of music streaming ramping up from 18% in 2013 to 57% in 2019, and the likes of Netflix, Amazon Prime and Now TV stepping into the fray, boosting video usage from only 17% to a whacking 70%.

When we break down these findings by generation, it isn’t surprising to note that usage of music and video streaming services is highest amongst Gen Z, at 92%. When it comes to online news sites and online grocery shopping, millennials are the biggest adopters at 71% and 66% respectively.

But these findings present only the tip of the iceberg for what is to come.

The big four future trends

At Consumer Intelligence, we use a proven methodology for identifying, interpreting and analysing emerging trends over a one-to-five year time period. In summary, we scan the horizon for potential innovation opportunities and emerging risks.

Changes in insurance are all too often industry driven. We firmly believe that putting the customer at the heart of your business is the key to success and therefore consumer attitudes, behaviour and expectations should be considered in every part of the development process.

For the consumer, insurance does not live within a vacuum. The way they interact with products and services is influenced by a vast number of factors within their lives. With this in mind, we have analysed 115 trends that touch all parts of consumers lives to establish the four major emerging themes that will shape the consumer of the future.

-

Consumer Affordability Squeeze

According to the FCA, 50% of all UK consumers are potentially financially vulnerable.[1] This means 25.6 million of us struggling with expenses. We can see this demonstrated in the trend of more and more people moving out of the cities and into the country, enabled by the increasing popularity of work flexibility. The differential of wages between rural and urban areas has shrunk, whilst the cost of living centrally has gone up: the move makes financial sense.

These financially squeezed consumers are turning to more flexible products. Cuvva is an example of this, having developed a ‘pay as you go’ product. They offer temporary car insurance from as little as 1 hour to 28 days – ideal for a consumer who’s renting a car when they can’t afford to buy.

-

Consumers in Control

Another consumer trend is the shift from product to service. On demand and subscription services across several industries have reinvented the end-to-end consumer experience. With Netflix as an example, the customer is in control. We can watch what we want, when we want and for however long we want. When it comes to millennials, this control is shown through different means – notably, the mega-trend of the self-employed.

‘Apps within apps’ are becoming popular as well. WeChat, for example, is a multi-purpose messaging, social media and mobile payment app. Known as the “app for everything”, it puts the user in complete control.

Buzzvault is a new entry into this field, as a digital and personalised asset vault, that allows you to store things, protect them and make claims, all from one app.

-

Changing mobility

It used to be that driving your own car was the only way you could get around. Now, years later, there are massive changes. Travel apps like Uber, Gett and Lyft present us with a wealth of transport options. Car manufacturers are now calling themselves ‘mobility providers’. Our cars spend their lives sat waiting as we choose differing options of transport, including tubes, buses, taxis and rental bikes. There are shared cars, driverless cars, electric vehicles, fewer younger drivers, and more that continue to push this trend forward.

Growth in car clubs and car sharing is expected to increase car parc by 26% to 1.3m vehicles in 2018,[2] and nearly 90% of private new car sales are purchased using finance such as PCP deals where the car is never owned by the consumer.[3]

Wrisk is a company that BMW chose to be its sole insurance partner in the UK in 2018. It aims to provide customers with a single platform for all their insurance policies. This is all based on an app that offers on-demand services which are hyper-convenient for the user, keeping up with the changing consumer base.

-

Personalised everything

The rise of using data and artificial intelligence results in a deeply personalised journey for the customer. IoT device growth is at 22% CAGR, and 78% of marketers are adopting or expanding artificial intelligence marketing solutions in 2018.

When we think about companies like Amazon, this is easy to see. Customers buying habits are tracked since their account is created. Not only does the site suggest things you might like to buy, but it shows what buyers just like you have ordered, what they’ve ordered it with, and what they might be looking to order in the future.

Brolly is a new player in the market: a personalised insurance concierge service. Another organisation reliant on technology, Brolly is an app that allows the consumer to find out which insurance cover they need, what they’re missing out on and how to optimise their portfolio. Just like amazon, it compares you to similar people, and tracks spending with a personalised feed.

What can we expect from Insurance 2025?

On Wednesday 3 July, Consumer Intelligence CEO, Ian Hughes, will be the keynote speaker at Insurance 2025. He will be revealing the data that sits behind these four big consumer trends, supporting by insight from real consumers that will help brands prepare for the challenges ahead. Never seen before research conducted by Consumer Intelligence will be revealed on the day as he explores not only how millennials are impacting the market, but how other generations are growing and adapting to a changing world, ultimately opening up the discussion: what does the future hold for the world of insurance?

[1] Financial Conduct Authority

[2] Frost and Sullivan Global Mobility Industry Outlook 2018

[3] Frost and Finance and Vehicle Licensing Association May 18

Why do you need consumer research?

Download our guide to 'Understanding Consumer Attitudes' to learn how our output goes beyond research and data to uncover genuinely exciting insights – invaluable insights that can help transform your business and your bottom line.

Submit a comment